Import Duties, Export Fees

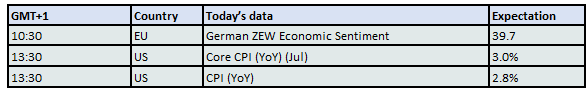

During the last seven whirlwind months, every week has felt pivotal and relevant, and the current one is no exception. Investors will no doubt stay glued to their screens at 13:30 UK time when the US inflation figures are released. A slight uptick is expected in both the headline and core numbers. They will be used to gauge the impact of US tariffs. Anything above the 2.8% and 3% forecasts will likely trigger a wave of disappointment. Matching or even beating expectations would go a long way toward making a September rate cut a dead cert unless the quality of the data, under the new leadership of the Bureau of Labor Statistics, is questioned.

Another milestone in upending the global trade status quo arrived today, as the latest extension of a tariff truce between the world’s two largest economies, China and the US, expired. One cannot help but think that the unprecedented and legally dubious 15% fee on chip exports by Nvidia and AMD, announced on Sunday, was primarily designed to appease China. Everything, even national security, has a price, or so the latest turnaround seems to imply. Those who bet on another reciprocal extension of the tariff deadline were proved right; the countdown to the next 90-day period begins in the early hours of tomorrow.

Oil watchers are eagerly, or, more accurately, anxiously, awaiting the US-Russia summit in Alaska on Friday. Behavioural economics suggests that humans are present-biased, placing undue weight on immediate gains even when they may cause greater harm in the future. (We all use credit cards.) This tendency certainly seems to apply to the US President, creating a conspicuous risk that a truce will be agreed upon for its own sake, potentially involving Ukraine ceding territory to Russia and agreeing never to join the EU or NATO. Satisfying Russia’s territorial demands is a red line for Ukraine and its European allies, especially if it is de jure as opposed to de facto, making the summit’s outcome far from certain. Once again, “uncertainty” is the most fitting soundbite to describe current investor sentiment, hence the wait-and-see attitude on all fronts and the cautious and tepid activity in both equities and oil yesterday.

It’s the Supply, Stupid

The market’s reaction to the April 2 tariff announcements is still fresh in memory. When nonsensical import taxes on both trading foes and partners, including countries running a trade deficit with the US, were unveiled, investors desperately sought shelter. They found it in gold, which surged to $3,500/ounce in the ensuing days. The loss of trust in, and credibility of, the US Administration triggered an exodus from the dollar into other currencies. As risk was shed, the MSCI All-Country Index fell 14% in three days, with the damage slightly more severe in the Nasdaq Composite Index. Oil was not immune either, and front-month Brent plunged 25% from high to low between April 2 and April 9.

The 90-day reprieve announced shortly after the mini-crash then reinforced the belief that the US President could either be reined in by an inauspicious market reaction or had merely used the exorbitant punitive measures as leverage to negotiate trade deals. Either way, the recovery took hold, and major stock indices, particularly in the US, are now hitting fresh historical highs almost daily. While this rally has been greatly aided by the tech sector, the 50%+ import taxes have faded into history, with the US ostensibly set to erect trade barriers no higher than 20%.

Whether this level of protectionism will hurt the US and global economy is open to debate; for now, investors remain buoyant. What is intriguing is that while equities have more than recovered their immediate post-Liberation losses, oil is lagging. The 30% jump in the global stock index has been accompanied by only a sluggish 13% rise in the European crude oil benchmark. More tellingly, over the past two months, Brent has fallen nearly 20% from its peak following the US attack on Iran, even as global equities have risen about 7%.

Geopolitical and geoeconomic developments neither discourage stock investors nor encourage oil bulls. This suggests that the detachment between stocks and oil is driven by supply rather than demand. In other words, the market is not worried about shortages — as illustrated by the sharp sell-off after the US attacks on Iranian nuclear infrastructure. Despite the $15/bbl price drop over the past 7–8 weeks, Brent remains in a firm backwardation, and the almost $2/bbl premium commanded by Dated Brent over the forward contract still points to healthy refinery demand.

Updated estimates of the global oil balance will provide insight into how demand and supply projections have shifted since last month. (The EIA and OPEC will publish their reports today, followed by the IEA tomorrow.) Looking back to April, it is clear that neither global oil demand nor non-DoC supply estimates have changed significantly for this year. There have been modest upward revisions to demand and small cuts to non-DoC supply for 2025. If anything, the call on non-DoC oil was slightly higher last month than in April. Yet, as noted, oil prices have failed to gain traction.

The most consequential development for the oil balance has been the change in OPEC+ output policy. The unwinding of the 2.2 mbpd voluntary cut, previously expected to last well into 2026, will be complete by next month, as the producer group now prioritises market share over price support. DoC supply rose by 600,000 bpd between April and June, and OPEC output has increased by roughly the same amount between April and July, according to monthly Reuters surveys.

This shift appears to have set a ceiling for oil prices at around $73/bbl, the recent peak, which is unlikely to be breached unless there is a tangible disruption to supply, particularly in the Middle East where most spare capacity resides, or if Russian oil buyers turn their back on their political ally.

As for the downside, while supply is widely seen as the main driver of oil prices, deteriorating economic data stemming from US trade policy could lead to a gradual equity market downturn by year-end. In that case, the oil/equity correlation would likely re-emerge. However, the cyclical nature of our market will likely constrain supply and boost demand. A prolonged drop below $60/bbl is not expected, unless a full-blown trade war, especially between the US and China, erupts.

Overnight Pricing

12 Aug 2025