It's All in a Day's Words

Well, it is that time of year again to recognise D-Day. No not that one, where thousands of lives were lost forming a bridgehead that threw over tyranny, the one in Switzerland where the powerful and the elite pontificate on grand matters and prescribe to, and chastise us on behaviour from the stairwells of private jets. But the only address worthy of tuning into at Davos will be that of the US President. Which Donald Tump turns up will determine the path of markets for the rest of the week until he once again outshines whatever words used with the next set of outrage. The stage is perfectly set for the Donald; the audience has been whipped up into a frenzy by his preceding bellicose and boorish attitude to the annexation of Greenland and his posts on social media are so inflammatory that one can only compare them with something from unmentionable regimes of the 1930s. Two posts on ‘Truth Social’ show the American President standing in front of map where Venezuela, Canada and Greenland are coloured in with the Stars and Stripes, and an A.I. mock up of him planting a flag in Greenland. Of course it is transactional, the Trump playbook is well-established, and the extreme position taken is to invite compromise in a middle-ground which has been shifted in the United States favour. His Treasury Secretary said as much in a side-bar meeting where he urged European allies not to retaliate and, according to the WSJ, said, “sit back, take a deep breath, do not retaliate, do not retaliate, the president will be here tomorrow, and he will get his message across.” Should we then expect a more conciliatory oration? Egg on one’s face is the normal outcome of predicting a Trump sermon, but his tracking of the US stock market which has lost about 3 percent in the last 2 days of trading because of his Greenland campaign, will not be lost to him and the only way to avoid a repetition of the rout seen after last April’s ‘Liberation Day’ is to tone down the rhetoric. For our oil community, we will not be allowed the luxury of a leisurely perusal of CPC problems, a Tengiz outage, how the US will deal with Iran or the likelihood in oil inventory builds in all but distillate in the United States delayed by the MLK public holiday. Oil drivers are well and truly ‘Trumped’, hopefully we can talk about oily things tomorrow.

All demand leads to China

Fresh from the publishing of its record $1.2 trillion trade surplus, there was never much doubt that China would then go on to reveal on how GDP for 2025 hit the expected target of 5 percent. China is now into its 15th five-year plan which sounds much more of a wish list than something that is fully deliverable, but underestimate China at one’s peril. It continues to seek self-reliance on far-ranging subjects such as technology, alternative energy, biotechnology and carbon control. All the while it will carry on with front-loading fiscal stimulus to once again reignite domestic demand only to encounter self-harm to such a cause because of an insistence on guarding national security, which in some ways defeats greater market openness. This then limits the declared ambition for economic, industrial and investment growth in its own populace which data showed on Monday continues to decline. The country's birth rate fell to 5.63 per 1,000 people, a record low since the Communist Party took power in 1949, while its death rate rose to 8.04 per 1,000 people, the highest since 1968.

There are many reasons to fall into the line of thinking on how China is becoming less of a commodity gorger as it suffers a check in activity since Covid, but the pullback comes from a dizzyingly high marker and although there is deflation and contraction, if the World Bank, Fitch, S&P or alternative economic commentator or rating agency offered 5 percent annual GDP to the many other nations in the world suffering delinquent economies, the snatch would pull the proffered arm off. It is worth remembering the demand China still wields. It is, in terms of bullion, the largest buyer of Gold and although other countries such as India and indeed Poland, topped periods of 2024 when their appetite for the historical tangible outpaced China’s, the hidden unofficial imports into the industrial dragon of Southeast Asia are a mainstay in the strength of the Gold price.

Even though Copper imports dropped by 6.4 percent in 2025 from a year earlier, according to Mining Weekly, the rundown is due to the large rally seen in the Copper price but does not stop China’s topping of the Copper league of imports and consumption. The same chart-topping performances are witnessed in Natural Gas, Soybeans, Coal and Iron Ore among others. Adapted and reversing the sardonic meaning in Donald Horne’s book ‘The Lucky Country’, Australians often describe their country as the ‘big mine’ and that it lights up like a periodic table Christmas tree. Over a third of such riches find their way to China. According to Australian Government’s Department of Foreign Affair and Trade, China is the largest two-way trading partner generating $312 billion in 2024 accounting for 12 percent of GDP with exports alone exceeding 8 percent of GDP.

As much as the Australian example is admirable in terms of exampling free trade and openness, given the optic of a Western eye, the unpalatable regimes of Moscow and Tehran are made economically sound by their relationships with Beijing. The argument is rehearsed enough on how petrodollars earned by Russian and Iranian oil exports to China fund a nefarious war and an oppressive, terrorist-friendly theocracy, which because of current affairs is being viewed as much more than meddlesome. However, the unpalatable and inconvenient truth is the oil price needs China. Imagine an oil balance without the phenomenal thirst coming from the bottom right-hand corner of Asia?

Forget Gaza and Ukraine, China’s price-opportune buying and filling of its strategic petroleum reserve stopped the Brent price from dredging so much lower than its 2025 low of $58.40/barrel. The General Administration of Customs showed crude imports at 11.55 million bpd, up 4.4% from a year earlier with Rystad Energy estimating, as seen on Reuters, average a stock build in 2025 of 430kbpd, up from 84kbpd in 2024, with half of the growth driven by new storage capacity from both state-owned and independent companies. As much as Donald Trump bangs his drill, baby drill desk and claims to be the custodian of oil prices, the real guarantor is located on the opposite side of the globe and outside of full-blown war, how the economy of China and its oil market exposure unfold in 2026 will be paramount to the price of crude oil.

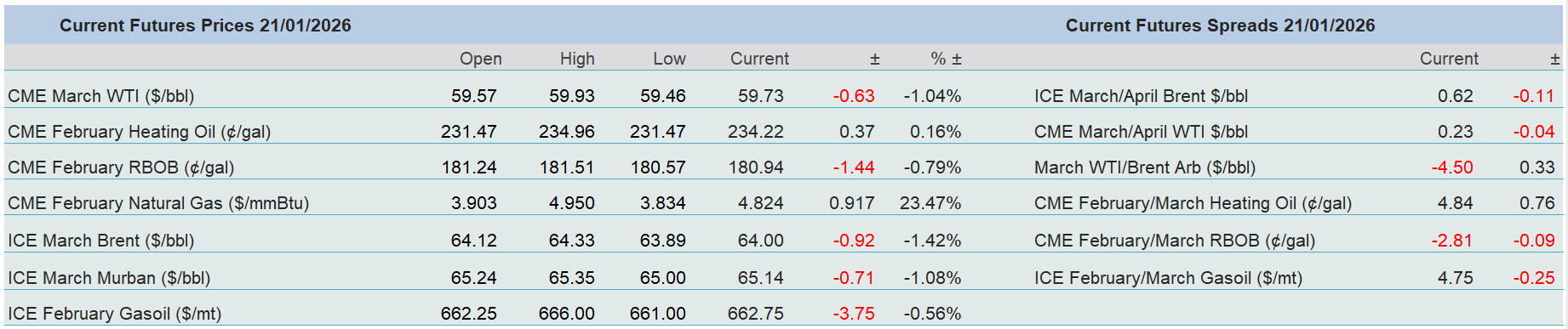

Overnight Pricing

21 Jan 2026