On Hurricane Watch

With the wisdom of hindsight, yesterday’s sharp intraday sell-off that took place after New York opened was never going to last. Firstly, tropical storm Idalia, which might reach a Category 4 hurricane status today, served us with a stark reminder that it is that time of the year when US Gulf Coast oil production and refinery operation can be adversely affected. Although the ironically named weather phenomenon, which means “loveable” will avoid the region’s main refining hub, oil major Chevron took pre-emptive steps and evacuated non-essential staff from three of its platforms – hence the rally in crude oil prices. Products were lagging and settled broadly unchanged as no disruption to refinery operation has been reported yet and Marathon is on the verge of restarting previously closed units at its Garyville, Louisiana refinery. The expected 3.3 million bbls draw in US crude oil inventories (Reuters poll) further boosted the confidence of oil bulls. It turned out to be even more price supportive. The API reported a plunge of 11.5 million bbls with product stockpiles fattening some.

The risk-on sentiment was palpable in equities, too, yesterday. Stock markets shot higher, and the dollar was encumbered as US job openings fell for the third consecutive month in July and stood at 8.827 implying easing tightness in the labour market and resulting in increasing hope that the Fed will pause rate increases next month. The CME’s FedWatch sees an 87% chance of unchanged borrowing costs in September and a 54% chance of steady rates throughout November. Current investor sentiment is upbeat, but in today’s headline driven trading environment all it takes to sour the mood is a below par set of economic data. For this reason, today’s eurozone consumer sentiment and the US 2Q GDP readings will be pivotal and eagerly watched.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

10.00 |

Euro zone |

Consumer Confidence Final August |

-16 |

|

13.00 |

Germany |

Inflation Rate Preliminary August |

6% |

|

13.30 |

US |

GDP Growth Rate QoQ 2nd Estimate 2Q |

2.4% |

Six New BRICS in the Wall

Last week’s BRICS meeting in Johannesburg is a major milestone in the relatively brief existence of this political and economic coalition. The existing members of the group of developing nations have invited Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE to join under the umbrella of emerging economies bringing six of the world’s major hydrocarbon producers together.

The four founding members are Brazil, Russia, India, and China – hence the acronym. The official date of birth of the group is 16 June 2009 and the place is Yekaterinburg, Russia. The original focus of the organization was vague. It was the improvement of global economic situation and the reforming of financial institutions. South Africa became a member in December 2010.

The foundation of BRICS coincided with the Great Recession. As the global economy recovered from the financial devastation of the 2007-2009 financial crisis the group’s goals changed accordingly. Over the past decade the BRICS nations have been seeking to fulfil a rebalancing role against what they see as a rigged international system that is dominated by developed nations. The expansion of the group is the embodiment of these efforts as member countries, collectively the ”Global South”, are intending to play an increasingly relevant role in the world’s affairs. It really started to grow in relevance after Donald Trump launched his economic war against China and it increased further in importance after the Ukrainian war broke out. The question is how effective the group will be and whether they will represent a formidable opposition to the US and its allies.

The list of complaints of a unipolar world from developing countries is long and possibly justified, at least elements of it: unfair trade deals, the hegemony of the often-weaponized dollar, and the predominantly western aligned international institutions, such as the IMF or the World Bank to name the most prominent ones. Productively addressing these issues, nonetheless, could prove problematic.

To begin with, BRICS countries are far less unified than the Western alliance. The values the individual members represent are not unequivocally shared. There are non-aligned members, the likes of India or Saudi Arabi versus autocracies who intend to directly challenge western dominance. Tension can also run high between member nations, just think of the Chinese-Indian border conflicts dragging over three years. The economies of member countries widely diverge, and their geopolitical interests could also differ significantly. Whilst Russia is firmly aligned with China, the Prime Minister of the biggest regional competitor of the latter, India was greeted with open arms in the US on his latest visit. Existing members and nations that have been invited also tend to advocate the non-alignment approach and are reluctant to be brought unconditionally under the sphere of influence of China.

The most striking case in point is Saudi Arabia. The Kingdom’s political focus has visibly shifted after the emergence of the US shale sector. US crude oil imports from Saudi Arabia has declined from 1.4 mbpd in 2012 to below 500,000 bpd 10 years later. New buyers, namely China and India filled the void, but relationships developed far beyond oil. Saudi Arabia entered a comprehensive strategic partnership with China. Yet, its reliance on the US in other areas remain critical and palpable. The US is still seen as a stalwart partner in guaranteeing regional security in the Middle East, it is the most significant supplier of military hardware and the most trustworthy, liberalized, and salient investment market for the Kingdom’s sovereign wealth fund.

The proposed expansion of the group is aimed at strengthening the presence of developing nations on the geopolitical and global economic stage. Is it a realistic goal? The group collectively represents almost half of the world’s population and around 30% of the global GDP, yet internal division and indistinctly defined objectives, apart from acting as a counterweight against Western dominance, will result in underachieving of currently ambitious goals. The most significant of these is to create a “BRICS” currency and challenge the dollar’s supremacy. The inflated group will, however, lead to a hastening polarization of the global economy and spiking geopolitical tensions with no winners. The increasing significance of the BRICS countries is a clear manifestation of a dysfunctional world order and might just help to come to the realization that there are gains for all parties involved to be made from globalization, more than from protectionism and polarization, as it was so discernibly on display in the early part of this century. This view might sound inspiring and sanguine, but, alas, the mills of political gods grind painfully slowly, therefore it could prove utopian.

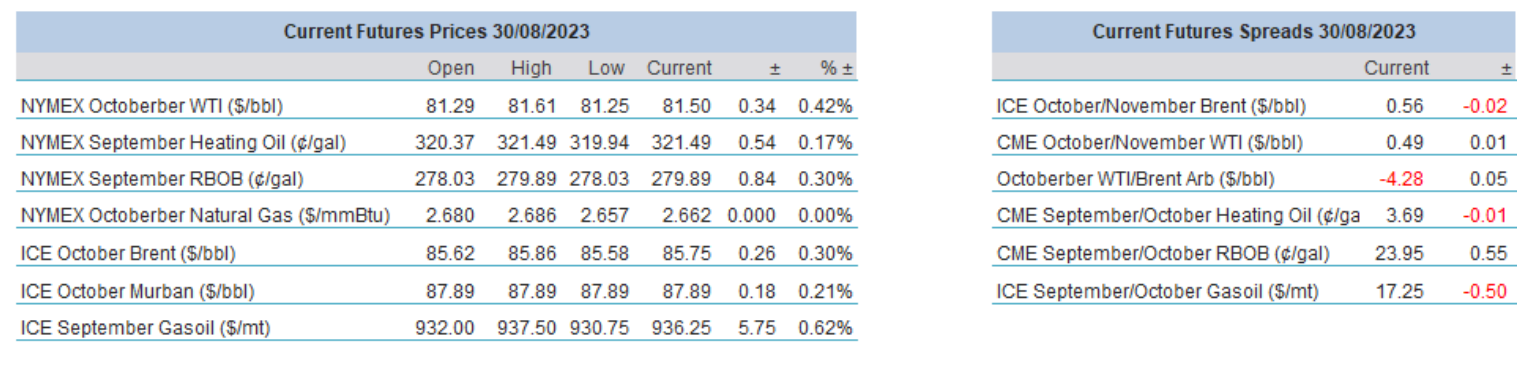

Overnight Pricing

30 Aug 2023