Green Shoots Despite Freezing Conditions

In a few years, we will look back at 2025 and conclude that whatever the outcomes of the Ukrainian-Russian war turn out to be or whatever the incumbent US Administration eventually accomplishes were obvious. Hindsight is a salient human characteristic, and we believe that predicting the future is a simple task. On the contrary, it is close to impossible and what will have seemed inevitable in the future is anything but obvious today. Did anyone predict the prevalence of the Covid-19 crisis, or the unthinkable, namely Russia’s nefarious incursion into Ukraine? Would you have thought that a real estate mogul, after becoming the President of the United States would openly advocate the annexation of independent nations in the 21st century? No crystal ball helps us to foresee the factors that shape our fortunes, and one can only try to envisage what lies ahead by taking constant snapshots of major developments.

The two pivotal focus points amongst investors in recent weeks and months have been the Ukrainian war and the implementation of reciprocal tariffs between the US and its trading partners. We know what the impacts of any given outcome of these developments would be, but we do not know the direction they will take. No doubt, an eventual peace agreement between Ukraine and Russia would be seen as stimulating for the global economy since geopolitical risk would be mitigated and sanctions on the aggressor would be lifted. Since Russia is a major producer of all sorts of energy, oil, in a base-case scenario, would come under pressure. Of course, the phrase ‘peace agreement’ has numerous definitions. The 30-day truce agreed between the US and Ukraine in Saudi Arabia last week appears unacceptable for Vladimir Putin as it is seen as a chance for Ukraine to retreat and re-arm. As for a protracted peace, the velvet handcuff the US is offering to Ukraine, to cease territory, and hand over natural resources to the US in return for not providing security guarantees against further Russian hostilities might not go far enough for the Kremlin either. Potential military assistance from European allies might not be forthcoming without American help and as such any peace deal under Russian terms would be the equivalent of capitulation and would probably mean the end of a sovereign Ukraine.

The trade war intensified last week. In February, sanctions came into effect on China but in March also on US allies. It is probably unnecessary to go into detail regarding the extent of the tit-for-tat measures as it changes almost hourly, and by the time this note lands in your inbox, a new bombshell will have been dropped. What is relevant to contemplate is that how far the US Administration and the countries in its crosshairs are willing to go in this trade conflict, which has no upside for either party. The first Trump administration might be taken as a reference point, and it is tempting to reason that stock markets will be the ultimate arbiters. There are, however, two major differences between the first and the current Trump stints in the White House. The first one is that the President has nothing to lose this time around as he will not be re-elected, his pain threshold is higher and consequently, he is more inclined to implement his trade policies now than 8 years ago, notwithstanding how misplaced they are. The checks of the markets are waning compared to 2016-2020. This attitude is mirrored in the pugnacious narrative and actions. Secondly, his administration and the US Congress are more sycophantic and less condemnatory (at least openly) than before. There is no feedback or constructive criticism from within. It strengthens Mr Trump’s eternal belief that he is infallible and severely clouds his judgement. It is impossible to know the limit of his stubbornness and what the market reaction to his actions will be. Yet, recent movements in assorted asset classes open a window to the thinking of investors.

Since the President's inauguration, the US stock markets have been hit hard. The 10% drop in the value of the Nasdaq Composite Index (including Friday’s 2.7% relief rally) shows the growing anxiety about the health of the US economy as reciprocal import tariffs are being introduced. This compares with a retreat of less than 4% in the MSCI All-Country Index. The US's explicit criticism of its now former allies as free riders has served as an effective wake-up call for Europe, and it seems that there is no snooze button on the alarm clock. The German debt brake is being lifted, EU defence spending is soaring, fiscal restraints are being removed, progress towards unified capital markets is tangible and as a result, the German DAX Index, for example, has produced a positive return of 9% in the last two months. The retreat in the US 2-year Treasury yields implies that investors are more worried about US recession than inflation, which is confirmed by the price of gold as it briefly breached the $3,000/ounce milestone.

The price of oil has been greatly influenced by the sentiment in the US stock markets. Brent has managed a negative return of more than 10% since January 21. Clearly, concerns about excise duties negatively impact the thinking on the demand side of the oil equation. The IEA agrees. The energy watchdog of the developed world cut its 2025 demand forecast last week and it foretells 600,000 bpd build in worldwide oil inventories. It is, nonetheless, dismissed out of hand by OPEC, which expects global stocks to decline by 580,000 bpd this year.

Although there is a conspicuously growing pessimism in the investment fraternity about tariffs and possibly Ukrainian peace, it is intriguing to observe that a.) the two major crude oil futures contracts remain in encouraging backwardation (Brent more so than WTI), b.) dated Brent commands a premium in excess of $1/bbl over forward and c.) US oil stockpiles registered considerable drawdowns last week and commercial inventories record meaningful deficits from last year and against the long-term seasonal norm. These are the green shoots referred to in the headline. They, together with concrete Venezuelan and ostensible Iranian sanctions, the ad hoc rise in geopolitical risk premium such as the latest flare up precipitated by US airstrikes on Yemeni Houthis, insinuate a comparatively healthy physical backdrop. Occasional upbeat economic data (Chinese retail sales grew and further fiscal stimulus is to be introduced) can also been seen as supportive. One should never underestimate the power of the sentiment of financial investors, yet it is tempting to wrap up by saying that unless demand prognosis is substantially downgraded and the backwardation in crude oil narrows or turns into contango, dips remain attractive, albeit short-term buying opportunities in an otherwise eerie macroeconomic environment.

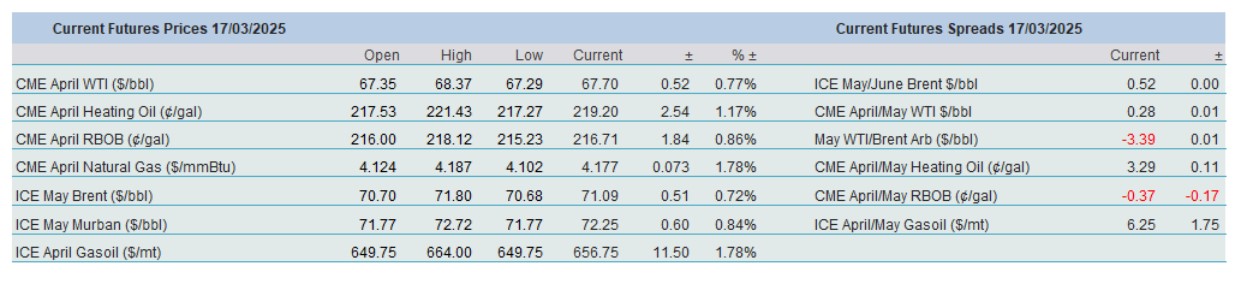

Overnight Pricing

17 Mar 2025