Growing Risk Appetite

A resilient and stubborn performance from risk assets on Friday wrapped up a buoyant week. The major price driver was undeniably the move by the Federal Reserve on Wednesday, and oil prices received additional support from Israel and Palestine, where a flare-up in tension most plausibly increased the risk premium. WTI moved $3.25/bbl higher on the week and is now $6.17/bbl above the September 10 bottom. Brent advanced $2.88/bbl during the last 5 days and jumped $5.81/bbl over the recent trough. Equally heartening for anyone with bullish inclination was that the structures of both benchmarks strengthened considerably over the past week and physical Brent commands a more than healthy premium of $1.20/bbl over the forward contract for the immediate future. The slight improvement of the 3-2-1 CME crack spread value must also be noted. Against this backdrop it is somewhat puzzling to see Brent money managers remaining short as they increased their net length by a paltry 4 million bbls. WTI investors were more adventurous, and they added 41 million bbls to their long exposure pushing net length up to 91 million bbls.

Equities also enjoyed a positive week. The MSCI All-Country Index rose 1.26% with the S&P 500 Index hitting a fresh all-time high on Thursday. The outcome of the FOMC meeting put understandable pressure on the USD, yet another supportive factor for commodities. Its index against six other major currencies briefly flirted with the pivotal 100 mark, the lowest since July 2023.

Never Ignore the Near East

As mentioned above, one of the reasons for the sanguine performance in oil was the elevated geopolitical tension in the perpetual animosity between Israel and its neighbours. Last week’s unprecedented and shocking mass explosions of pagers throughout Lebanon and the follow-up Israeli air strikes over the weekend made it abundantly clear that the appetite for truce is non-existent until Israel’s goal of obliterating Hamas and Hezbollah is achieved – which is the exact antithesis of any potential peace talks. The reply from the other side is equally alarming. The Hezbollah leader declared that ‘all red lines’ had been crossed and after the attacks on Hezbollah and Lebanon it feels as though that Iran’s direct involvement in the conflict is the question of ‘when’ and not ‘if’. One can only hope that such a scenario will prove implausible, but if not, oil will inevitably rally. In the meantime, events around Israel, Gaza and Palestine remain a significant source of volatility.

How Long Will Interest Rate Support Last?

In a ‘damned if they do, damned if they don’t’ meeting the US Federal Reserve opted, not unanimously, to reduce benchmark interest rates by 0.5% after 4 years of restrictive monetary policy. The background of the rate cut is elevated consumer prices triggered by the massive stimulus package implemented during the Covid-19 pandemic and compounded by of Russia’s war against Ukraine. Some says that lowering the borrowing cost by 0.5% was a defensive move and envisages a weak economy. Although equally subjective, it seems it was more like a confident decision. Current data suggests that the extent of the cut will not re-ignite inflationary pressure and was a step in the right direction towards achieving the neutral interest rate, which neither restricts nor stimulates the economy.

The dual mandate of the Fed is to provide price stability and full employment, or better say to achieve the natural rate of unemployment. US headline inflation has been reduced from 9.1% in June 2022 to 2.5% last month. Core reading has plunged from 6.6% to 3.2% in the previous two years. Price stability has been achieved. The Fed has not received the plaudits it deserves for the surgical precision it carried out its tightening cycle to tame galloping consumer prices without pushing the economy into recession. The US central bank will focus on the labour market in the coming months, whilst keeping an eye on inflation.

Should the job market deteriorate in the near future another 0.50% reduction cannot be ruled out in November, provided inflation remains under control. In case unemployment remains stable a 0.25% cut is reasonable. The Fed ‘dot plot’, the estimates of monetary potentates, foresees borrowing costs falling to around 4.25%-4.50% by the year's end and to 3.25%-3.50% a year later, an auspicious scenario.

The rate cuts have and will continue having wide-reaching impacts. It is meant to revitalize the domestic economy, incentivize investment and spending and increase housing affordability by lowering mortgage rates. Its global effect is also plain to see. The interest rate gap between the dollar and other major currencies narrows, consequently, the dollar’s exchange rate weakens – or remains constantly pressured as the dollar index has already lost 6% of its value since April and plummeted last week to its lowest level since July 2023. Developing countries will find it easier to finance their debts. Not a negligible side effect that it helps the yuan strengthen providing support for the country’s ailing economy. Oil becomes cheaper all over the world. Conversely, producers are de-incentivized to pump.

The consequences of Wednesday’s Fed’s move are bullish all around and perceived additional cuts will brighten the mood further, correct? Indeed, or at least this is what the initial market reaction insinuates. Yet, it is imperative that we do not lose sight of the big picture. As US rates are merely one of the thousands of factors that shape markets and thinking, albeit admittedly a pivotal one, soon attention will shift back to the supply-demand equilibrium. It currently shows stuttering demand, in fact, it is solely the US economy, which is the ‘central bank’ of prosperity. China is faltering, introducing austerity measures in the UK is forthcoming, the eurozone is lagging, and one ponders how long the US will be able to provide unconditional support amidst this unparalleled de-coupling. OPEC’s ample supply cushion is reassuring, therefore the amended view that a protracted break above $80 basis Brent is implausible remains intact. An interest rate wonder lasts but nine days under dark economic clouds.

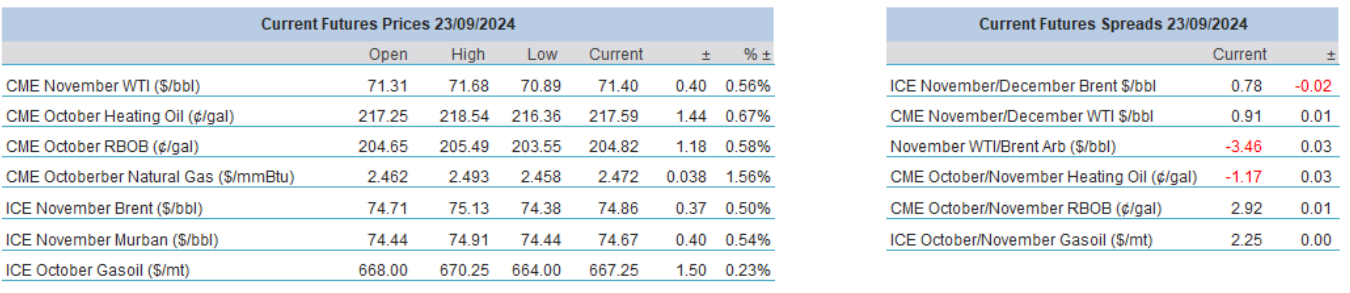

Overnight Pricing

23 Sep 2024