Iran is the New Greenland

It is no longer panic buying; yesterday’s jump was not triggered by algorithms scanning for keywords and reacting to headlines by shedding length. Nor was it driven by the polar vortex in the US, which shut down oil and gas production and severely hampered refinery operations. After all, US output is already being restored, and the 2 mbpd of affected production has been reduced to 500,000 bpd. The Kazakh output issues are also easing since Tengiz is on the verge of restarting pumping.

Yesterday’s jump, which saw WTI and Brent settling more than $2/bbl higher, was a calculated move, prompted by the ostensible tightening of the noose around the neck of the Iranian regime. The calculation is that US military intervention, with all its unpredictable consequences, is ever so plausible. Will this bet prove to be correct?

Just like with Greenland, probably not, since self-inflicted supply disruption and galloping oil prices are not in the medium- and long-term interests of the world’s strongest economy. Nonetheless, when additional US warships appear in the Middle East, and the EU designates Iran’s Republican Guards as a terrorist organisation, staying on the long side of oil is fully vindicated.

Apart from the privileged few, it is impossible to foresee whether the rising tension will develop into military assaults with intentional damage to oil infrastructure in Iran or surrounding countries or, heaven forbid, the closure of the Strait of Hormuz. If not, the recent gains, aka the risk premium, will probably erode faster than they rose. We might see the beginning of such a retreat this morning. On the other hand, if all hell breaks loose, then brace yourself for a sharp and painful spike above $80/bbl, and all that will be left for the pacifist is to cover herself in sackcloth and ashes.

Returning Risk Appetite

The last trading day of the month provides a timely opportunity to sum up the major developments shaping investors’ sentiment. We shall devote Monday’s note to just that. And there is a lot to ponder: the global economy, political adventures, the health of relationships between allies and foes, and any apparent changes in the global oil balance and inventory movements. The interpretation of these developments is obviously subjective, and until we share our view on the impact of recent events, it is a useful exercise to launch a Keynesian beauty contest, where the focus is not on what we contemplate but on what market players think.

The most obvious support in this endeavour is provided by the weekly reports from both the CFTC and ICE, which lay bare exactly how committed different market participants are to oil. Since the updated statistics are released tonight, the analysis below covers the period ending January 20. During the latest week, oil prices increased quite significantly, it must be stressed. Therefore, the somewhat bullish conclusion at the end of the report should be decoded accordingly.

At first glance, it is discernible that although the hunger for oil is not exactly voracious, there is a growing interest in investing in our markets. Combined assets under management in the five main futures and options contracts have risen from a low of just over $7 billion in October last year to $25.5 billion in the latest week. More than tripling the amount of money in three months is, beyond doubt, an encouraging development. Yet it is intriguing to observe that net speculative length (NSL) in most contracts remains far below the 2025 peak. The notable exception is Brent, which is comparatively close to the peak NSL recorded last year.

While on the topic, it must be pointed out that open interest (OI) in the European benchmark reached a record high of 3.4 million contracts on Tuesday, January 27. Elucidating OI is admittedly more of an art than a science; nonetheless, a rise in OI, in conjunction with rising prices, signals growing investor confidence, as it implies that new money is entering the market.

Returning to the general increase in NSL, the swing in mood is explicitly expressed in WTI. Between mid-August and early 2026, WTI NSL was negative every week bar one in September. The mood has started to shift over the past two weeks, and on January 20, money managers were once again net long in the US crude oil marker. The NSL of 19 million barrels, however, still pales in comparison with the 2025 high of 207 million barrels. From the trough reached at the end of November, when NSL stood at minus 53 million barrels, gross long positions rose by less (28 million barrels) than short positions declined (44 million barrels).

Interest in Brent was more intense. NSL increased from 33 million barrels in mid-December to 217 million barrels by January 20, with bullish bets soaring by 92 million barrels and bears reducing their exposure by the same amount.

Money managers remain upbeat on RBOB. Its NSL has risen by 13 million barrels, from 49 million barrels to 62 million barrels in just two weeks, yet it remains well below the counter-seasonal peak of 100 million barrels recorded in November last year. On the subject of counter-seasonality, the new year began with investors deserting heating oil and building net short positions in this contract, as concerns about a Russian diesel shortage subsided markedly. However, given the recent rally triggered by freezing temperatures in the US, its NSL is likely to turn positive, at least for the next few weeks.

Gasoil NSL has also been on the rise, reaching 67,000 contracts, up from 19,000 lots just before Christmas, as gross long positions increased faster than short positions were unwound.

An intriguing aspect of the recent repositioning is the composition of the combined NSL. The clear winner is crude oil, and within that, Brent. In mid-December, Brent and WTI collectively accounted for only 10% of total NSL, dragged down by net short positions in the latter. Fast forward five weeks, and this share has surged to 62%, with Brent dominating at 57% of the total. Although products are likely to regain some of this lost ground in the near term due to the weather-induced Heating Oil rally, the main conclusion from the latest fluctuation in NSL is clear: levels remain historically low, but with Brent being the primary beneficiary of the increase, it suggests that geopolitical considerations are the main catalyst behind the current strength and are likely to remain the salient driving factor going forward.

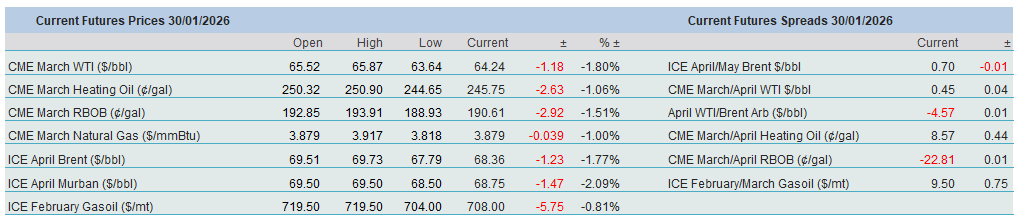

Overnight Pricing

30 Jan 2026