Iran Fears Dominate Action

Oil market players are more anxious about losing Iranian barrels than gaining Venezuelan ones. As Tehran and other major cities are engulfed in flames amid anti-government riots, the US President has encouraged protesters to persevere, declaring that “HELP IS ON ITS WAY.” In what shape or form this support might arrive remains unclear at this stage; however, it is blatantly obvious that significant supply disruptions, whether through attacks on oil infrastructure or the imposition of secondary sanctions on Iranian oil buyers, are not being dismissed.

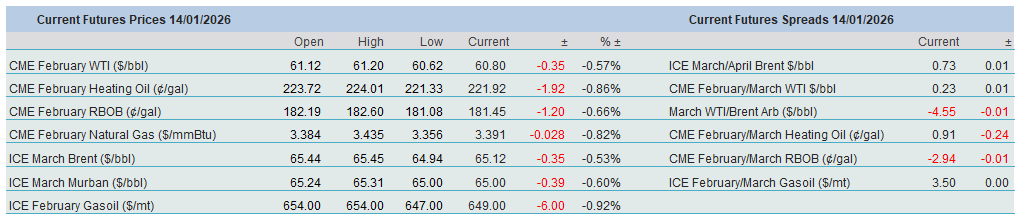

This thinking is echoed in the widening Brent backwardation, while the premium that front-month WTI commands over the second or third month remains comparatively depressed. The pragmatic attitude has led to the shedding of downside risk, and Brent gained $1.60/bbl on the previous day, registering a $5.50/bbl increase over the past four trading sessions, also aided by drone attacks on oil tankers waiting to be loaded at a CPC terminal in the Black Sea. Notwithstanding the almost 10% advance, the strength, which is based on perception and anxiety, will not prove sustainable unless the oil balance materially tightens. If the weekly API data is deemed the harbinger of global and OECD stock changes, then supply will well exceed demand in the immediate future, as the three major categories showed a combined build of almost 18 million bbls last week.

Equities were less enthusiastic than oil, although the 2.7% rise in US December consumer prices matched expectations. The figure, albeit still considerably higher than the 2% target, warrants a rate cut at the end of the month in the view of the US President. Investors, also uneasy about the spurious accusations against the Fed chair and the proposed 10% cap on credit card rates, are happy to differ, however. The CME FedWatch tool indicates a near-100% probability of unchanged rates at the end of this month.

No Risk Mitigation in 2026

It is becoming increasingly apparent that the uncertainty and unpredictability that characterised 2025 will be omnipresent throughout the new year. As the events of last week laid bare, this will manifest itself in geopolitical upheavals across the globe, with the US apparently putting its National Security Strategy 2025, published last November, into action. And when geopolitics takes centre stage, it goes without saying that its impact on geoeconomics, and, by extension, on the oil balance, cannot be ignored. For this reason, it is crucial to identify the main risks of 2026. An invaluable helping hand is provided by the political consultancy Eurasia Group, which has recently published its view of the top risks of the year ahead.

Out of the top ten risks, ranging from the perennial Ukrainian crisis to artificial intelligence and the revised trade agreement between the US, Canada, and Mexico, we arbitrarily select four that we believe will be the most critical and potentially the most tempestuous this year. These are the US political revolution, Europe under siege, state capitalism with American characteristics, and China’s deflation trap. Given everything that happened last year and is expected to unfold this year, the authors conclude that 2026 will be a pivotal year from social, political and economic perspectives.

US political revolution: This revolution has its roots in what can be described as the greatest political comeback in US history and is, at least in part, the product of unsuccessful attempts to impeach and even assassinate Donald Trump. He is in the process of dismantling all checks on his power, legislative, judicial and media alike, capturing the machinery of government and deploying it against his enemies, thereby further cementing his position as an autocrat.

The revolution will continue unabated in 2026. With Democrats appearing likely to win the House in the midterm elections, the administration will become even less risk-averse than it was in 2025, whether through investigations into Democratic donors and supporters or the gerrymandering of electoral district boundaries. However, because of domestic economic headwinds of their own making, Republicans are likely to lose the House. Ultimately, the Trump revolution is more likely to fail than succeed, but a return to the old status quo appears implausible.

Europe under siege: The gradual decline of the political centre in Europe, most evident in France, Germany and the UK, continued last year, significantly aided by the openly declared support for the far right from across the Atlantic. The rising popularity of the UK’s Reform Party, led by Nigel Farage, will pull both the Conservatives and Labour away from the centre, and the current Prime Minister will be sternly and probably successfully challenged from within his own party. France is ungovernable, as a hung parliament makes it all but impossible to pass a budget. If the current government resigns and fresh elections are called, the far-right Rassemblement National would be the favourite. In Germany, the hard-right Alternative for Germany is topping national polls and is expected to perform strongly in the five state elections this year.

State capitalism with American characteristics: The crony capitalism implemented by the incumbent President will prevail in 2026. The evolving relationship between the private and public sectors will continue, as evidenced by the growing stakes held by the US taxpayer in an increasing number of companies. Transactional policies will remain a defining idiosyncrasy of the administration. This transactional approach extends to foreign governments, most conspicuously through the formula of investment in return for tariff relief and market access. State intervention in a market economy, of course, carries obvious drawbacks, and this year the Trump apparatus will face increasing pressure from the electorate to justify its policies. After all, the labour market is weakening, and inflation remains stuck above the 2% target. A possible political backlash would likely prompt further intervention rather than retrenchment. Should fears of recession or inflation intensify, the response would become even more interventionist. Productivity could suffer, the rule of law may erode further, and vested interests could eclipse the proper functioning of markets.

China’s deflation trap: The deflationary headache of the world’s second-largest economy could turn from acute to chronic. Despite ten successive quarters of deflationary pressure, efforts to stimulate domestic consumption and implement structural reforms continue to fade in importance relative to political control and technological supremacy. China will persist in exporting its way out of its domestic economic crisis, prompting tariffs and other protectionist measures from its major trading partners, particularly the EU. A growing trade surplus, which stood at $1.189 trillion last year, cannot be sustained indefinitely, and ultimately, China will be forced to stimulate domestic consumption, possibly after 2026.

Overnight Pricing

14 Jan 2026