Growing Interest in Diminishing Interest Rates

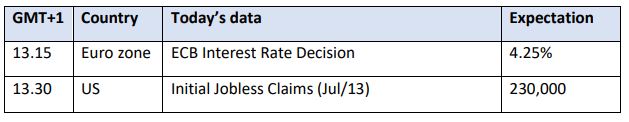

Everything, literally everything pales in relevance when it comes to auspicious inflation readings. Both the pound and the euro strengthened against the dollar as inflation in the UK remained at the target level making the lowering of the borrowing cost from the current 5.25% ever more plausible. In the common currency area headline inflation edged lower to 2.5% and core stayed at 2.9%. The ECB is to leave rates untouched in today’s meeting laying the groundwork for one more cut at the next get-together on September 12. Throw in the increasing confidence of US rate setters of an impending cut as mirrored in the probability of a 95% of a September move, according to the CME FedWatch, and you have made yourself a bullish rate cocktail.

Such is the optimism that Chinese economic data, which was predominantly responsible for oil’s recent malaise, was conveniently swept under the carpet and so was the bloodbath in the US stock market and within that in the technological sector triggered by comments from Donald Trump that Taiwan ought to pay for its own defense and by plans of the current administration to restrict the exports of advanced semiconductor technology. The Nasdaq Composite Index lost 2.77%. Why this plunge was more of a protective knee-jerk reaction than a vindicated and calculated move is discussed below.

Oil, nonetheless, danced to the tune of the dollar and advanced sharply from the one-month low achieved on Tuesday. This jump was the function of macroeconomic considerations, and not the making of brighter fundamental prospects. Crude oil rallied much harder than products as the EIA reported a steep drawdown in crude inventories whilst both distillate and gasoline stocks built. Commercial stocks jumped more than 10 million bbls and proxy demand plummeted by 1.3 mbpd on the week to 19.43 mbpd. Consequently, crack spreads remained under pressure. Financial demand is unambiguously healthy as rate cut expectations are on the ascent. It limits downside potential, but it needs to be aligned with supportive physical markets to see a convincing break over the $90/bbl barrier. And it is this conducive fundamental backdrop that has been AWOL in the first half of the summer, albeit, judging by the resilience of the crude oil contracts and the steepening backwardation refiners are betting on an imminent improvement in product demand.

The Greatest Survival of American Politics

History suggests that political violence, attempts on the lives of US Presidents are usually followed by some kind of national unity. And there are numerous examples of such incidents: Andrew Jackson, Abraham Lincoln, James A. Garfield, William McKinley, Theodore Roosevelt, John F. Kennedy, and Ronald Reagen. Both Robert F. Kennedy and Martin Luther King can be added to this long list as they were also prominent political figures. The reaction to last week’s assassination attempt on Donald Trump understandably sent shockwaves throughout the US and was immediately and justly condemned from nearly every corner of the world. Yet, in the case of the former and plausibly future POTUS, who seems to have more than nine political and certainly at least two biological lives, calls for reconciliation and unity were anything but unequivocal. Just think of the riposte of JD Vance, the Republican Senator from Ohio who immediately and squarely laid the blame for the attack on the incumbent President. The intellectually flexible foe-turned-ally, who once dubbed Donald Trump as America’s Hitler, was richly rewarded by his newly found idol just a few days after the assassination attempt as he was picked as the Republican nominee’s running mate in the battle for the White House.

His nomination is yet another clear indication of the forthcoming strategy of the prospective old-new administration. No doubt, the potential repercussions of a Trump presidency will be discussed on a frequent basis on the pages of this report. It will have a profound impact on the country’s foreign policy, as touched upon in yesterday’s note but today we focus on the economic impacts, which are equally concerning. What exactly is the Trump trade? How would markets react to his re-election, which he and his acolytes are becoming increasingly sanguine and even vainglorious of?

The cornerstone of his conservative economic agenda, just like during his first stint in the White House, is supply side economics -tax cuts and de-regulations-, together with protectionism and even isolationism. His economic policies will also be defined by tariffs and immigration.

He will likely dismantle his predecessor’s environmental measures, will be the advocate of oil drilling on federal land (admittedly a tiny portion of nationwide production). Ultimately, attempts to hasten the fight against global warming will suffer a setback, albeit, as pointed out in The Economist, during his previous 4 years at the helm his attempts to de-regulate were successfully countered in court. The Tax Cuts and Jobs Acts (TCJA), which came into effect in January 2018, and part of it will expire at the end of 2025, cut corporate tax rates to 21% permanently and also lowered individual tax rates temporarily on almost all brackets but the lowest one. No doubt he will pursue of making the temporary cuts permanent, at the cost of $4.5 trillion over the next decade, calculations show.

Possibly more contentious issues are tariffs and immigration. He flatly rejects the notion of gains to be made from global trade. Thus, the idea of introducing 10% universal tariffs on all imports and, in the name of decoupling and national security, a 60-100% levy on goods from China is being floated, re-igniting the trade war, devastating China’s economy with adverse consequences to global growth. His planned policies on immigration, or ‘invasion’, using his term, could also inflict close to immeasurable damage. Immigration work force has been absolutely crucial in bringing inflation down and refusing access to the labour market for millions of people will probably cause a considerable shock.

De-regulations will probably precipitate the least of harm. Tax policies will put strains on government spending and increase budget deficit, tariffs would significantly add to the cost of imports and the rigid stance on immigration and a wave of deportation could push wages meaningfully higher. Inflationary pressure will become elevated once again leaving the Fed with no other choice than upping the cost of borrowing, which, in turn, would strengthen the dollar. Of course, there will be checks in place. Even if the Republicans win both chambers of the Congress, some of his ilk might go against the planned economic policies and courts will also be used to mitigate the negative impacts of his measures. But most importantly, investors voting with their dollar will be the most hopeful and effective tool to keep him and his administration under control given his susceptibility to the equity markets. Nonetheless, if Donald Trump gets the mandate to govern the world’s biggest economy between 2025 and 2029 it is only reasonable to brace ourselves for an unpredictable and volatile four year on the economic front and his perplexingly random use of capital letters in social media.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

18 Jul 2024