A Hard Week for Global Investors

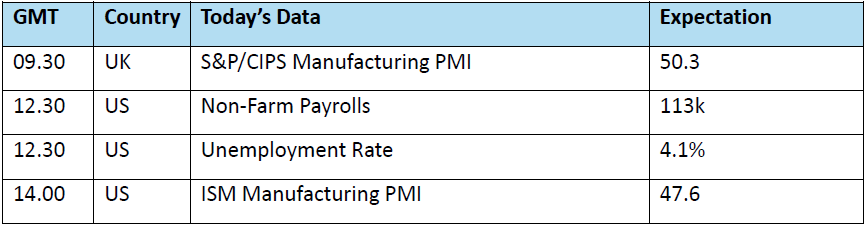

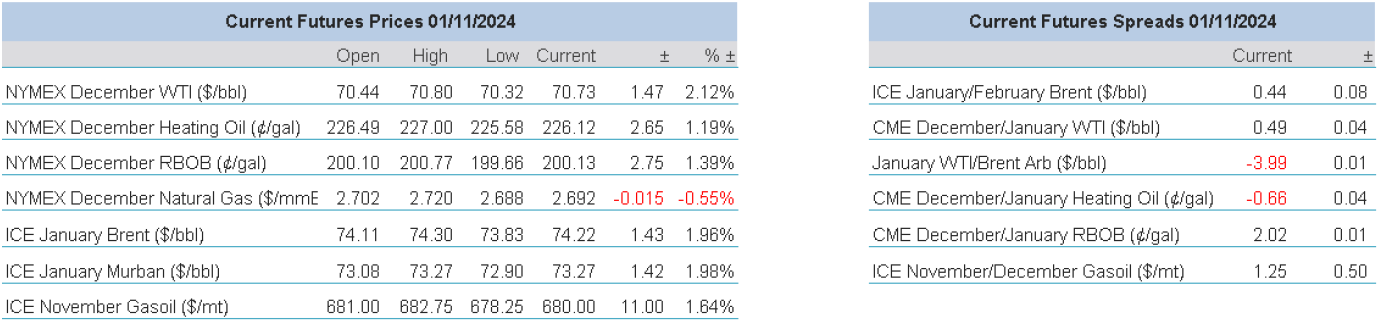

The wider suite is experiencing another swathe of risk-off going into the US election. This, of course, is expected but corporate results, national data and warnings from monetary watchdogs accelerate reasons to be cautious. The investor populace has been indulged this year to an easy boom in tech related spoils. So much so, that even with Microsoft and Meta reporting better than expected earnings, anything short of stellar is greeted with dismay. There is a realism setting in as corporation after corporation warn on the increase in capital spending to fuel AI investments giving enough reason for a bout of flight and a subsequent fall in the Nasdaq as it gave back all of October's gains. The US Core PCE did little to move the markets as it has mostly been factored in with the GDP advance from the day before, however, as low as it remains, the stubbornness to deflate further gives a headache for those wishing to see a more swashbuckling Federal Reserve. Eyes today will fall upon the Non-Farm Payrolls, which seem likely to fall after the dramatic rise of last month. Ordinarily, a fall would be greeted with ideas of the FED being a little more dovish, but a poor reading at this time of sensitivity might see more of a stock market fallout. Elsewhere China finds continuity in PMIs as the private Caixin reading of 50.3 beats expectation, but it barely registers. There is too much suppressive noise from the US and even Japan where the recent hawkish stance from the BoJ keeps sentiment contained. The IMF, which is probably the most miserable forecaster of all, also negates the good Chinese data. It warned that there are viable risks to the downside in Asia, mainly due to the increase in trade tensions and China's current negative malaise spreading. The report yesterday of imminent attack from Iran, probably via Iraq, into Israel may have rallied oil prices to the tune of $1/barrel in WTI and Brent, but it does little to aid the worry the wider suite experiences while faced with state of global current affairs.

Do not forget to look both ways in a war

Attributed to the late British Prime Minister, Harold Wilson, “a week is a long time in politics” can be subverted into a “a week is long time for Middle East wars”. Both are obvious references to the changeability and ephemeral matters of importance that at some point seem crisis but quickly find themselves considered false flags. The hype and build up to the eventual attack by Israel into Iran last Saturday became so palpable that one can be forgiven in detecting a willing-on by the oil fraternity of action from Israel, not in any side-taking or warmongering, but to clear the occlusion disabling analysis of oil market levels without any war interference. After the air raid was over on Saturday and the market on Monday rightly lost its current war premium, an eerie atmosphere has since descended. The imaginings of burning oil infrastructure across the Persian Gulf region or even mushroom-shaped clouds in the skies of the Arabias have disappeared to be replaced with a fraternity that is non-plussed. There has been hardly a reaction to the Prime Minister of Lebanon, Najib Mikati’s speculation that a ceasefire deal with Israel could be announced very soon. In opposition to that, nothing much has been made of Israel banning UNRWA from its country, a move which must stand against any hope of ceasefire in Gaza and ought to serve a warning for the hopes of Lebanon’s leader. Yet, as often been the case in Lebanon, the government continues to be undermined by Hezbollah. Its newly elected Secretary-General Sheikh Naim Qassem did not seem to read the memo. He spoke on the Hezbollah’s ability to wage a long war, that it would continue its war plan and eventually inflict absolute defeat on Israel.

There is an acceptance that the mode of Israel’s attack and consequential narrative of the matter being over is very much at the behest of the United States. While this might be true from an Israeli point of view that finds itself under an attack limiter imposed by Washington because of next week’s election, can the market be sure of such limitations of operation from Iran? The Islamic Revolutionary Guards Corps (IRGC) said that Israel will face “bitter and unimaginable consequences”. The Defence Ministry also said, “Iran can launch dozens of retaliatory operations”, later expanded by legal sources, "whenever the airspace of a country is violated, that country will be entitled to respond.” As unlikely as it may seem at present, with dialled down rhetoric from Ayatollah Khamenei, has the market prematurely dismissed another attack from Iran in the time left before the US election? Saeed Jalili, the one-time nuclear negotiator and failed runner in the Iranian election, may be a favourite of the Ayatollah, but he is never shy in coming forward in aggressive rhetoric. He stated, “the enemy should be slapped in the face,” according to the government-owned Iranian Students News Agency (ISNA). Vatan-e Emrooz a hardline Persian-language newspaper only yesterday asserted that Iran will pull the trigger, in reference to retaliation, while according to Iran Insight, The Kayhan, a hardline newspaper linked to Khamenei's office, wrote that a cease-fire with Israel is impossible. Our market has quietened its fear for more attacks from Israel into Iran, but is it giving enough regard to aggression coming in reverse, even with the small rally inspired by such a rumour overnight?

Overnight Pricing

01 Nov 2024