Gloom and Doom

A glance at the chart of any of the five major oil futures contracts reveals that the oil complex is bound by its range established this month – and it is the lower end, which is under pressure but is holding. Consequently, it is premature to conclude that the only way is down, yet, given the quality of news the second consecutive daily loss must have raised red flags. Tension in the Middle East and Eastern Europe must be supportive. Israeli forces raided the West Bank leading to civilian casualties just a few days after the exchange of rockets and missiles between Israel and Hamas. As Ukraine’s incursion into Russia continues drones set an oil depot ablaze in Rostov and struck an oil reservoir in the Kirov region. In Libya, oil production in the eastern part of the country is shut due to fractions over the control of the embattled OPEC member’s central bank. As much as 1 mbpd of output might be affected for several weeks, consultancy Rapidan Energy Group estimates. It might just be the perfect excuse for the producer alliance to go ahead with the gradual unwinding of the 2.2 mbpd voluntary supply constraints from October.

The weekly US oil statistics were also deemed constructive. Crude oil inventories declined, albeit less than expected, gasoline stocks fell 2.2 million bbls which was coupled with a slight increase in distillate stockpiles. Commercial oil inventories thinned by 3.1 million bbls but it was the proxy demand reading that looked particularly attractive. Refiners supplied a total of 21.6 mbpd of products last week, the highest reading since last November with gasoline sitting above 9.3 mbpd.

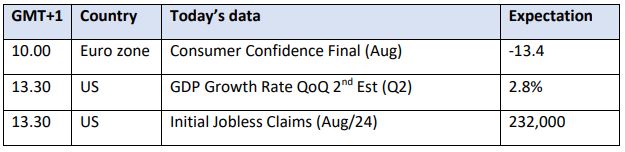

Yet, values eroded as Chinese demand worries still cause anxiety among market players. The stronger dollar and the sell-off in equities were also seen as impediments to an oil price rally. The eagerly awaited financial result of chipmaker Nvidia exceeded expectations, yet its shares dropped nearly 7% in after-hours trading. Today assorted inflation data and the US jobless claims report will be eagerly watched and weighted against the ubiquitous view of a looser oil balance in 4Q 2024 and the whole of 2025.

As Ambivalent as It Gets

Daily volatility in the oil market has cooled significantly over the past 2 years. In 2022 it averaged 44%, last year it retreated further and stood at 31% and year-to-date it is 22% on Brent. The same tendency is observed in the other four futures contracts. It suggests calmer trading conditions, however, nothing could be further from the truth. The oil complex remains choppy on an intra-day basis. Given the huge amount of uncertainty lurking from left, right and centre participants tend to react to headlines leading to occasionally strained trading conditions. The geopolitical outlook, the diverging views on global oil balance, and the possibility of trade wars between economic juggernauts all contribute to this unstable backdrop. As money flows in and out of different asset classes it has become increasingly challenging to foresee outright price movements. It seems obvious is that our market is stuck in a range, however wide it is, with $90 seemingly an impossible task to scale and $75 being the bottom on the European crude oil benchmark. Under these circumstances forming a tenacious view is a bold and even risky undertaking.

When searching for a method to this madness it is only reasonable to turn to assorted price differentials as they are deemed to provide a faithfully accurate picture of the underlying cash markets. The outlook on the crude front is auspicious. The structures of the two major benchmarks, WTI and Brent, are solid backwardation implying tightness on the physical front. The M1/M6 spread is around $3/bbl on both crude oil futures contracts. Brent CFDs also indicate a healthy outlook as the value of the physical benchmark is significantly above the forward contracts. This apparent tightness is partly the function of the OPEC+ market management policy and the result of the geopolitical environment coupled with actual supply disruptions from Libya and Colombia. Although the extent of the backwardation is nothing out of the ordinary by historic standards it still implies scarce availability of crude oil.

The state of the crude oil market, however, is anything but indicative without considering the availability of products, a more salient price driver. And the picture on that front is conspicuously less sanguine. Although the ICE Gasoil contract, apart from the front two spreads, displays narrow backwardation as the winter months approach, its extent does not insinuate meaningful tightness. The October/March spread is around $2/tonne. On the CME, the March 2025 Heating Oil contract is currently more expensive than its October 2024 peer, suggesting adequate supply throughout the US heating season. Curiously, the RBOB contract displays a healthy backwardation between October 2024 and March 2025, the extent of which is just under 1 cent/gallon a month.

The ultimate indicators of the underlying oil balance and the health of our market are the price differentials between crude oil and products refined from it. Healthy physical demand increases refinery profits and serves as an incentive to churn out as much product as possible to satisfy this demand. Margins refiners can rely on are currently subdued. Over the last month crack spread values trended lower. On the CME, the 3-2-1 crack spread lost nearly $6/bbl since the end of July and the Gasoil/Brent price differential narrowed $4/bbl.

The IEA’s Global Indicator of Refining Margins published monthly alongside with its Oil Market Report confirms this trend. Every major hub in the world registered lower margins in July, the month for which the latest data is available, than for the corresponding period of the preceding year. In Northwest Europe, for example, the light sweet cracking margin declined from $10.55/bbl to $3.87/bbl year-on-year. The medium sour cracking margin in Singapore fell from $2.78/bbl to $0.73/bbl and the same tendency is observed in other refining centres. Interest rates, economic prospects, OPEC+ output policy and several other factors undeniably shape investor’s thinking, but unless margins, possibly the most salient harbinger of the oil market, improve meaningfully, the upside will remain severely restricted and a downside price break-out cannot be ruled out.

Overnight Pricing

29 Aug 2024