Global Market Drivers Find More Sympathy in Bourses than in Oil

Described eloquently elsewhere as 'window dressing', the US bourses again registered new highs as longs were determined to register a very positive end to a successful stock market quarter. This is despite a return to conservative ways by the language deployed by Jerome Powell yesterday. In a speech to the National Association for Business Economics, the Federal Reserve Chair remarked on impending rate decisions that “the risks are two-sided, and we will continue to make our decisions meeting by meeting.” He went on to indicate that there would be only two 25-basis point cuts for the remainder of the year, which should have scuppered market pricing for another double decker reduction. Incredibly, hope springs eternal within bourse bulls because the CME FedWatch tool yesterday was pricing a 0.5% cut at 53.3%, but today still holds onto at 38.2% reading. The global stock market picture is well and truly mixed. Chinese stimulus continues to echo across its indices and the Shanghai and CSI300 again pushed firmly on, aided by a fear of missing out as they are closed for the balance of the week. Even though the Nikkei has recovered, Japan's investors are proving twitchy after the index lost nearly 4% yesterday at the election of incoming Prime Minister Shigeru Ishiba. A known hawk, markets now believe that any political barriers hindering the BoJ from increasing interest rates are now likely removed.

Oil prices found little aid from stock markets. Even China's sentiment that currently feasts on the stimulus servings could not halt what remains a rather downtrodden performance. Such is the mood in oil, compounded by backwardation crushing Brent expiry, that even Israel's "targeted" launch of a ground invasion against Hezbollah in Lebanon is not enough to agitate bulls. There is also a muted response from Iran. Whether or not the concerted attacks on its proxy allies have caught it off guard or that the United States has indicated it stands solidly with Israel, traders sense that retribution feels a long way off. Therefore, the idea of returning Libyan crude and the forthcoming trimming of voluntary cuts by OPEC+ in December serves as interference for those that are contemplating reduced oil stocks in the US and improving cracks as demonstrated by a $1.50 rally in the 3-2-1 crack in less than two-weeks. What is also seeing contained reaction is how the influence of a dockworkers strike in the US might play out. The International Longshoreman Association (ILA) are about to begin a strike on the US East and Gulf Coasts which could see 50% of ocean shipping stymied.

The SPR is not boring

Tracking the United States Strategic Petroleum Reserve (SPR) is a sometime ‘watching paint dry’ experience. The rolling of inventory to stop fouling or spoiling and granting of tenders is a commonplace affair, and rightly oil market watchers usually skim over such news and concentrate on other more important components of global oil stock influences. That is of course until there is a dramatic change in its levels, patterns of depletion or increase, and its use as a both a political and economic tool. Back at the start when SPR measurement was first published by the US Energy Information Administration (EIA), in December 1982 the value of oil stocks held was some 293 million barrels. This steadily progressed in the ensuing years to just short of 600 million barrels at the start of 1994 staying between 550-600 million barrels for the next 13 years only to increase again to a high of 727 million barrels in 2011 although the authorised storage capacity is set at 714 million.

The history of SPR is one of high holdings, as the only time sales are allowed, outside of the usual care and maintenance, is when the President finds, pursuant to the conditions set forth in the Energy Policy and Conservation Act (EPCA), that a sale is required. Or, if in extreme circumstances the Energy Secretary allows oil ‘exchanges’ where short-term oil is basically ‘lent’ to companies in times of stress such as weather incidents which is delivered back at a later date. One of the only major releases of federally owned crude came in 2011 when members countries of the International Energy Agency released 60 million barrels, of which US crude made up half, when the overthrow of Libyan leader Muammar Gaddafi led to civil war and disruption of supply that threatened to push oil prices to intolerable levels. That is why SPR reduced from the high in 2011 of 727mb to 695mb where it stayed for nearly 5 years and started a downward trend to 600mb at the end of 2021. There is little doubt that the 10-year period of lower strategic stocks was inspired by the fall in oil prices after the ravages of the banking crisis and post-Libya spike. The maintenance of supressed price levels over the decade gave little reason for the US to hold onto such mighty stores of feedstock and while the world has always offered geopolitical troubles, it was also a time of benign international relations.

