Interest Rate Cuts are Shrugged Off by Oil Prices

While the oil product price of Distillate is acting as something of a parachute and balloon, holding up the wider complex, the pressure being felt in Crude prices is a counterweight and while crack levels remain elevated, there are increasing stories and signs of a future where feedstock supply is unlikely to be a problem. Indeed, when we enter the refinery turnaround and maintenance season, it is difficult not to envisage Distillate cracks widening even more as processing will wane. The idea of copious Crudes is made all the worse by the current affairs of supply. Just on a US domestic level, EIA Inventory reported Crude Oil stocks increasing by 2.4mb with international pressure coming from elsewhere. Russia is playing its own kind of crack game due to damage on its refiner sector from Ukrainian drone strikes causing a hiatus in Gasoline exports but an increase in Crude Oil outflows to make up for lost revenue. However, what is more worrying and really supressing the fate of unrefined grades is the now market belief that on Sunday, at the OPEC+ monthly meeting, another 1.65mbpd of supply on hold that had formerly been expected to be introduced next year, will now be brought forward. This of course is based around ‘sources’ close to OPEC, but the recent modus operandi of the cartel is to leak bad news first and ready the market.

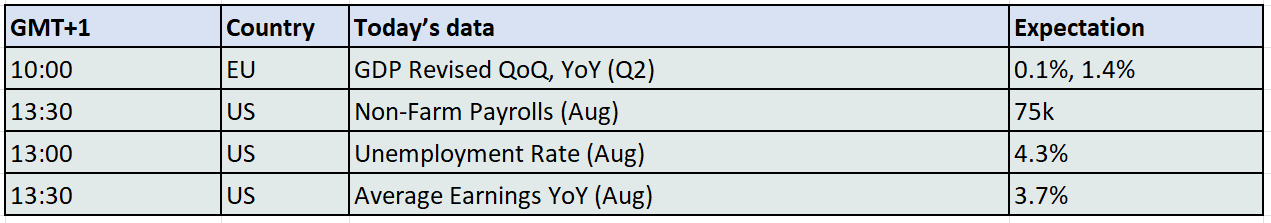

Oil practitioners are clearly taking this threat of possible oversupply very seriously. This is proven by how they are not joining in with the wider suite’s buoyant expectation of a poor Non-Farm Payrolls reading today. Investors are back in bad news is good news mood being centred around the state of US employment. After the JOLTs job openings indicating Americans are now faced with more employment seekers than jobs available, yesterday saw the ADP National Employment data print fall below the market call, Challenger Job Cuts increase, leading to Initial Jobless Claims climbing. With FED members allowing dovish inclinations into the public domain and that at the recent Jackson Hole Symposium, Jerome Powell intimated that a rate cut in September could only be stopped by data, markets are assuming a true to word reaction and a cut. The CME FedWatch tool is posing a 99.3 percent chance of a 25-basis point cut but also a 50 percent chance that that another two similar cuts will be seen before the year is out. Crude oil prices are being left behind by its finished derivates, but oil in the whole is once again being outclassed by other investment modes.

Who goes there, friend or foe?

A new world order is opening in front of our very eyes and brings together historical adversaries that up and until recently could never be seen together hanging around a missile parade in Beijing. It is optically extraordinary to see Vladimir Putin as almost guest of honour being feted at China’s ‘Victory Day’ to mark the 80th anniversary of the end of the Second World War in Asia. The relevance of the guest list is made even more poignant by there being only two invites to Western leaders. Slovakia’s Robert Fico and Aleksandar Vucic of Serbia cut controversial figures in Europe with both looking to cement economic ties with China but are allies in calling for a normalisation of diplomatic relations with Russia. Sprinkle the whole recipe with North Korea’s Kim Jong-un marching side-by-side with his other border sharers, the world is served a new triumvirate platter of easily labelled bad guys.

But, in the prism of international trade, are they? And what has forced such a public display of unity? The answer lies in how given the attitude of the US to foes and friends alike, new forms of alliances are increasingly likely. The revisionism of the Trump Administration, its bulldozing of international trade via tariffs and taking US exceptionalism to an extreme is starting to come at a cost. Assessing the same concerns, the Guardian shares this view and neatly observes the three-way Chinese, Russian and North Korean partnership on show in Beijing is united in opposition to US hegemony and a Western-dominated financial system. It is no longer possible to describe such opposition as being trite, that such anti-American/Western attitude has been part of the global furniture for decades; this looks to be the start of a new phenomenon.

Just look at the recent visit of India’s Prime Minister Narendra Modi to China. Under the canopy of attending the Shanghai Cooperation Organisation (SCO) meeting, Modi was able to eyeball President Xi in what would have been only a few years ago deemed impossible. Gautam Bambawale, India’s former ambassador to China, told CNBC’s Inside India: “The dragon and the elephant are not dancing as yet. They are just looking at each other from opposite sides of a room and trying to assess what are the implications of the relationship between the two? It’s going to take time to bring the relationship back on track.” This facing of diplomatic awkwardness, plagued with border disputes and economic rivalry, portrays a new willingness to find an alternative financial path, one that is not policed by the US.

Indeed, Xi was expansive in interview on Monday, "we must continue to take a clear stand against hegemonism and power politics, and practise true multilateralism," he said, giving little doubt as to whom he referred. Tariffs, sanctions and the wielding of the US Dollar as a lasso to wrangle countries to American and Western bidding, now sees BRICS becoming more relevant. Yesterday we shared IMF data predicting developing nations will claim 61% of the value of goods and services this year alone. In 2024 the original five members of BRICS, Brazil, Russia, India, China, and South Africa added Egypt, Ethiopia, Iran, and the United Arab Emirates (UAE), followed by Indonesia with many others being designated partners or interested in joining. According to research carried out by Carnegie Endowment for International Peace, the bloc already boasts about 45 percent of the world’s population, generates more than 35 percent of its GDP (as measured in purchasing power parity, or PPP), and produces 30 percent of its oil.

The EU, US and the West were the first to weaponize energy after Russia’s invasion of Ukraine. But punitive levies are no longer placed upon those countries that are practising illegal wars or nuclear development. They are finding deployment against allies such as India, whose thirst for oil might well eventually match that of China, but New Delhi is being told it cannot practice oil purchases from its cheapest source.

Allow us then a speculative leap. We have read in recent days, ‘from sources’, that OPEC+ will not only re-engage those barrels that have been for years subject to voluntary and official cuts, but even more of the oil cartel’s output will soon find its way into the oil balance. This should come as no surprise bearing in mind OPEC’s newfound goal on capturing market share rather than guarding price. At first look, it would appear OPEC’s releasing more barrels is doing a favour to the US by enabling it to keep sanctions on Iran, Russia and secondary ones on India by not upsetting the global production stream.

However, imagine then that such new alliances, seen and unseen, as depicted above and a growing willingness to escape the financial jurisdiction and scrutiny of the US, where OPEC will continue to offer safe harbour to Iran and Russia as producing members. With such meaty and readily available volumes, OPEC can be relied on in performance of delivery of oil stuffs for the demand of not only India and China, but to the whole of Asia, the sub-continent, Africa and even eventually Europe. OPEC would not hurry oil onto a market it might send below $50/barrel if it did not believe that custom was available. We live in times of the extraordinary. Of shifting political and economic boundaries. If the US is seen within some of the countries mentioned as a bully, reaction must surely come, and if the Trump administration carries on pursuant of isolation, it may just get its wish as oil relations and long-term contracts are forged elsewhere and the damage to the US oil sector would be incalculable.

Overnight Pricing

05 Sep 2025