Hold that Oil Thought, Here Comes the FED

Despite the hullabaloo surrounding the US Federal Reserve's interest rate decision this afternoon, oil prices are still enjoying enough micro drivers to keep our fraternity very much interested. After pushing into new year-to-date lows last week, prices have recovered to a point where one might say the interests of bears and bulls are evenly matched. The elongation of problems in Libya cannot be understated, the opinion here is before production started to normalise, it saved Brent from carousing with even lower levels and probably nullified what looked to be a chance of seeing contango spreads for quite some time. Backed up by 'Francine' in Louisiana, which has still yet to puff its last influence, and a realisation on just how short the likes of Commodity Trade Advisors (CTA) funds have been, oil markets have gone through a bout of efficiency with technical and positional corrections to leave them poised in anticipation for 'what's next?'

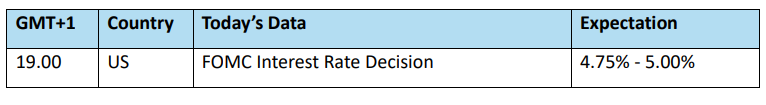

There is plenty. The EIA Inventory Report will be awaited this afternoon because this morning's API report offers a little confusion. Against a Reuters poll of a 0.5mb draw, Crude stock built by 2mb. With USGC Crude production shut in by up to 40% last week, there is an anomaly that might reveal itself in PADD breakdown or even a later correction, but at first glance it does appear odd, especially as Cushing stocks drew by 1.4mb. Gasoline and Distillate stocks also had outsized builds of 2.3mb in both against much shorter calls. The Middle East will never leave us alone and the latest audacious and outrageous event is something only imagined in sci-fi and James Bond movies. Lebanon and Hezbollah are firmly pointing an accusing finger toward Israel after up to 3,000 pagers were seemingly simultaneously detonated causing death, injuries and utter havoc to those sporting them or in their vicinity. What humans can do to each other. Yet, all of us must do our jobs and consider that this event can only ratchet up tension between all the various interested parties, call them proxies or allies. We touch on China below, but this morning's flash data via Bloomberg quoting the General Administration of Customs shows Gasoline and Diesel exports falling again in August by 26.1% and 30.6% respectively year-to-date. There can be little doubt that troubling refiner margin is still causing a pinch. Still, after this afternoon, our fraternity will have to wait to debate oil issues, for the FED decision is upon us and the whole world is invested in it and no matter what opinion might hold for oil it will have to be shuttered until the tsunami caused by the outcome abates to navigable ripples.

China, yet again

There is a fascination in all that is the United States within financial markets and rightly so at present. The leading light of all economies, showing the way from pandemic ravages and inflation fuelling invasions, remains the source for most positive stories and indeed wealth generation. In a similar vein, but in diametric opposition, whenever there is a ‘but’ or need of a balancing to bullish arguments, China in contemporary times can always be relied upon to be the financial hope suppressant in the global economic saga. So much can be blamed on the downward correction of the housing market but there is something of a negative spiral going on in which each data set from the various sectors knocks on to another with the biggest of all market supporters, namely confidence, suffering blow after blow that if it were actually in a boxing ring it would receive a standing count.

Such is the weight of what might happen at the FOMC decision that the data from China over the weekend is most definitely on the back burner and awaiting attention. This situation has been compounded by the holiday period in the region. Yet again the House Price Index, Fixed Asset Investment, Retail Sales and Foreign Direct Investment behave poorly and hammer home how bleak current prospects look. Consumption and investment deteriorate in repetition adding to poor domestic demand which must be continually offset by exports. Faced with a year of systemic economic failings, the response from government has been at best sketchy. Policy announcements, targets and aspirations are often brought forth instead of actual stimulus and monetary injections into housing or financial markets have been scatter-gun, incremental, prone to the charge of crowd pleasing and with no follow-on planning. Indeed, and in an opinion piece from the Economist, shared by others, government is widely believed to be massaging data, suppressing sensitive facts and sometimes offering delusional prescriptions for the economy.

These struggles have even been recognised by OPEC, the most bullish of all China callers. Its forecast for China's oil demand growth in last week’s Monthly Oil Market Report was cut for a second straight month to 650kbpd for 2024 from 700kbpd in August, and 760kbpd in July before that. Frankly, OPEC was so far out of step with other publications, analysts and indeed the hard data that it had little choice in doing so. Even though customs data showed August crude arrivals increasing to 11.56mbpd, the heightened appetite has been widely accepted as price convenience rather than any requirement for industry. China has history in opportunistic buying and the favourable year-to-date low prices that began to appear in August is just way too tempting for a country that boasts over a billion barrels of potential storage capacity. In keeping with the above observations that China obfuscates data, it does not offer insights into SPR, but Reuters calculate that with 15.76mbpd available from domestic production and imports and processing amounting to 13.91mbpd, that means 1.85mbpd is going into storage backing up the idea of nearby demand being all about price rather than thirst.

Refinery margin is all the rage in bearish circles, and they do not have to look that far within China to back up such sentiment. The state of the Distillate market is likely to continue to ravage the massive processing capacity even after recent closures of plants. Sinochem closed its Zhenghe and Changyi refineries and the record processing number of 14.76mbpd for 2023 is but a pipe dream in current conditions. Many of the predictions of a flat reading in 2024 are being revised lower and with spare capacity likely to increase, smaller less profitable refineries are likely to befall the same fate as those of the Shandong province. Staying with products, but switching to Gasoline, exports year-on-year in July were down 35.7% from 1.22Mmt to 0.790Mmt due to margin showing actual losses of $3 to $4/barrel according to a Reuters opinion. A loss of margin will be exacerbated by loss of market. Take for instance the start up of the massive 650kbpd Nigerian Dangote refinery. Argus reports that it expects to be able to produce 57 million litres per day of Gasoline, with Nigerian domestic demand being 33mlpd speculation is rife that the balance will find its way to Europe. This is doubly bad for China as the EU is becoming more antagonistic towards China’s export policy and taking motor fuels from elsewhere will be politically expedient.

Conversely, lower prices mean more China demand from cavernous storage. But if one’s biggest asset, is forced to sit on a reservoir of feedstock and no emerging outlet for it to spill into, how long can the situation be viable? Unless China can instil a domestic revival of demand in any of its massive industries through stimulus and a change of policies, the only oil demand that is likely to be shown is that from tankage. The continued strategic threat to its financial fortunes via trade wars, tariffs and competition does not bode well for its refining industry nor does China’s own policy of transitioning to greener solutions. China is by no means a spent force in terms of oil demand. But that demand is flat-lining and whereas the South-East Asia’s industrial dynamo could once be counted on to mop all available oil before it, the state of its economy, government policies and over-capacity plots a very different future.

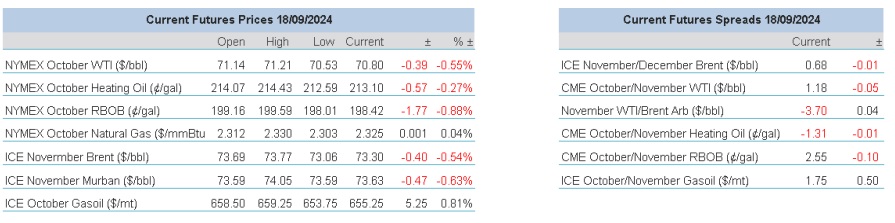

Overnight Pricing

18 Sep 2024