Geopolitical Circle

The reaction to unexpected geopolitical developments in the proximity of oil-producing regions, such as the current Israeli assault on Iran, follows a similar pattern. When the headline hits the screens man and machine (traders and algorithms) get rid of risky positions and the adventurous ones start building up length. Phase one was embodied in Friday’s jump to $78.50/bbl in Brent. As details start to filter through, the actual situation is assessed, which can be labelled phase two. Oil supply and production were ostensibly spared in the initial strikes, and oil fell from the summit but still posted considerable daily gains because of the uncertainty the weekend carried. When the giant Iranian South Pars gas field came under attack on Sunday, the week was guaranteed to open significantly higher.

A few hours later it became increasingly discernible that Israel had mainly targeted Iranian energy infrastructure, which supplies the domestic market. Oil fields and the pivotal export terminal on the Kharg Island were unharmed and we recalled from the back of our mind that the not once has the Strait of Hormuz closed completely down during past conflicts. International oil flow was mostly uninterrupted, and prices started to drift south. Selling intensified as Iran reportedly asked three Gulf nations to pledge with the US President to put pressure on Israel for an immediate ceasefire. Phase three ended with a daily loss of $1/bbl.

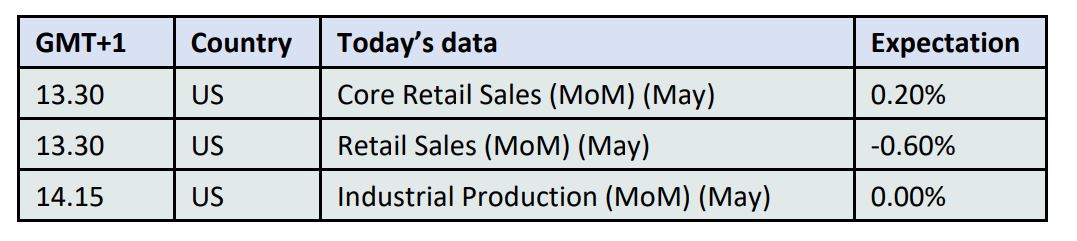

It would, nonetheless, be irresponsible to jump to an early conclusion that this latest chapter in this decades-long conflict is irrevocably closed as manifested in this morning’s price rise. Sure enough, the anxiety thermometer dropped and there will be sufficient and deserved focus on central banks’ rate decisions (the Bank of Japan left rates unchanged). US retail data will also be scrutinized today together with the Fed’s interest rate move tomorrow. Yet, it is worth remembering, that the ultimate Israeli objective is a regime change in Iran. There might be growing hopes that a slow but irreversible de-escalation will follow soon but it is simply impossible to foretell the outcome with great confidence. Wars are usually unreasonable human acts and when one party is cornered and fights for its survival, it might be forced to take unreasonable steps irrespective of the damage it could potentially cause. In the Israel-Iran war the completion of the geopolitical cycle might take longer than just a few days.

Uncompromising OPEC

In a way, the updated OPEC view on global supply and demand has not changed; if anything, it turned even more upbeat. There was an upward revision in 2H 2025 global oil demand whilst the 2026 estimate was also upgraded. At the same time, supply from those outside the alliance was cut. The organization saw a surprisingly resilient global economy in the first half of the year with China, India and Brazil exceeding expectations. In the OECD part of the world, US expansion remained stable and Eurozone growth rebounded slightly. The global economy is projected to grow by 2.9% in 2025. It is, nonetheless, noticeable that the higher growth is concentrated in the first half of the year. In OPEC’s view, in the latter part of 2025, the US will strike trade agreements with its partners and as such a huge amount of uncertainty will be removed from the market.

The solid economic forecast underpins sanguine oil demand growth. Consumption is set to rise by 1.4 mbpd in 2H 2025 whilst for the whole of 2025 the expansion will be 1.3 mbpd. In OECD countries this growth will be a meagre 90,000 bpd in 2H 2025. In developing countries, China and India will lead the advance in oil demand. This increase is predicted to be 1.3 mbpd in 2H, year-on-year.

On the supply side, non-DoC liquids will see an increase of 500,000 bpd in 2H 2025 following an expansion of 1.2 mbpd in 1H, resulting in an annual average of 800,000 bpd. OECD liquids supply will advance by 200,000 bpd in the second half, and the trailblazers will be the US, Norway and Canada. Non-OECD countries (excluding OPEC+ members) will pump 300,000 bpd more in 2H 2025 than in the corresponding period of 2024.

Commercial oil stocks in April rose by 4.7 million bbls and reached 2.739 billion bbls. They were 95 million bbls under the April 2024 level and 135 million bbls below the seasonal 5-year average. The movements in crude oil and product inventories were aligned in April, as both are under the year-ago level and the long-term mean. In terms of forward cover, which is perhaps a more indicative gauge than absolute levels, OECD industry stockpiles were at 59.7 days, which is 1.9 days under the April 2024 stock levels and 5.5 days less than the 5-year average.

It is the first time since April 2024 that OPEC revised upward its 2025 demand forecast. Back then they expected this year’s consumption to stand at 106.33 mbpd. It compares to the current estimate of 105.13 mbpd, a hefty downward revision, which must not mislead us. When it is set against non-OPEC+ supply estimates one will find that the organization has constantly been the most bullish on the demand for its oil. Take the EIA as an example (and the IEA later today, after they release their updated report). The statistical arm of the Department of Energy expects the OPEC+ call to average 42.95 mbpd in the second half of the year. OPEC puts it at 43.55 mbpd, a chasm of 600,000 bpd. Given the myriad of variables, only time will tell which prognosis proves the most accurate.

What is, however, an undeniable bearish development of the last month is the group’s U-turn in its market management strategy. As opposed to the originally scheduled 16 months, the 2.2 mbpd voluntary cuts from the eight OPEC+ members will have been, in all likelihood, unwound by September. It will inevitably loosen the oil balance for the third and the fourth quarters of the year. Global and OECD stock builds will hasten or stock depletion slow down, depending on which forecaster is to be believed. By any means, the 2H 2025 price forecast must be revised lower. Taking the latest set of OPEC data into account and based on increased OPEC+ output, OECD stocks ought to be around 25 million bbls higher in 2H 2025 than previously estimated leading to a price downgrade of around $3/bbl and giving us an average Brent price of $70 bbl between July and December this year. Of course, anyone, who is brazen enough to come up with a price prediction will clearly state in the small print that she reserves the right to amend her price forecast as deemed necessary based on the perpetually changing economic and geopolitical outlook.

Overnight Pricing

17 Jun 2025