It is Either/Or

Whilst the underlying risk is currently firmly skewed to the upside the daily activity in the oil market, it appears, is almost exclusively dominated by the perpetually changing view on the distillate/crude oil spread. One day crude oil is lethargic whilst Heating Oil soars and the other ferocious profit-taking sends the price of the latter spiralling lower whilst crude oil rallies out of sight. Yesterday both Brent and WTI closed at their highest levels since last November, greatly aided by the updated OPEC report discussed below. Heating Oil and Gasoil, conversely, ended the day significantly lower. Whatever the trigger point is for this volatile spread, and it is possibly the guessing game of how big the perceived shortage will be in the middle of the barrel this coming winter, it is becoming blatantly evident that that distillate will play the most pivotal role in the formation of the oil prices in the near future. Changes in inventory levels will, therefore, be relevant. The API last night showed a build of 2.6 million bbls in distillate and 4.2 million bbls in gasoline stockpiles. Crude oil stocks rose 1.2 million bbls.

The interplay between oil and equities has been pronounced in the last few months. High oil prices stoke inflation fears and have an adverse impact on equities whilst falling consumer prices could brighten investors’ mood and help risk assets climb collectively higher. It is the recent increase in energy prices that has plausibly pushed US headline inflation up in August, whilst core inflation probably eased from 4.7% in July to 4.3% last month. If expectations prove correct this afternoon, then the uptrend could continue in oil and re-gain momentum in equities, but below-par readings might raise the anxiety level and drive pragmatic bulls towards the exit.

|

GMT +1 |

Country |

Today’s data |

Expectation |

|

10.00 |

Euro zone |

Industrial Production YoY July |

-0.3% |

|

13.30 |

US |

Headline Inflation Rate YoY August |

3.6% |

|

13.30 |

US |

Core Inflation rate YoY August |

4.3% |

Brutal 4Q Shortage, OPEC Says, EIA Disagrees

The critical sets of data yesterday were the updated supply-demand estimates from OPEC and the EIA. Today’s IEA findings will complete the latest round of prognosis on global oil balance. The salient questions were and still are as follows: does the inflationary pressure that is seemingly being mitigated have any impediment on global oil demand? Is Chinese deflation leading to demand growth deterioration? Consequently, does annual demand growth remain healthy? Is supply from non-OPEC+ countries on the rise and is there any improvement in output from underproducing OPEC+ nations? Does Saudi Arabia put its dollar where its mouth is and radically reduces its own output level? Will global and OECD inventories decline as much as they were expected earlier in the last three months of 2023?

OPEC, in a nutshell, is unambiguously upbeat on the performance of the global economy, thus on oil demand. Whilst it acknowledges the challenges and potential headwinds that might come in the form of continuously high borrowing costs, Chinese economic malaise, and the Ukrainian conflict, the organization left global oil demand growth unchanged at 2.24 mbpd, chiefly because it believes that the buoyant service sector will more than compensate for stuttering manufacturing activity in the most important economic hubs in the world. Global oil demand will rise to 102.06 mbpd in the whole of 2023, which is a slight upgrade from last month and the highest annual value ever. In the last quarter the globe will consume an eye-popping 103.18 mbpd of the black stuff. Slowing Chinese factory activity, the property sector, which is in intensive care and sluggish consumer spending have no bearings on the country’s oil demand, which is expected to stabilize at 16.11 mbpd in the October-December period, unchanged from August. Annual Chinese demand growth is seen at 970,000 bpd (40% of the total) and non-OECD at 2.32 mbpd (95% of the total).

