Iran Tension Endures, the EIA Predicts Huge Stock Build

Perhaps the culprit is the annual industry gathering in London, but oil, compared with recent weeks and months, was uncharacteristically subdued yesterday. No doubt, as market players rub shoulders, the centrepiece of discussions is the brewing tension between Iran and the US and whether nuclear talks between the traditional adversaries might break down, leading to actual supply disruptions, potentially including the feared closure of the Strait of Hormuz. While rhetoric remains belligerent at times, there are no signs, at least for now, of escalation, and the US President believes that Iran will ultimately want to strike a deal on its nuclear missile programme.

Unless oil output, supply, and shipping are disrupted in the region, the view of those anticipating a massive swelling of global and regional oil inventories will prevail. That much became clear after the EIA’s monthly update, which revised non-DoC output higher for 2026 and sees OECD oil stockpiles ballooning to over 3.1 billion barrels by year-end. The API would not disagree, as it reported a significant rise in US oil stocks. Crude inventories rose by over 13 million barrels and gasoline stocks by 3.3 million barrels, while distillate stockpiles fell by 1.94 million barrels. If geopolitical support is removed, and it is a pivotal “if”, there appears to be only one direction for oil prices to go.

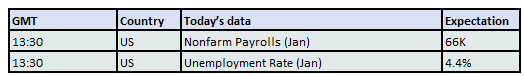

In equity markets, the worryingly disappointing US retail figures provided a timely excuse for investors to step back, pause for breath, and re-evaluate the upside potential in stocks. This process will most likely continue throughout today, as the delayed release of the nonfarm payrolls is eagerly awaited by those searching for clues about the Fed’s next move. Meanwhile, China does not seem able to gain the upper hand in its fight against deflation, and its sluggish domestic demand outlook will ensure that it continues trying to export its way out of its economic malaise, foreshadowing prolonged trade tensions with its trading partners.

Solid Demand, Fragile Refining Sector

As the perpetual battle against climate change and global warming conspicuously slows, oil demand estimates and peak oil demand predictions are being revised upward. Carbon dioxide emissions will persist well after 2030 and, although they are expected to decline gradually, this still implies healthy consumption of black gold well beyond the end of the third decade of the century.

Perhaps the most spectacular adjustment has come from the IEA. In 2021, the Agency concluded that by 2026, renewable energy would overtake coal, with oil following four years later. By 2025, green energy was expected to provide two-thirds of the global energy supply and 90% of electricity generation. Under this pathway, no new investment in oil and gas projects would be needed to keep global warming around 1.5°C above pre-industrial temperatures. In a sharp turnaround, as it became apparent that reliance on fossil fuels, and oil in particular, had been underestimated, the IEA warned last year that without new upstream investment, oil supply would decline by 5.5 mbpd every year.

Accordingly, peak oil demand estimates have been amended. There is a developing consensus that the thirst for oil will continue to grow until 2050, although there are wide divergences over where consumption will peak. OPEC places it at 123 mbpd, versus the IEA’s forecast of 113 mbpd under its Current Policies Scenario. Meanwhile, several oil companies and consultants anticipate demand reaching its summit between 2032 and 2040, at levels ranging from 108 mbpd to 115 mbpd.

Clearly, oil traders, brokers and researchers are not in imminent danger of losing their jobs. In fact, the key question they are grappling with is whether upward revisions in oil demand will be met by sufficient global and regional refining capacity. After all, crude oil in itself is a worthless commodity unless it is transformed into valuable products that can be used for transportation, electricity generation and petrochemical feedstock.

This is a valid concern. Between 2020 and 2023, an estimated 3 mbpd to 4 mbpd of refining capacity was lost, mainly in the developed world, as refineries were either permanently shut down or converted. A direct consequence of these closures, compounded by recent and ongoing geopolitical events near major oil-producing regions, has been rising refinery margins, as reflected in the CME 3-2-1 crack spread. Its average value between 2007 and 2020 stood at just over $17/bbl, compared with $29.50 between 2021 and 2025. It is therefore imperative to reliably assess possible changes in refining capacity in order to gauge whether product supply will comfortably meet demand for the remainder of the current decade.

The picture emerging from a smorgasbord of sources is ambiguous and, in the IEA’s view, does not point to a tight traditional product market over the next five years. In last year’s Oil 2025 report, the Agency highlighted “mounting challenges” for the global refining sector. It projects global oil demand rising from 103 mbpd in 2024 to 105.5 mbpd by 2030, with the bulk of this growth driven by LPG/ethane, naphtha and jet fuel. Since this growth is chiefly underpinned by petrochemical feedstocks increasingly produced from non-refined products, the prospects for a refining sector revival are called into question. Even so, total refining throughput is expected to increase modestly, from 82.6 mbpd in 2024 to 83.3 mbpd by 2030.

OPEC’s findings from last year could hardly be starker. It projects refinery throughput rising from 82.4 mbpd in 2025 to 89.6 mbpd in 2030, with the increase concentrated in China (+1.2 mbpd), Africa (+1.4 mbpd) and the rest of the Asia-Pacific region (+2.7 mbpd). Utilisation rates are forecast to climb from 80.4% to 83.3% over the same period.

While the IEA expects global oil demand growth to be driven predominantly by petrochemical feedstocks, OPEC foresees tightening refining capacity as 2030 approaches. At the global level, it sees potential and required refining capacity broadly aligned in 2025 and 2026, after which the downstream market tightens. The gap between required and potential refining capacity is projected to widen from 500,000 bpd in 2027 to 1.6 mbpd by 2030. The prosaic explanation is that oil demand growth is expected to meaningfully outpace refining capacity additions between 2027 and 2030. Should OPEC’s assessment prove accurate, a tight global product market, driven by comparatively slow refining capacity growth, would provide an auspicious backdrop for sustained strength in crack spreads.

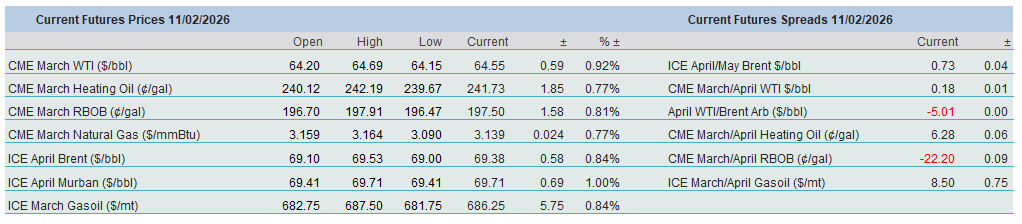

Overnight Pricing

11 Feb 2026