Imports, Inventories and Interest Rates

There is an oddity in reaction to the China Customs data released this morning. On the face of it, the decrease in both imports and exports ought to send more of shock through the minds of investors particularly as some economists have downgraded their economic predictions for the balance of 2023. However, bourses abetted by financial tourism seem in no mind to consider these uncomfortable data. Indeed, when breaking down China’s trade, those of an oil bent and a bullish nature will welcome the very healthy increase in crude imports. Yes, the caveat is that China’s refiners are coming out of maintenance season and that independent refiners are enjoying a 10% increased quota after pollution/emission limits are relaxed, but the headline of imports at a 3-year high is hardly the stuff that bears are made from. June saw 12.7 million barrels per day as inflows and even as Vortexa points to onshore inventories being 980-million barrels, only 20-million barrels from the record, the notion of a thirsty China will aid the current market temperament.

With inventories in mind, the weekly US EIA stock report caused something of hiatus in proceedings yesterday. The banner build of 5.95 million barrels for crude and an implied demand shrink of 0.84 million barrels per day for gasoline stood the bulls down for part of the afternoon session, but being the only build for a time and with the 5- year average stores in evidence the complex soon assumed its upward momentum. US Crude, Gasoline and Heating Oil are -1%, -5.3%, and -13.3% respectively below their 5-year averages and with refinery turnarounds in view, bulls will be looking for that deficit to increase.

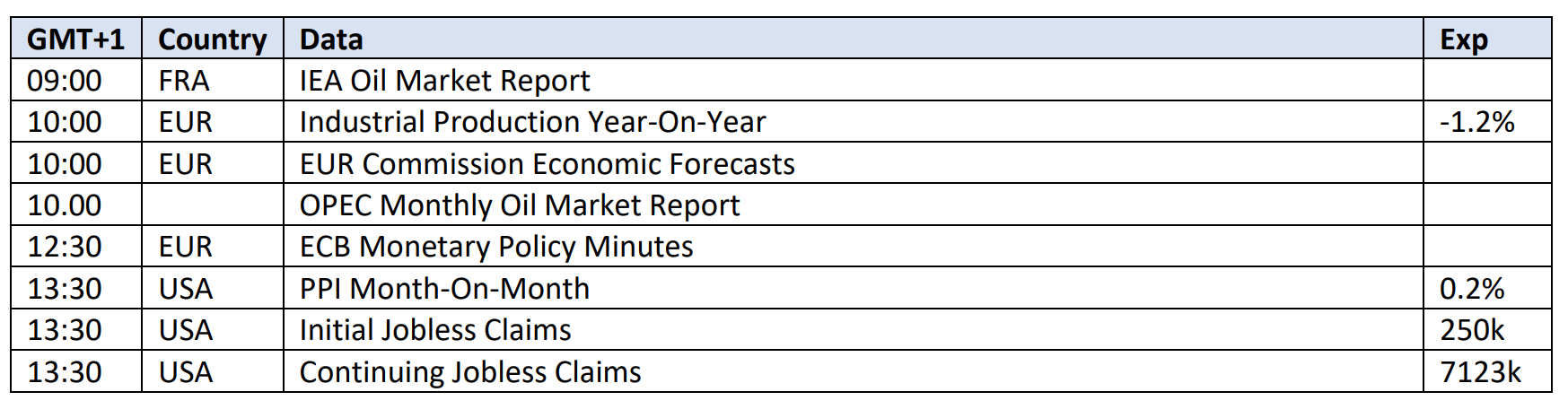

As predictions of deficits are in vogue it will be interesting to see how the IEA’s Oil Market Report and OPEC’s Monthly Oil Market Report align or diverge today. There is little reason to believe that either will change attitude in prediction of negative balances and soon to be inventory draws, but it is always fascinating to compare and contrast. Frankly, it would take more than an uneasy read to knock oil from its climb, it will be as it has been for some time now the machinations of the wider macro and in particular, interest rates.

‘I’d rather be a hammer than a nail.’

