He May or May Not

The US President’s influence on financial markets has become irritatingly axiomatic. Even when his posts or throw-away comments lack coherence and are contradictory, markets swing wider than a pendulum. Oil prices dropped nearly $3/bbl after Mr Trump said Iran tried to reach out to negotiate, although in the same sentence, he warned that the attempt came very late. Thankfully, later he clarified if a direct US involvement in the conflict is plausible by categorically stating that he may or may not do it. It leaves the market on the fence as the odds of a potential supply disruption has not vanished. The Iranian reaction to US involvement might entail unforeseeable consequences on oil shipping or production. On the other hand, it is worth remembering that the ultimate Israeli objective is regime change, and the path towards it could lead through considerable supply disruptions.

Investors are, justifiably, so preoccupied with the Middle East that the usually salient reports and financial events have been dwarfed in significance. The 11 million bbls draw in US crude oil inventories went largely unnoticed. Commercial stocks in the US register hefty deficits to the year-ago level and the 5-year average, hinting at no considerable stock build in OECD inventories until after the second half of the year. Yet, the two major crude oil contracts finished only a tad higher.

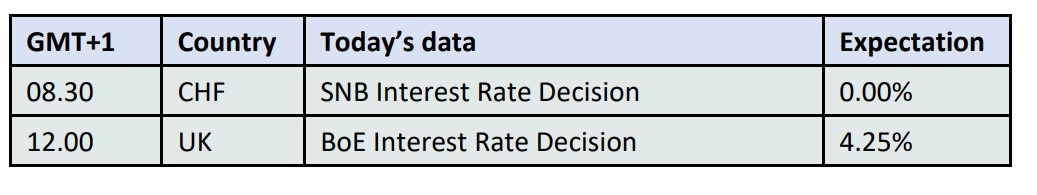

Equity markets also stayed in limbo, although the Fed, much to the dismay of Mr Trump, left interest rates unchanged. Its latest economic projection foreshadows growth retreating to 1.4%, unemployment and inflation rising to 4.5% and 3% respectively by the year-end, the quasi-definition of stagflation. This is heavy stuff, which raises anxiety levels, but the focus is firmly on the Middle East crisis and its potential impact on stocks and oil. How long will it cause understandable unease?

Supply Shocks are Transient

With last week’s Israeli assault on Iran and the response from the Persian Gulf adversary, another layer of uncertainty has been added to the expanding list of ‘known unknowns’. It is ambiguous at best how trade talks will unfold, what the economic impact of the proposed US budget will be, whether central banks will have to lower or raise interest rates because of recessionary or inflationary fears, or they will face the nightmare scenario of stagflation. Or will the current concerns about the economy and oil demand prospects prove completely misplaced, and one big, beautiful world awaits, nothing short of an economic Canaan? The outcome of the Russian-Ukrainian conflict is also unpredictable, and so is its long-term impact on oil supply. The same goes for the Middle East. What appears indubitable is that with last Thursday’s assault on Iran the regional status quo of the last seven or eight decades, if it existed at all, has been irrevocably upended. Or it would be more accurate to deduce that the hornet’s nest was irreversibly stirred in October 2023, when Hamas launched its abhorrent attack on Israeli civilians. The Israeli retaliation, including the current conflict, is an inevitable consequence of the terrorist strike, even if some believe that the countermeasures are disproportionate. Amidst the fluid scenario, which changes almost by the hour, anyone involved in the oil market is desperate to find a solid answer to one question: how will oil prices be affected?

The lazy reply is that it is impossible to tell. Looking at past conflicts, nonetheless, provides a helping hand. These wars, clashes, and terrorist events predominantly jeopardised the supply side of the oil equation, directly or indirectly. They can be divided into two groups: those which were foreseen and those which caused shocks. Their common denominator was that they were brief, and every time the oil market showed a remarkable ability to adapt, notwithstanding the occasional price spikes.

Take the first Gulf War of 1990 as the first example. In the immediate aftermath of the Iraqi invasion of Kuwait, Brent rallied $25/bbl or 170% in less than three months and gave back almost all of these gains the moment the first US bombs were dropped on the instigator. The impact of Gulf War II between March and May 2003 was even more muted. We saw a jump of $12/bbl or 53% in the four months leading up to the operation and a price collapse during April and May. The Arab Spring, which started in December 2010, initially pushed oil up from $85/bbl to $127/bbl in the space of 4 months, only to be followed by a consolidation during the ensuing 1 ½ years. The market's gut reaction to Russia’s incursion into Ukraine was more intense as Brent topped just under $140/bbl, yet it was shortly followed by a rather spectacular plunge. The terrorist attacks of 9/11 in the US and 7/7 in the UK raised fears of retaliatory measures, military or otherwise, on oil-producing countries, but the bullish reaction had the lifespan of a mayfly.

There does not seem to be an undisputable and rigid relationship between supply shocks precipitated by geopolitical events and the market reaction – they largely depend on the geographical origin and the severity of the tension. The common feature is that the initial response is comparatively brief. There are possibly two reasons for it: 1.) the jump in oil prices entails recessionary fears lowering oil demand (demand shock), and 2.) there is adequate spare production capacity (which is primarily the zeitgeist of the last 10 years) to cushion the blow of any potential supply disruption.

As pointed out in an opinion piece in the Financial Times, the latest IMF Global Financial Stability Report found that major geopolitical events have not had a lasting impact on equity markets since the Second World War. An ECB study concluded that the upside oil price pressure triggered by rising tensions between countries or terrorist attacks is generally short-lived and, on average, reverses after one quarter, although the impact of these shocks varies across countries. In the ongoing Israel-Iran conflict, it is intriguing to observe that analysts, when predicting $100+ oil prices in a doomsday scenario, use, without exception, the phrase ‘price spike’. It neatly confirms the findings that supply shocks tend to be temporary. It might well be the case regarding the Middle East conflict unless all hell breaks loose and the region’s oil fields and energy infrastructures are engulfed in flames.

Overnight Pricing

19 Jun 2025