Iran Still Smothers All Considerations

When in doubt, pick a Sun Tzu quote. ‘All men can see these tactics whereby I conquer, but what none can see is the strategy out of which victory is evolved.’ Landing on an enemy, or even an ally, with an intercontinental ballistic loud hailer with demands that stretch beyond anything that can be granted until negotiation brings a favourable outcome to the US President, is a solid and well-trodden play. The Chinese general’s historical observation is made almost complete as the outcome of the US/Iran talks in Oman remains unclear and grows more so every day. We are told in the broad media by both sides on how the indirect negotiations have been positive and the allusion is of an atmosphere of there being a preparedness to find a diplomatic solution. Given that oil prices started to rest easy on such companionable language, the announcement by the US Department of Transportation’s Maritime Administration advising US flagged vessels to actively avoid Iranian controlled waters acts as a stimulant to those grown weary of expecting oil supply problems should all go awry. A closing of the Strait of Hormuz is back on the menu of ‘what ifs’, and with two rogue states as the protagonists, is it wise for any part of our oily community to be positioned as if such a world-changing outcome be impossible?

Can India afford it?

With all threats blazing, President Donald Trump is at last starting to badger India into a trade relationship just where the US wants it. Forget the uneven exchange where the hounded has promised to reduce its standard tariffs on US industrial goods and products within food and agriculture; the hunter will only lower reciprocal charges from 50 percent to 18 percent on half of Indian products which will also depend on New Delhi’s compliance in halting its oil trade with Moscow. Whether or not Prime Minister Narendra Modi’s government will stop buying oil from the northern reaches of Asia’s continent does not come with explicit language, but there are signs of adherence. According to Reuters, the last of the refiners still processing Russian crude will stop purchases in April and any existing contracts will be fulfilled by the end of March. Whether or not this action will show any longevity will be all about economic impact. If the most populated country on this sphere starts to experience higher domestic gasoline and diesel prices, and by definition, inflation, one wonders how long the government can run in the avenue of White House favour. Still, in this world of political ephemeris, Modi could do a Trump/Putin/Xi, agree to everything and when nobody is looking rejoin that which gives India energy security, and probably for us that want to track oil movement, the only open sanction-busting that can be relied upon.

Again, and in the spirit of consistency, what might be a consideration, which has been disappearing as collateral damage in the current ‘oversupply’ argument, is how the Russia to India oil trade is a stabilising effect for oil prices. An overly thirsty sub-continent coming to the global market to sate its needs with a daily bid of 1.2mb as a replacement if it adheres to the ‘cease and desist’ caveat on a US reduction in tariffs would be no small alteration in calculating oil flows. While the resulting, stranded and heavily price-discounted Russian oil will likely be absorbed into the monstrous caverns of China’s strategic petroleum reserve, India will have to go shopping in an oil mall where bargains are scant and made much more sensitive to price rises because of the geopolitics of our time. The type of crude India requires may not so easily be replaced. The US President would be completely correct in saying the US might provide all of India’s displaced crude needs, if refinery configuration were not a thing. But it is, and Uncle Sam cannot. Much of New Delhi’s contracts with Moscow involve heavier crudes such as Urals; the Mid-Western lighter blends of feedstock from the US in ordinary circumstances would be a ‘stop out’ buy, rather than that of choice. Venezuelan crude would be an ideal heavier substitute, but history suggests production will have to earn the status of ‘reliable’ given the geopolitical meddling involved in its oil industry even with a Reuters report today showing the country’s output increasing to 1mbpd. Investments need consistently to flow back into the likes of the Orinoco Oil Belt, and as much as data shows the South American country’s exports dramatically climbing to over 800kbpd, reports reveal such an increase is being serviced by a drawdown in storage situated both domestically and in outlying sites of the Caribbean.

Sourcing oil from so far away will come with a litany of shipping costs. While Russian oil will hide from sight as it puts on the invisibility cloak of the dark fleet, India’s publicised foray into the Atlantic Basin, if indeed it looks that way, will be faced with freight costs so high that the inevitable passing on of transport fees to retail customers will only bring realisation to those inflation fears. What India requires is consistency of supply and competitive market rates, something it might be hard-pressed to find when taking its mercantile to the Americas. Yes, it can take its business to the Middle East, as it has been in the process of doing, but eventually the same cost issues would apply, although a little less extreme. However, given that India has promised it will purchase $500 billion worth of US goods over five years, getting to that enormous commitment must surely by made easier if oil purchases are factored in. Can India really afford not to buy Russian oil? We will find out soon enough.

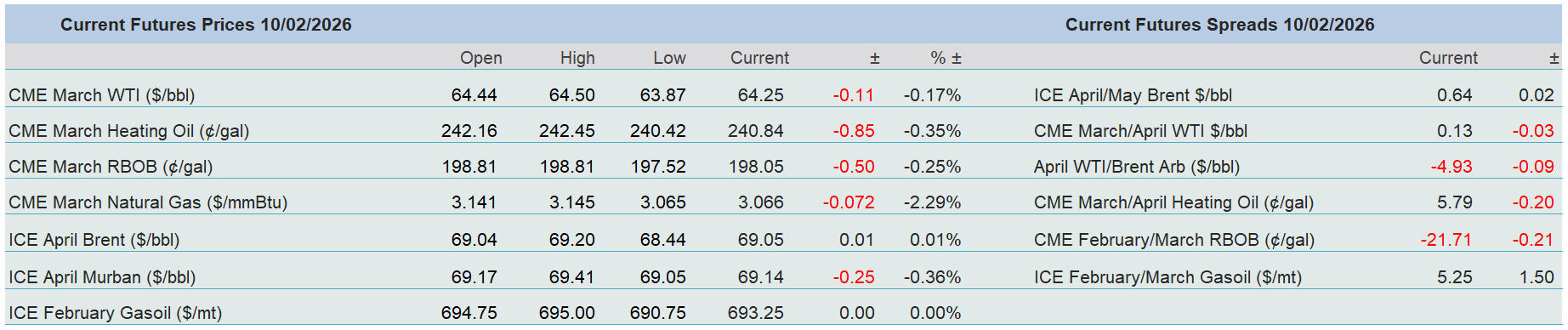

Overnight Pricing

10 Feb 2026