The haunting strains of Simon and Garfunkel’s ‘El condor pasa’ are easily commutable as a metaphoric look at how the United States Federal Reserve and OPEC’s recent past, present and probable future actions seem to be playing out. By trying to control the price of oil from supply is a neat and complicated affair involving dancing around geopolitical liaisons that on the face of it do seem unlikely but, for OPEC in contemporary times, understandable.

In a world where the backdrop of macro-economic influences dominates all, one wonders how OPEC, and by OPEC we mean Saudi Arabia, can hope to yield any sort of fruit from what appears to be a very lonely battle in maintaining strength in the oil price be it physical or rhetorical. Yet here we are, the narrative snatched from the doomsaying of global industrial measures and an intricate foregrounding of future demand being carved into the current psyche of the market using Saudi’s ‘nail’ of voluntary cuts.

The Kingdom may claim otherwise, but its timing does seem fortuitous. The hiatus in June for any increased interest rates by the US Federal Reserve has allowed a growing belief that this interest rate cycle is nearing an end, something that Chair Jerome Powell has not dismissed out of hand and or reined in FED board members from speculating on. Yesterday’s US CPI reading is a real boon for OPEC, but although encouraging, ought not be viewed as a portent that the inflation battle is over. Indeed, the Wall Street Journal suggests that housing and car disinflation has been anticipated for months and warns rebound inflation has happened before. Aiding the oil price is a wilting US Dollar. Not everything regarding the greenback is US related. The recent financial performance of Japan and its lately rallying Yen, the ever-hawkish European Central Bank and a Bank of England besieged by workforce pay rises are upping the ante in interest rates, resulting in the combined influence pressuring the Dollar Index to 1-year lows.

Yesterday’s CPI figure saw end of year yield pricing reduced from 35% to 25% for another FED hike of 25-basis points. However, the CME FEDwatch tool is still pricing a July bump of 25-basis points. In another global sign that interest rates are not going away anytime soon, the Bank of Canada yesterday raised its rate by an expected 25-basis points. The next FOMC meeting is not until 25-26 of July, therefore it is likely that Saudi/OPEC will maintain the narrative which in some ways might just end up being counterproductive. The higher the oil price as we approach the FOMC meeting, the more likely the FED is to wield the ‘hammer’ and bring order back to an excitable oil market.

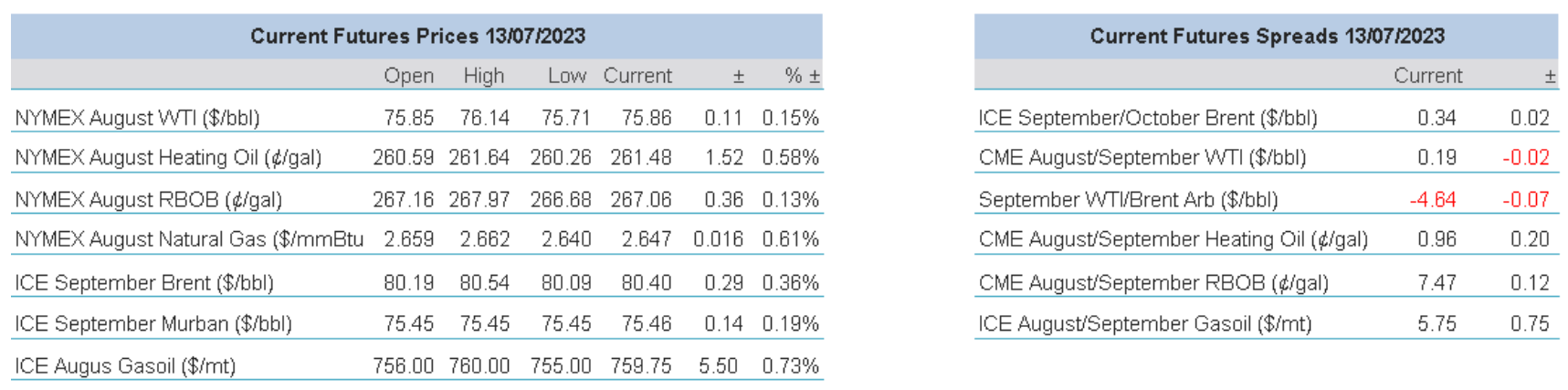

Overnight Pricing

13 Jul 2023