Interest rates a threat to personal spending demand

Crude oil prices enter the day still very much enjoying the rallying effect provided by the inventory draw first indicated in the API report and then confirmed within the EIAs. Arguably it is not the size of the draw being 10.584 million barrels or that it was very much below the forecasted -3.3 million, but how the state of US crude inventory puts it 15.623 million barrels below the 5-year average that catches the eye. Some consternation comes from a greater than forecast build in Distillate stock, 1.235 million barrels versus 0.2, prompting a spate of profit taking as seen by the Heating Oil futures contract losing 11c/gallon yesterday and in the narrowing of the Gasoil/Brent futures crack which has lost $7.50/barrel in 3 days. However, and returning to the 5-year average point, Distillate is still 18.064 million barrels and even a recently underperforming Gasoline is 7.776 million barrels beneath their respective multi-year means. Seasonal thirst for Gasoline is still showing some resilience with implied demand rising 158,000 barrels week-on-week.

China remains on the radar of the oil community as it looks for any positive sign of change in the fortunes of its embattled economy. Therefore, every piece of data is mulled and measured which is why the National Bureau of Statistics publishing of August PMIs today had been so anticipated as a bellwether for industrial demand. Frankly, they are mixed at best, manufacturing came in at 49.7 and above the 49.4 forecast, with non-manufacturing at 51 versus 51.1. As much as the improvement in the manufacturing figure is welcomed, it is still below the expansion number of 50 and has now been so for 5-straight months. If only China’s PMIs were published in isolation, running in unison as warnings are the industrial production numbers of South Korea and Japan this morning. Year-on-year South Korea’s -2% against a -0.4% call and Japan’s -2.5% versus a previous flat reading expose continued frailty in Asia’s industry.

It does appear that services industries and personal consumption rather than manufacturing and industry are keeping the economies of the world ticking over. Strength in employment and a so far resilient attitude in the face of higher interest rates is made all the more impressive which is why personal behaviour such as retail sales, air travel, motor car miles and credit use are becoming more important than the normal dour soundings of industrial data. Oil is reliant at present on individual attitudes and sentiment. Today’s US Core PCE, the main marker for personal consumption, will be keenly observed. But some behaviour comes at a cost and it is usually inflation, which for central bankers is the nemesis to control. The next bout of interest rate decisions will very much rely on societal monetary behaviour and why their associated measures and indices are increasingly important.

|

GMT +1 |

Country |

Today’s Data |

Expectation |

|

08.55 |

DE |

Unemployment Rate (AUG) |

5.7% |

|

10.00 |

EU |

CPI YoY Flash (AUG) |

5.3% |

|

10.00 |

EU |

Unemployment Rate (JUL) |

6.4% |

|

12.30 |

EU |

ECB Monetary Policy Minutes |

|

|

13.30 |

IN |

GDP YoY (Q2) |

7.7% |

|

13.30 |

US |

Core PCE Index YoY (JUL) |

4.2% |

|

13.30 |

US |

Initial Jobless Claims |

235k |

|

13.30 |

US |

Continuing Jobless Claims |

1.703m |

Tough decisions ahead

It looks as if the European Central Bank will again have a tricky path to tread as it comes closer in having to announce what interest rates will be at the next meeting of September 14.

Various polls of analysts predict today’s European August Core Inflation Flash to come in between 5.1 and 5.3%, down from July’s 5.5%. However, yesterday’s higher than expected Spain and obdurate Germany inflation readings make the reality of achieving these lower calls a little difficult. Spain CPI Flash for August at 2.4% year-on-year, is higher than the 2.1% for July and while the Germany reading of 6.1% is slightly better than 6.2% of July, it still shows a stubbornness from increasing prices. This morning, as France inflation rate comes in at 4.8% against a 4.6% forecast, the ECB’s saga of the trials and tribulations of an interest rate setter is lining up for an encore. The commissioners of the bank will have to consider whether another rate hike can be tolerated from economies that have been kicking the can of recession down the road, but arguably more consideration needs to be offered to the greatest of all movers, sentiment.

