Headline Bingo

It is only the start of February and already our fraternity is tired of the banners which flash across screens trying to grab our attention in their own importance. What makes them more infuriatingly difficult to ignore are the many and varied A.I.-like tools which read headlines and are programmed to react. Or should we not offend and say coded? Debatable semantics aside, the multi-dollar moves in crude futures yesterday were authored by an initial flash that informed on how the US/Iran talks has been cancelled on Friday because of Iran’s unhappiness of both the venue and refusal to expand talks on anything beyond nuclear issues. Just over two hours later, and apparently under pressure from Gulf states, Iran reversed its position. The combined rally and correction totalled $4/barrel and was largely equal in being a 2 up 2 down affair and nothing to do with buying one’s first home. Sometimes, levity and humour are the only things left, but dare one utter such diffidence to those caught up in positional opposition to ephemeral diplomatic brinkmanship and their accompanying media exposure? In current affairs the targets are so rich as to be bursting the skies. But despite how in bourses A.I. is eating A.I. companies, central banks (discussed below) are setting interest rate paths and Gold and Silver are on a daily basis, either solid or melting, nothing in our oily circles is as sensitive or more important than the goings-on in Iran. We await/dread the next headline.

Nothing to rely on here

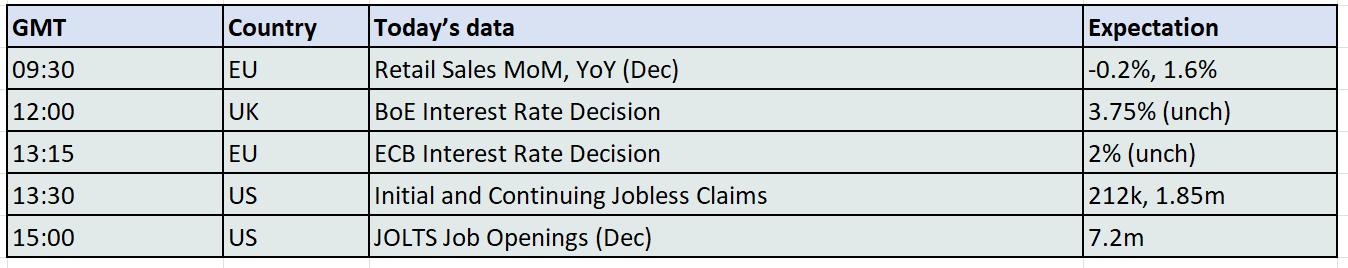

We keep returning to the role of central banks, and the habit is unlikely to change for some time as the world churns and shakes and forces the guardians of economical health to likewise trim their actions accordingly. All corners of the globe await the European Central Bank and the Bank of England’s interest rate decisions today and what paths they foresee in the near future. The premise and role of central banks is to act in independence of its government and in some ways the ephemeral demands or spending behaviour of the population it represents. It is a tightrope. The likes of the Fed, ECB, BoJ and BoE cannot dare to stand aloof, detached from the those that legislate policy or by those that drive fiscal necessity which are the source of such instruction. The plain truth is if a government is elected, then it has been mandated to do with the economy what it will, and the central bank must serve policy as if it were serving voters. The nuanced and somewhat enforced duplicitous part played by the likes of Jerome Powell, is whatever monetary policy is meted out on an economy, the central bank must manage the effects, and these at times seem to be in direct contrast to what a government wants. Hence the continual bark from the Oval Office on the need for lower interest rates and the conservative considerations of the US Federal Reserve which knows that massive government debt, made curiously and counterintuitively worse under a Republican Administration, will cause inflation.

In discussion yesterday, my colleague rightly pointed out on how it is the Fed’s role to ‘manipulate’ interest rates now, to set a stable path for the economy over the next five or ten years, which is why long-term bond yields are sensitive to rate changes. Conversely, governments, particularly the current US one, want economic stability immediately, because they must service debt now, want cheap mortgages now and care little for long-term goals. This is a mini cultural war of independence that cannot be blamed on the Brits. In fact, the same issue has gone before us. "I respect his independence,” so said US President Richard Nixon in 1970 of the then Fed Chair, Arthur Burns. However, I hope that, independently, he will conclude that my views are the ones that should be followed".

