Fresh Hopes or Old Tricks?

It was a paradoxical, almost cynical day. The axiom holds that the Russian-Ukrainian war is directly and indirectly to blame for the oil complex's resilience. Reciprocal attacks and Western sanctions do more than just raise the geopolitical risk premium; they create a physical oil shortage, leaving consumers scrambling for alternatives. It is therefore understandable and justifiable to see long positions liquidated when peace prospects are floated. Yet news of this proposal broke on the very day heavy Russian attacks in western Ukraine killed more than 20 civilians, including children. Go figure.

Any attempt to stop the nearly four-year madness must be welcomed. However, when one of the warring parties, Ukraine, together with its unconditional ally, Europe, is excluded from the talks, one cannot help but suspect the revived negotiations lack substance. Alternatively, it suggests the U.S. will exert immense pressure on Ukraine to accept coercive terms and strike a deal merely for the sake of having one.

We will examine the proposed peace plan and its potential consequences in detail tomorrow. Still, at first glance, it seems nothing more than another U-turn by the self-proclaimed deal-making US President, who, let us hope, will not start dancing to the tune of Vladimir Putin as tomorrow’s US-imposed deadline on dealing in Russian oil fast approaches.

US Stock Roundup Paints an Upbeat Picture

Yesterday’s Weekly Petroleum Status Report from the EIA provides a good enough excuse to use the current US snapshot to assess whether the tug-of-war between present distillate strength and the perceived supply excess in 2026 faithfully mirrors the underlying fundamental backdrop; after all, the US is the world’s largest producer and consumer of oil. Before diving into the topic, here are the headline figures from the latest findings: crude oil stocks drew 3.4 million bbls, gasoline inventories built 2.3 million bbls, and distillate stockpiles were broadly unchanged.

First, let us begin with domestic production. It is resilient, to say the least. The Trump administration’s pledge to increase output by 3 mbpd during the incumbent’s term is an obvious exaggeration and a misleading campaign promise, as it would imply a production level of around 16 mbpd by the end of 2028. Nonetheless, weekly data suggests that reaching 14 mbpd in the foreseeable future, primarily driven by shale but also helped by revived interest in offshore E&P, remains plausible. As far as domestic production estimates are concerned, it is worth pointing out that if the EIA identifies any difference between “survey-based domestic production reported in the Petroleum Supply Monthly and other current data,” the weekly figures may be re-benchmarked during the week of the release of the monthly report. This adjustment amounted to +206,000 bpd this month, or 1.49% of the weekly total.

And now, over to stocks. Total commercial oil inventories, at 1.27 billion bbls, are above both the year-ago level and the 5-year average. US industrial stockpiles make up the lion’s share of OECD stocks; therefore, they provide an ostensibly reliable view of inventories in the developed world. This statement, however, comes with a caveat. It is intriguing to observe that, according to EIA data, US inventories have historically accounted for 43%–45% of total OECD stocks, but this fraction is expected to drop to 40% by the end of next year, suggesting that stockpiles will swell faster in the non-US portion of the OECD. In any case, both the US and OECD inventories showed a year-on-year deficit between January and July 2025, something that has turned into a surplus from August onwards. By next month, OECD stocks will be some 184 million bbls above the comparable month of 2024, but US inventories will be only 17 million bbls higher. One cannot help but think that estimates for OECD stock growth are more likely to be revised lower than US stock builds higher.

The comparatively insignificant US stock surplus does not come as a complete shock, since the three major categories, crude oil, gasoline and distillates, all show deficits relative to last year’s levels and the long-term seasonal mean. It is the so-called “other products” category that is responsible for the slight annual increase in total commercial inventories. At 528 million bbls, these stocks are around 8% higher than during the same period last year and compared with the 5-year average.

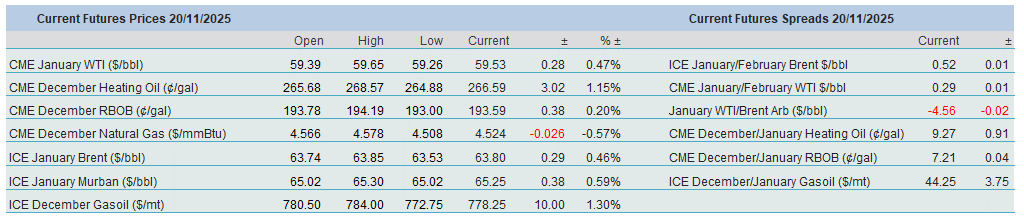

The tightness in product inventories explains the healthy refinery demand for crude oil and the resultant, seemingly unquenchable thirst for products, neatly illustrated by rocketing crack spreads. The CME 3-2-1 crack at $32/bbl is around 62% above last year’s value and 17% higher than the 5-year average. The current RBOB/WTI spread is also stronger than last year or the 5-year average; the real change, however, is in distillates. A barrel (42 gallons) of front-month Heating Oil is worth around $52/bbl more than a barrel of WTI. In other words, its absolute value is $112/bbl. Its premium to crude oil is $10/bbl higher, notwithstanding yesterday’s drop, than the 5-year average, which includes the seasonally elevated 2022 Heat crack value of $63/bbl following Russia’s invasion of Ukraine.

In 2025, distillate strength also partly originates from Russia, as the country’s gasoil exports are plummeting due to Ukrainian strikes on its refineries and Western sanctions. But this is not the sole reason. Global and US refinery maintenance contributes to product tightness, as does a perceptible decline in US refining capacity. It fell from 18.35 mbpd in 2024 to 18.15 mbpd in 2025, with a further decline anticipated next year, when it could retreat to 17.92 mbpd, according to the EIA, impeding healthy US product exports. The same tendency is observed in Europe, where refining capacity, shrinking by about 400,000 bpd year-on-year, is undergoing structural decline.

Next year’s supply surplus is well-advertised. Yet the contemporary reality is that the war Russia has been waging against Ukraine, product shortages and refinery constraints collectively serve as a considerable hindrance to significantly lower prices. Staying in the US, the first signs that price support is being pulled will be rising distillate and possibly gasoline inventories, a narrowing of the gap between OECD and US commercial stocks and, most importantly, a substantial weakening of the Heating Oil structure and refinery margins. Whether yesterday’s revived attempt to broker a so-called peace between Russia and Ukraine is the beginning of such a downturn remains to be seen, but only the brave would bet on it.

Overnight Pricing

20 Nov 2025