Happy New Year, All…

…and a less volatile and more predictable 2026. The second part of this wish (and even the first half, a sceptic would argue) might be bordering on wishful thinking, at least judging by the main events of the past year. Before attempting to foresee what 2026 may have in store for the world, it is undeniably useful, and by now traditional, to look back at how the past year shaped our lives from a social, political, and economic perspective, not least through the lens of oil. This is what we attempt to outline in today’s report. Tomorrow, we will arbitrarily select the two most intriguing developments of 2025 (yes, both related to President Trump), and on Wednesday, we will take a deep breath and dive into the most plausible scenarios for 2026.

From a social perspective, the most appropriate words to describe 2025 are probably 'fragmentation' and 'polarisation'. Whether it was the reaction to the arrest and deportation of migrants and even US citizens by faceless ICE officials, the “No Kings” protests against an autocratic president, unprecedented pressure on the media, or alienating former US allies, it is fair to say that norm-breaking behaviour and the “us versus them” narrative were amplified. An alarming aspect, as the social and political fabric frayed, is that constructive dialogue across ideological lines has virtually ceased to exist, while the “show-business-ification” of governance and the offering of simplistic solutions to complex problems gained traction.

The tone in the geopolitical arena was set early by the US Vice President. JD Vance’s speech at the Munich Security Conference, in which he accused Europe of anti-democratic tendencies, was followed by the disgraceful and very public dressing-down of the Ukrainian president in the Oval Office. Despite siding with Russia and the campaign promise of resolving the Russia–Ukraine conflict within 24 hours, the war shows no sign of ending, and following last month’s Trump–Zelensky meeting, no concrete evidence of impending peace has emerged. Elsewhere, while brokering a fragile truce between Israel and Hamas, Iranian nuclear facilities came under US fire in June, and public protests against the regime erupted last week. The declared US war on drugs also brought Venezuela into the crosshairs of the US president, resulting in the removal of the country’s leader, Nicolás Maduro, over the weekend. It has been a controversial move, to say the least, which will be covered in detail tomorrow.

As for domestic and global economies, the defining soundbite was tariffs. The incumbent administration firmly believes that the road to the economic Promised Land is paved with excise duties, not only for trading partners running trade surpluses with the US, but also for those who disagree with its policies. The now-infamous “Liberation Day” tariff announcement and the ensuing market reaction will likely be taught in macroeconomics courses for decades, with tariff advocates ending up on the wrong side of history. Analysts calculated that average US tariff rates, based on figures released on April 2, would have exceeded 20%, the highest level in 90 years. Markets, however, were quick to vote with their dollars: the MSCI All-Country World Index recorded one of its largest negative daily swings on record, while bond yields skyrocketed. This sobering reaction prompted a partial climbdown on import duties, aided by China’s brazen use of its leverage in critical minerals and its willingness to engage in a no-holds-barred confrontation with its main competitor. Average tariff rates now stand at around 15–17%, with a 10% baseline.

These levels remain historically high, yet investors showed admirable resilience for the remainder of the year, partly grounded in the belief that what matters is what Donald Trump does, not what he says. Equities resumed their upward trajectory, and major indices finished the year in positive territory, helped in part by the AI frenzy. Notably, however, US stocks lagged the rest of the world. The S&P 500 index, for instance, returned 16% in 2025, compared with 21% for the MSCI All-Country World Index and 23% for the German stock market. Meanwhile, the dollar, possibly reflecting a loss of confidence in the US, fell nearly 10% over the year, and in 2025, investors earned roughly 64 cents on every dollar invested in gold, one of the safest havens. It is tempting to conclude that coercive, exploitative, and transactional economic policies somewhat backfired by redirecting capital flows toward markets outside the US.

The upbeat performance of global equity markets would normally signal healthy growth in global oil demand. On average, the three most influential forecasters, the EIA, OPEC, and the IEA, pegged demand growth at 1.09 mbpd, with OPEC the most optimistic at 1.35 mbpd and the IEA the most cautious at 800,000 bpd. Robust consumption should imply firm oil prices, yet what we observed last year was a 9% decline in both WTI and Brent, including monthly rollovers. This outcome is surprising, particularly given the turbulence in oil-producing regions such as Iran and Venezuela, the raft of sanctions on Russian oil companies and exports, and surgical Ukrainian drone strikes on oil infrastructure.

The impact of these disruptions was more clearly reflected in crack spreads. While crude oil and RBOB posted negative returns in 2025, ICE Gasoil and CME Heating Oil gained 5% and 7%, respectively (again, including rollovers). The front-month Heating Oil crack averaged $32/bbl, while the Gasoil crack averaged $23/bbl, clear evidence of Russia’s difficulties in finding buyers for its distillates and of the effectiveness of depriving the country of critical revenues needed to finance its war against its western neighbour.

There is a straightforward explanation for why demand failed to provide meaningful price support: supply growth, both non-OPEC+ and OPEC+, outpaced consumption. Non-OPEC+ supply grew by an average of 1.63 mbpd year on year, versus 1.09 mbpd demand growth, resulting in a 610,000 bpd decline in the OPEC+ call once increases in other OPEC+ liquids are taken into account. The producer alliance’s shift in modus operandi of unwinding voluntary production cuts earlier than originally planned further boosted global supply (although the group now does not see the necessity to add more oil back to the market, and they held off further increases at yesterday’s meeting). Independent sources used by the OPEC Secretariat estimate that group production rose from 40.571 mbpd in December 2024 to 43.065 mbpd in November 2025. The latest monthly data point to an annual build of 160 million barrels in OECD commercial inventories, corroborated by weekly EIA figures, which project US commercial stocks rising by 56 million barrels, or 4.6%, over the course of 2025.

A cornucopia of factors will shape investor sentiment in 2026, and there is little doubt that the global oil balance and inventory dynamics will be among the most salient.

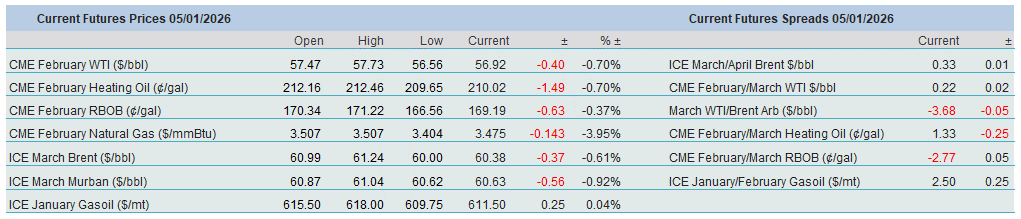

Overnight Pricing

05 Jan 2026