Non-OPEC output was amended upwards by 130,000 bpd, predominantly due to the 430,000 bpd correction in the 3Q number, which comes from the Americas (+280,000 bpd) and Latin America (+180,000 bpd). Supply for 4Q was revised upwards by 100,000 bpd. OPEC pumped 27.45 mbpd in August, 110,000 bpd more than in July, only the fourth monthly increase in a year. Saudi Arabia has remained true to its pledge as it produced 8.97 mbpd in August, 1 mbpd under the June level. The increase came from Iran (+143,000 bpd) and Nigeria (+98,000 bpd) although the latter is still nearly 500,000 bpd under its allowed output ceiling. It appears that less is, indeed, sometimes more, and the voluntary cuts work. The OPEC basket price advanced to $87.33/bbl in August resulting in a daily revenue of $2.4 billion for member countries with an output of 27.45 mbpd, which is less than the 28.08 mbpd registered in May with daily petrodollar income at $2.1 billion back then.

Because of the significant upside revision in 3Q non-OPEC supply the call on OPEC was revised down by 330,000 bpd for the incumbent quarter and by 60,000 bpd for the whole year. In the October-December period demand for OPEC’s oil will be 40,000 bpd less than previously predicted, nonetheless it is still 30.71 mbpd. When it is set against a potential OPEC output of 27.5 mbpd, it makes you want to close your eyes, acquire as much hydrocarbon as you can, turn your computer off, take a very long holiday, come back at the beginning of January, and put a hefty amount of realized profit in the bank. A daily stock depletion of more than 3 mbpd, if proves accurate, represents the widest global supply deficit for 16 years. It makes the official narrative for the cuts, which is ensuring balanced market, look as credible as Donald Trump’s claim that Covid can be treated with bleach and possibly foreshadows renewed inflationary pressure. For now, however, the expected shortage shapes the mood.

The EIA, on the other hand, which is generally less upbeat on demand and more buoyant on supply came out with a considerable downward revision in consumption and a slight hike in non-OPEC supply. Whilst acknowledging the voluntary output constraints by the Saudis it now sees the 2023 call on OPEC at 27.70 mbpd with 4Q at 27.77 mbpd resulting in a global stock draw of a mere 230,000 bpd versus 3.18 mbpd envisaged by OPEC. Welcome to the chaotic world of forecasting.

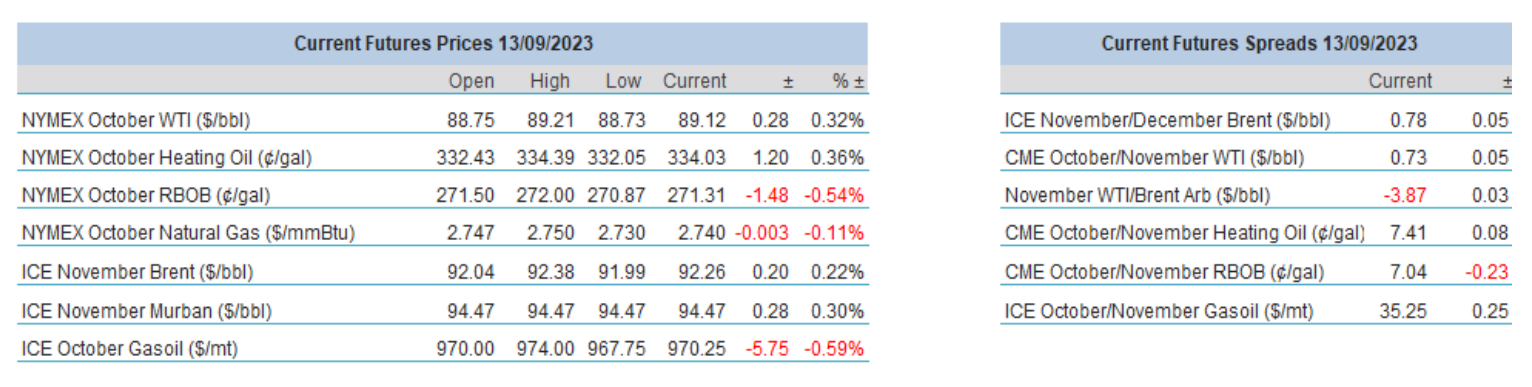

Overnight Pricing

13 Sep 2023