A Good Recovery, But Let’s Not Get Excited

After oil prices experienced a bearish confluence of events, shook out much length and toyed with being oversold, there is almost an inevitability in the rally back to current levels. In a further display in how the oil fraternity remains very much imbued with ‘buy the dip’ programming, the recent abandonment of length is quickly replaced by default behaviour particularly as the market finds itself neatly accompanied by some friendly drivers and that scoundrel to a trading mind, hope.

Initially prompting the route higher came from the US DOE announcing that it was prepared to accelerate some of its buying for the SPR in such favourable price conditions. An additional 6 million barrels is hardly massive, but in a market that is running to low levels of speculative length, there was enough encouragement for embattled bulls to make a return. Investors that still follow Goldman’s calls in oil, and there remain many, seemed spurred into action as well when the Wall Streeter called for an increase in third quarter demand that will see a deficit in balance of some 1.3mbpd and a Brent price of $86 in the period. With the International Air Transport Association (IATA), last week predicting a record high for air passenger travel this year at nearly 5 billion journeys, and when coupled with the hope of a Gasoline season that has to reveal itself, the market has become better armed with a friendlier arsenal of drivers and perceptions.

There can be little doubt that the OPEC monthly report will harm such notions and whether there is contention with what the IEA will say in its own remains to be seen. However, all bets are off when oil price pickers come face to face with the US CPI and FOMC decision due tomorrow. Technicians will note that the 200-week moving average in Brent offers support at $80 and that its 200-day moving average offers resistance at $84, it would be surprising if Brent finished much higher or lower than this offered range by the end of the week.

Europe adds more pieces to the puzzle of markets

There is little doubt that the greatest driver in any market is confidence. At present, it is not confidence in the performances of counter parties or exchanges or some such consideration; it is current affairs, the state of the world and the political climate. Markets, including our one, have been on shaky foundations in terms of faith since the pandemic and the Russian invasion of Ukraine ran roughshod over the concept of a world that was formerly, inextricably financially tied in something of a state of benign politics. Benign, admittedly, is a matter of opinion and arguably the global shift to the politics of the absurd has been going on for decades. But with an alignment of Trump, Putin, Xi and Boris we eventually attained a nadir in world leaders that are akin to an amalgam of the satirical ‘Spitting Image’ and ‘The Muppet Show’. It is naïve to think that markets are truly capitalist and free, politicians interfere and indeed intervene at regular intervals, sometimes welcomely, sometimes not. Therefore, when there is political upheaval, markets have a way of making like a snail and disappearing into their shells.

Such a market shyness might again be seen from the election results from Europe over the weekend. The lurch to the right in the European elections has already had profound effects. In an attempt to cut off what might be a nationally hamstrung government (or at least perceived), Emmanuel Macron, the French President has called a snap election in which he hopes to prove that right wing politics is all well and good in the lowly parts of French democracy but at the higher echelons he hopes to prove there is a different national attitude. Whether or not Mr Macron is right or not, he has helped to add to the uneasiness in the corridors of power in Europe and migrated it to the corridors of finance where the Euro turned turtle in the early hours of Monday morning losing a whole cent and sending it back to one-month lows against the US Dollar. Much of the market good will that European markets were enjoying after the ECB’s 25-basis point interest rate cut last week is eroding under the spectre of what some fear will be an era of even uglier politics for the old continent.

Beyond what might just happen in French politics the European Union will enter another period of a threat to its being with many of the parties that have found favour in this swing to nationalist vote rather Eurosceptic. Clearly there will be no Blacks Shirts on the streets, the European Parliament looks very much as if it will stay centrist but probably now with a right-wing bias. However, it returns us to the scene of uncertainty. Arguably, the scepticism will allow for freedom in decision making from member states. Enforcement of common rules will be back seated by countries with nationalist sympathies such as Italy, Hungary, Sweden, Slovakia and now joined by France and Germany. The European Union has lorded it as the epicentre of the green movement with lauded high hopes for the Green Deal framework and policies to adopt net zero targets, these are now under threat to be at least diluted or even abandoned. It is hard to quantify if this will lead to direct increase in actual or forecasted fossil fuel use, but in terms of political influence and the global public’s antipathy to the spiralling cost of green energy, alternative power sources are in for another kicking which can only be added to in the US election. Parochial national needs in oil and the like will be given its head again, adding to confusion. General Elections in two of the three biggest economies of Europe, the UK and France will now almost overlap and be joined in a grand finale by the US in November. Vested interest expressions, unravelling of current and forming of newfound partnerships will be a weekly occurrence. Finally, there is the Bear in the room. Who is to say that any of the mentioned and unmentioned countries will not now take a more sympathetic view to Russia? Uncertainty just got another leg up and oil prices will be one of its major victims.

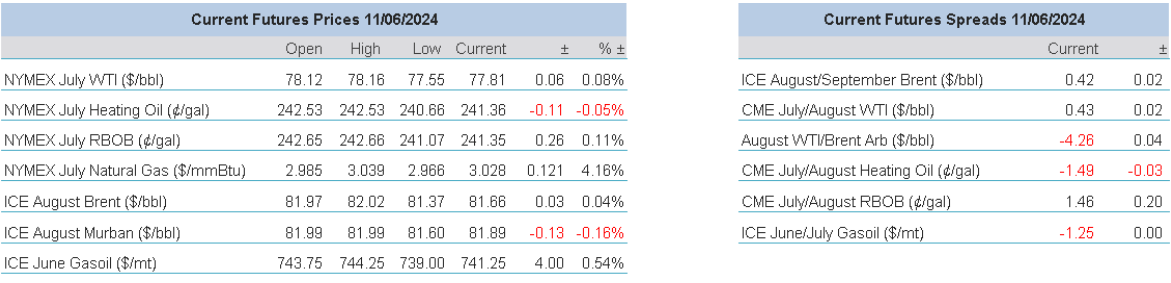

Overnight Pricing

© 2024 PVM Oil Associates Ltd

11 Jun 2024