History does not even Rhyme

Only the gullible would be the stubborn advocate of one of the alleged cornerstones of chart analysis, namely that history repeats itself and the same event would repeatedly trigger the same reaction. It has been evident on a frequent basis that a bearish occurrence would less likely trigger renewed selling in a falling market than in a rising one and vice versa. Look no further than yesterday. The EIA recorded builds in literally every category (albeit less than the API) as commercial oil inventories in the US surged 13.5 million bbls last week with proxy gasoline demand dipping below 9 mbpd. On a side note, the infamous Row 16 in Table 1, the adjustment factor that is meant to bring supply and demand in line in case of some inconsistency showed an increase of 1.3 mbpd. The Saudi cut in July official selling price was not exactly a confidence booster either.

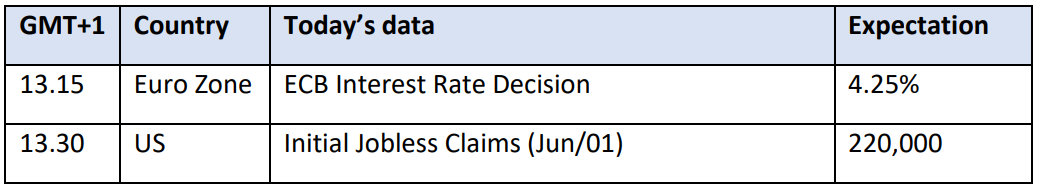

Although fertile ground for further weakness was prepared after a $8/bbl losing streak, focus shifted to the macro world where hopes of rate cuts starting with the BoC yesterday and the ECB today, continuing with the Fed possibly in September were on the ascent with the inevitable consequences of healthy economic and oil demand growth. After Tuesday’s US JOLTS report, the May private payroll data yesterday also suggested a slowing labour market much to the delight of the Federal Reserve. US equities climbed to fresh historic highs and the temptation was irresistible for oil, it faithfully followed. Whilst after the weekend’s OPEC+ meeting all the weak length might have been flushed out, it would be foolish to think that the path higher is now just a walk in the park. As we ponder below, global oil inventories must reflect developing tightness in global oil balance to irrevocably reverse the trend. If US stocks are the bellwether of worldwide stockpiles, then this demand excess is anything but perceptible yet. Thus, the road to the summit will prove rocky.

Sum of the Parts versus the Whole

The oil market is a constructive and challenging mess. There are so many moving parts and therefore assumptions that it is equally justified to paint a bearish or a bullish view. It is plausibly a fair statement that recession has been avoided globally as well as in the developed part of the world. The question is how buoyant economic prospects are, whether rate cuts on both sides of the Atlantic will materialize. Consequently, estimates about oil consumption stand on shaky legs. The fragile oil balance for the rest of the year and for 2025 has been made even more uncertain by geopolitical/geoeconomic developments in the Near East and in Ukraine. The upcoming US election is another, quite salient, source of concern and so are the unforeseen developments in the battle against climate change. And whatever view one formed, it has surely been upended with the decision of the OPEC+ producer group over the weekend to gradually re-add more than 2 mbpd of oil between October 2024 and September 2025.

Do these factors justify a price drop of more than $15/bbl or 17% in the past two months? Does the unexpected unwinding of voluntary OPEC+ cuts explain a fall nearly $5/bbl in less than two days? And is it the supply or the demand side of the oil equation that is responsible for the recent sell-off or the devious combination of the two? Will it continue or is the slump overdone and we have seen the beginning of the end yesterday? Numerous questions, doubt and precariousness is the zeitgeist of the past two years.

It is useful to recall that ultimately stock levels are the dominant force in the formation of oil prices. And global oil inventories are shaped by the difference between supply and demand. The more the latter exceeds the former the steeper stock depletion is. Therefore, it is almost innate and instinctive to call for a healthy rise in oil demand in order to reason for a march towards the recent peaks. Yet, what is not emphasized is that global oil consumption grows annually and reaches fresh records every year. It suggests that notwithstanding interest rate anxiety, the global economy, including China, is, at least for now, doing just fine. We pointed to the $15/bbl price drop above. Well, since the beginning of April the MSCI All-Country Index, after a sharp plunge in mid-April, has recovered decisively and has gained more than 3%. The 17% erosion of front-month Brent can also be set against the less than 4% loss in the value of the FTSE/CoreCommodity CRB Index, which oil is a dominant component of. Blaming the demand side of the equation for oil’s misfortune does not add up convincingly.

On the other hand, both the EIA and the IEA sees 2024 non-DoC supply growth trump global oil demand growth with gusto observed for 2025. OPEC is the odd one out as it foresees consumption accelerating faster than non-DoC supply effectively indicating rising demand for DoC oil. Resolute non-DoC supply should not come as a surprise for two reasons. Firstly, and for the longer term, there is a growing belief that oil will be a prominent part of the energy mix for years to come. Secondly, the alliance’s willingness to sacrifice market share was greeted by non-DoC producers by stepping on the accelerator. US output is resolute, and healthy growth rates are penciled in in Guyana, Brazil, and Canada, amongst others. Stable oil flows from Russia and the Middle East adds to the misery. Ultimately, in its effort to stabilize the market OPEC+ created its own Waterloo, which are its peers outside the group.

Is OPEC+, therefore, inert to have an impact on the oil balance and on prices? Not quite. The well-publicized diverging views on supply and demand cause understandable perplexity when projecting the outlook. These gaps, however, were already in existence last year and we know that Brent, for example, averaged $82.17 in 2023 and $84.40 in 2H 2023. The reference point has been set. And this point suggests that with perseverance and continuous output restraints OPEC+ could actually arrest any potential rise in global stockpiles and could force them to decline. Such a scenario might presently be ostensible but once it becomes palpably obvious, the price reversal can get duly and confidently under way. It will be interesting to see if next week’s updates subscribe to this view. The sum of the parts seems less than the whole.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

06 Jun 2024