Monetary conservatives seem never far away, and in an interview with Bloomberg, Governor of Austria’s central bank and member of the ECB Governing Council, Robert Holzman, confessed a preference for another rate hike. Judging by the European money market pricing attaching a 60% chance of an ECB hike, the Austrian Governor might just get his favoured outcome. Those that harbour a hawkish stance might do well in taking into account the very real bite higher interest rates are having on tolerance to taking on loans. A recent report showed corporate lending appetite in July had risen by 2.2% year-on-year, but this is lower than the 3% recorded for June. This reduction in credit risk for companies is also reflected in household credit that stuttered to a 1.3% year-on-year rise in July compared with a 1.7% reading in June. Unsurprisingly, and running in tandem with these data is the EU and Eurozone area’s Economic Sentiment Index (ESI) flash estimate in August being -0.6 for the EU, -1.2 for the EZ and that the Employment Expectations Indicator (EEI) was for the EU and EZ, -1.0 and -1.3 respectively. An important factor and indicator for doves and hawks to thrash out is the state of money supply. Being a significant marker observed by the ECB, the news that it has reduced for the first time since 2010 is another indication of a shrinking economy and a shying away from taking on loans. M3 money supply, i.e., borrowing, savings and cash to name but a few in its basket, reduced by 0.4% year-to-date in July, down from an increase of 0.6% in June.

Quantifying how this debated punch to the ribs of confidence plays out within in the oil market is as thankless a task as the ECB now faces. The tightness of refined fuels is documented well enough, especially that of distillate derivatives but it would seem that crude in Europe, as it has done in the United States is experiencing something of a draw itself. Genscape reports that inventory in Amsterdam-Rotterdam-Antwerp declined by 1.2% or 780,000 barrels to 62 million barrels. It would be wise to consider the vulnerability that Europe as a collective feel in terms of gas supplies and the recent issues with Australian LNG. Continued reports of scarcity in any energy form will bring keener buyers and higher prices. Higher energy prices will bring another bout of inflation and so these circular gyrations continue and with them such discussions as this.

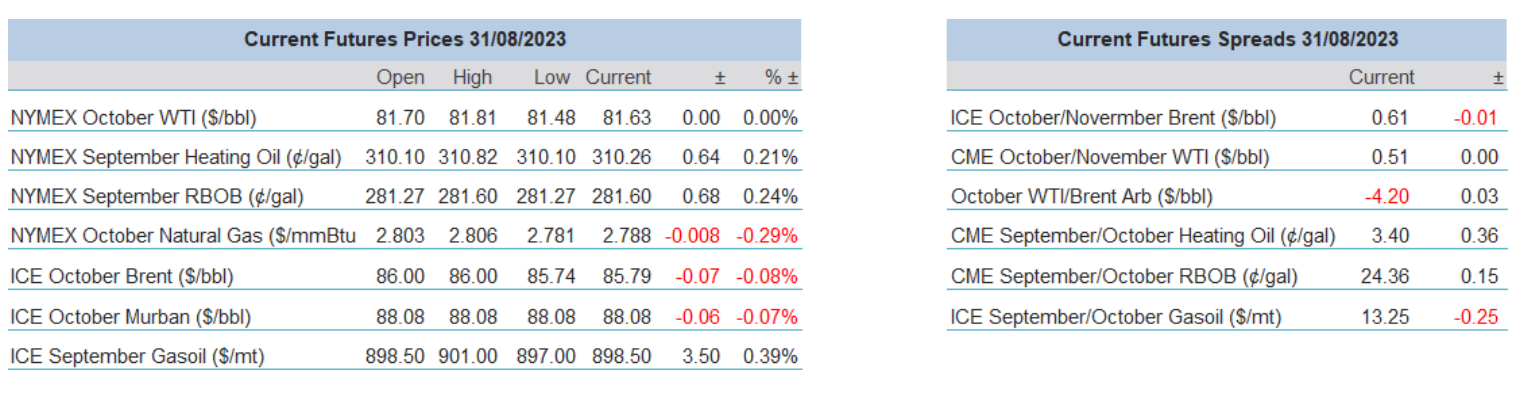

Overnight Pricing

31 Aug 2023