It is Always Interesting Times for the FED

The US stock market rally continues to feed itself with the largesse of its tech sector. The world has become immune to the bandying around of so many zeroes, but the darling Nvidia now expects a staggering $500 billion of business over the next five quarters. Adding to the self-propelled hike in bourses was the announcement of a new agreement between Microsoft and OpenAI. The latter will purchase $25 billion of Azure services in return for the former lifting some restrictions in investments into its newfound partner. Once again investors are unleashed, even before the results of the mega-caps earnings are released. US bourses extend record highs with the Nasdaq-100 up by nearly 1,000 points or (3.6%) in the last five trading days.

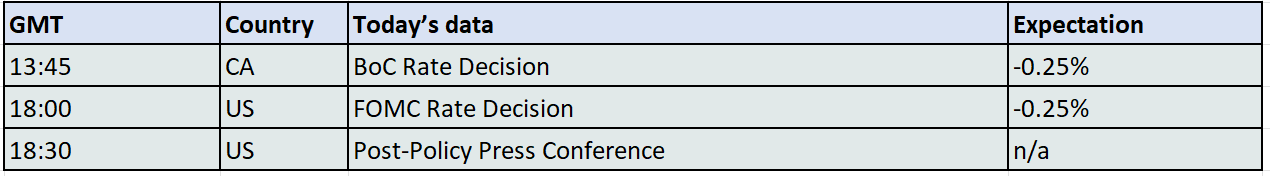

There is little doubt on how the FOMC decision later today will see a cut of 25-basis points, but it will be to the post-meeting narrative that all will look to. The Federal Reserve must act with one arm behind its back because of the lack of data caused by the government shutdown. Yet it must address a growing conundrum. To offer a future of easing will only bolster the sky-high progress of stock markets and what will eventually be an inflationary kicker. But to not do so risks a reaction in a job market, ironically being made worse by AI now substituting thousands of roles. Most of 2025 has seen a period described in the US as ‘no hire, no fire’ where jobs openings are scarce, but employees could rely on security. This period of expected equilibrium is now being shattered by layoffs. Amazon yesterday announced 14k job cuts as UPS informed on how over it had let 48k roles go over the last 12-month period. As seen on CBS, new data from Challenger show companies in the US cutting nearly 950,000 jobs this year through September, the largest number of layoffs since 2020. Given the uncertainty of the US shutdown, a lack of data, the stunning ride in equities and a change in fortunes for employment, the assessments seen in Jerome Powell’s words later have suddenly taken on greater importance.

Not so much South Korea or bust

As much as the noise emanating from the White House and what appears scatter gun policies when dealing with the complexities of global diplomacy, none in the current Administration are naïve enough to believe that the flashpoints of the world can be dealt with in isolation. While the statecraft of President Trump’s Secretaries of government appears as brash and gauche as the top man himself to detractors, there is method and, dare one say, success in the madness. Overegging? Well, as much as Trump has no issue in offending the sensibilities of any government of the world, when he boards a plane to their geographies there is not a one unseen in scrambling to roll out the red carpet and all the pomp they might muster. In example, look at the circumstance poured out to him when he made a state visit to the UK which was all but repeated on Monday when he was greeted in the Imperial Palace of Tokyo by Emperor Naruhito on a leg of his current Asian odyssey.

It depends on proclivity, but one could view the minimal effect tariffs have had on the US as lucky, or in contrast, strategized, by a President not afraid to throw around the weight of the US, in all its forms, to get what it wants. There were moments of obsequiousness worthy of parody from the likes of the UK, Japan and the EU when after offering hollow words of resistance, rushed to sign tariff deals. Since then, there have been glitches and moans concerning procedure, but an all-out trade war has been averted and with it any massive passing of costs to the US and the global populace. None of this could happen without the fear of the consequences of not acceding to Trump’s deals. Weak behaviour from his counterparts or wise and measured? Argue away.

Although there has been an unease in Europe toward China, another Trump triumph has been his continue portrayal of Beijing as the bad guy in global trade. One of the cornerstones of gripe is the subsidised metal industry in China. As the US President meanders his way to the all-important face-to-face with President Xi, the UK has pitched in another item of leverage. The UK is seeking support from the EU and the US in a ‘steel alliance’ to counter the current overproduction, the blame of which it lays squarely at the foot of Beijing. Sir Chris Bryant, Minister of State for Trade Policy, told the Financial Times that the British government was in “continuous discussions” about the possibility of a 1950s-style tariff pact in which the US, the EU and the UK would agree to forge an alliance to protect against unfairly subsidised steel, much of which comes from China.

All well and good the mustering of historical allies, even if somewhat wrangled. Dealing with China and Russia, however, is much more of a challenge and they have not resulted in American success. Glancing back to June when Trump proclaimed not only an excellent relationship with President Xi of China, but he also described a trade deal as ‘done’. The memo must have been missed by Xi, who in a move straight from the Trump playbook, this month placed extra controls on rare earth materials and triggered a bout of publicly aired vulnerability within the US and the threat of 100 percent retaliatory tariffs once again. There should be little doubt that in this current chapter, and this will not be the last one of trade talks, Beijing has the upper hand because of the rare earth issue. If the vociferous Trump thought his deck was loaded, China’s position would have been dispelled by a bout of derogative invective on ‘Truth Social’ with Trump staying at home.

The American leader also needs the aid of President Xi when dealing with Vladimir Putin. The Russian leader has crooned, groomed and delivered absolutely nothing other than his normal wan smile. The Alaskan meeting was a farce and instead of a breakthrough in a Ukraine ceasefire, the world just became two months older. It is a veritable slap by someone Trump once said was a friend, but to take Moscow to task he must enlist the aid of Beijing. The US rightly has no wish for a nuclear weapon standoff which is what Trump feels might happen if he allows the sale of powerful weaponry such as Tomahawk missiles to Kyiv. Therefore, the obvious thrust to Russia’s underbelly is stop China’s incessant import of its oil supplies. Our view is that we will believe it when we see it. It is not just the favourable prices China pays for Russia’s greatest money-earning resource, Beijing may not be prepared to give up the newfound alliance with a country that was once its regional enemy. Another consideration is the weighing of what the US would choose, security in rare earth supply and lower oil prices or the opposite in pursuit of a ceasefire deal?

Unlike the cohort of the US and its allies, who have a new philosophy every four or five years when the government turns over, strategic thinking is long-term in China and Russia, and their alliance would be hard abandoned particularly as one their main source of comradeship is antipathy toward the US. Sanctions are not working, well at least to the extent of being other than an inconvenience to China and Russia’s expertise at circumvention. Yesterday, Bloomberg reported on how Shandong Yulong Petrochemical Company bought as many as 15 cargoes of Russian oil for November loading, all the while being under fresh sanction from the UK and the EU. China and the US may very well come to another temporary trade deal tomorrow, but it is unlikely to include China abandoning its northern oil supplying ally.

Overnight Pricing

29 Oct 2025