As with every oil consideration this was very much changed by the quick succession of the pandemic and the Russian invasion of Ukraine. While western governments and allies pontificated and parsed over what sanctions might look like against Russia allowing them time to adapt to life without cheap Russian energy, it was the huge amount of US reserves that the Biden administration allowed to flow into markets that put the brake on Brent for example reaching $140/barrel when it very much looked as if it was on the way to the all-time high of $147.50. Indeed, the US Treasury Department estimated that Biden’s sales of oil from the reserve reduced gasoline prices by up to 40 cents per gallon. The US SPR dropped from 600mb level of 2021 to the now low of 347mb in July 2023 equating to a 40% reduction. However, such a state of depletion is not without criticism. Detractors point to how the US has played a soft hand in terms of oil sanction pressure on Iran and cite the low level of SPR as a reason for a lack of forthrightness. This challenge is repeated when the US has faced a battle to contain inflation and indeed elongated high interest rates which have been made sticky in part due to OPEC’s production cutting policy. Basically, its international teeth are dulled by low SPR levels.

Yet, the run-down of stock, and some might argue that the last part was due to OPEC action, might just turn out to be judged historically a success. Oh, how we mocked when the Energy Department predicted it would seek to buy back the reported 180 million barrels total when prices were competitive and under $80/barrel. According to various sources, the average price of the sales of SPR that mostly occurred in 2022 garnered $95/barrel and with EIA reports of SPR being over 380mb and Reuters last week reporting that 50 million barrels have already been repurchased, the DoE now looks something of a trading genius. Setting about a publicised program of buying back 3mb per month, stock levels have increased accordingly.

However, and something that chimes with the opportunistic way in which China takes advantage of lower prices, last week it was announced the current administration would buy a further 6mb for delivery in early 2025. Staying with the China comparison, the US SPR seems historically under-gunned, and if heaven forbid the current antagonistic Sino/US relations deteriorate the US military will be howling if one of the reasons it could not stamp authority was because of a fuel concern. Indeed, with assets stretched by the current presence of US war stuffs massed in support of Israel and global shipping in the Middle East, the idea of a bottoming of SPR must be an anathema to the powers of the Pentagon. This of course is political manna for The Donald. Back in August when the measure stood at 1983 levels the presidential candidate vowed to fill the SPR. Whether or not the reserve is to be filled by a continued drip feed from a Harris administration or flooded by a Trump government, continued Federal buying seems to be a sure-fired thing and will obviously be a prop to crude prices, be it from light touch longer-term point of view or a short-term burst. The US SPR and its influence is no longer something to be considered as an extra, it might just yet take a leading role.

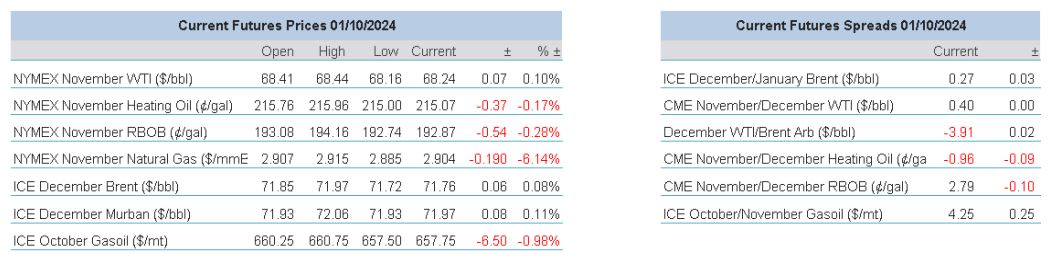

Overnight Pricing

01 Oct 2024