Over in Japan there is potential for a similar type of rift between the Liberal Democratic Party and the Bank of Japan. Prime Minister Sanae Takaichi, and after being elected prime minister by lawmakers in October, has called a snap election in Asia’s second-biggest economy as she seeks affirmation from the electorate in her aims to have a more expansive set of policies which will balloon the already burgeoning national debt. There seems to be little doubt on Takaichi’s gambit being successful if polls are to be believed, but what will be intriguing is despite the largesse promised, the BoJ may not be as accommodating to policy as the prime minister might like. Being profligate with Japan Government Bonds (JGBs) has already seen push back from markets when the snap election was first announced. The Yen cratered to the market-important $1.60 number, something not seen for nigh on thirty years. The resultant rally from such a sensitive, psychological number was inspired by barely guarded hints that there would be intervention. Given the BoJ’s reluctance to allow the Yen to devalue any more because of the risk to inflation and domestic growth, it might not wish to stand as guarantor for greater government money raising. The Governor, Kazuo Ueda, has that the BoJ stood ready to play its role in being a stabilising force, but according to an opinion from a former colleague on the board of the central bank, as seen on Reuters, "it's the government's job, not the BOJ's, to deal with the consequences of market distrust over fiscal policy."

Modern markets are so attuned to discord, and a future government/central bank clash is being smelled from months and miles away. But at least in Japan it will be all business and manners, not so much in the United States, even if President Trump’s nominee Kevin Warsh mounts the podium as the new Fed chair with expectations of lower interest rates giving fanfare. The financer and former Federal Board Member, seems to have a nasty market-upsetting hawkish streak. His opinion on how the Fed is holding way too high of a balance sheet and its inclination to prioritise easing rather than controlling, was the major factor in the extraordinary ‘rotation’ witnessed on Monday. Gold and Silver for a time lost all the brothers and sisters of opportunity and with a chair who might just defend the honour of the US Dollar, the correctional rethink was felt everywhere.

Such differing views on how to manage economies are becoming more and more public and with each clash of sabres, be they polite or denigrating undermines trust. The minutes of central bank decision meetings will be poured over more than the Epstein files with just as much accusation and fallout. Our market is dogged by geopolitical influences, some of which are beyond ego. If such absurdities enter into the trusted hallows of those who man the ramparts of economic health in central banks, then things which can be relied upon become even fewer. Future erratic moves are now a sure-fire thing but rather than quell them, disjointed and inharmonious central bank policy is about to inflame them.

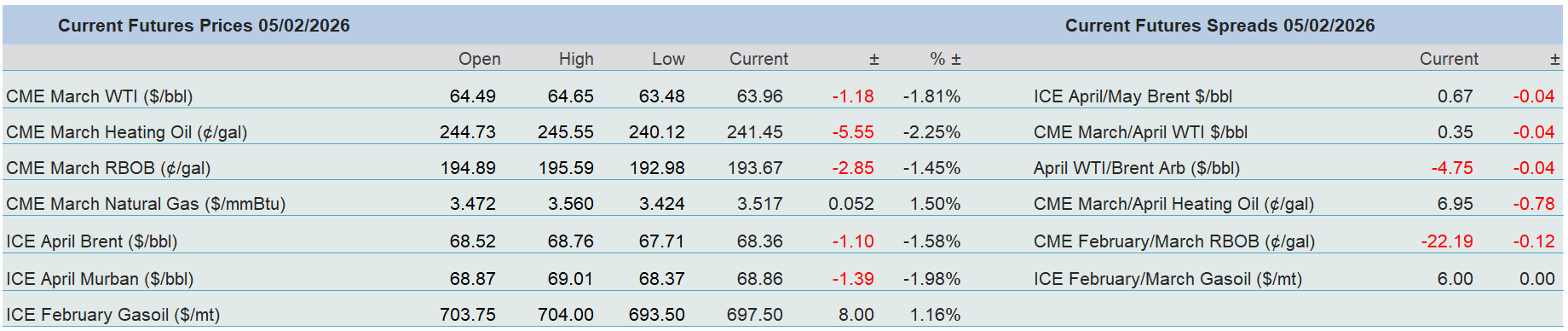

Overnight Pricing

05 Feb 2026