Justifiably Hesitant with Some Downside Bias

If the oil market is deemed bullish because the complex remained stable last week, then it is so only tentatively. Conversely, if it is considered more negative due to the complete lack of willingness to approach significant resistance levels, that view does not rest on a firm footing either. It is telling that during the generally demand-supportive summer months, the European crude oil benchmark, for example, was unable to challenge either extremity of the trading range established between May and June, with the lower end at $58/bbl and the upper end just above $76/bbl.

The most illustrative way to describe the current trading environment is with a cliché: there are opposing forces at work. This holds true for both financial and oil markets, although the former somewhat contradicts the observation, as global and US stock indices continue to record new all-time highs almost daily. Last week, the MSCI All-Country Index returned 1% and closed at a historic high on Friday. In the US, the S&P 500 and the Nasdaq Composite indices more than emulated this global performance, advancing 1.22% and 2.21%, respectively.

The question that arises is whether such convincing equity gains truly reflect the underlying economic backdrop. The answer is, unsurprisingly, ambivalent. Last week, the Bank of England and the Bank of Japan left interest rates unchanged, while the central banks of the US, Canada, and Norway all cut borrowing costs. This is an unmistakable sign that monetary acolytes across the globe are more concerned about economic health than inflation. Lowering the cost of money is intended to stimulate growth; however, one must remember that global trade wars, coupled with pugnacious rhetoric, are far from over. Their impact, despite the relative calm displayed by investors, will inevitably be felt.

Just as the perpetual dilemma of inflation versus growth pervades the financial sector, oil market participants remain torn between geopolitical developments, increasing supply, and fears of stalling economies. If one were to remove the war factor in Ukraine and possibly even in the Middle East, the logical conclusion would be that prices should be lower. Yet cross-border tension, particularly between Ukraine and Russia, has recently translated into actual disruptions to supply, refinery operation, and product exports. Set this against the clear increase in oil availability, and the range-bound nature of the market becomes easier to comprehend.

Geopolitical support will eventually fade, leaving the fundamental backdrop as the sole driving force. While this outlook appears tilted more to the downside, it is useful to support such an assessment with the two most reliable indicators of oil balance: spreads and stocks.

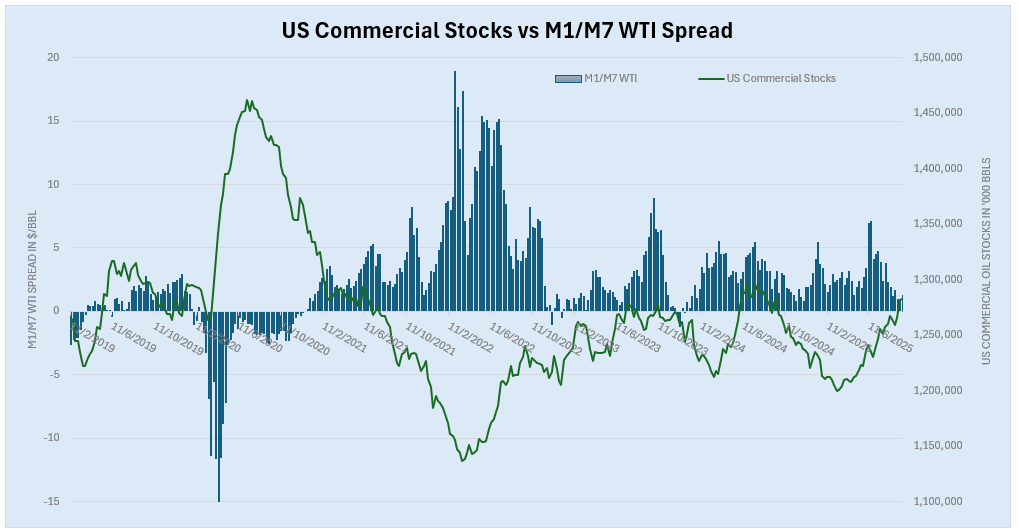

As supply is expected to outpace demand, global and OECD inventories should inevitably grow. Early signs are already evident, with builds in US commercial stocks and a related weakening of the WTI structure. The inverse relationship between US stocks and the WTI curve is undeniable, as displayed in the graph below; the more inventories rise, as they usually do toward the end of the year, the narrower WTI backwardation becomes, potentially flipping into contango.

Crack spreads, however, paint a different picture. They remain stubbornly resilient. As noted repeatedly in this report, distillate cracks displayed counter-seasonal strength during the summer months, and a prolonged cold snap in the northern hemisphere could sustain elevated values, thereby supporting crude oil as well. The CME 3-2-1 crack spread is also considerably stronger than during the comparable period of 2024. Nonetheless, this support may gradually fade, as suggested by the latest weekly data from the world’s major storage hubs, the US, the ARA triangle in Northwest Europe, and Singapore. These data show cumulative product stock builds over the past two months, with major inventories, except for US gasoline, also exceeding their long-term seasonal norms.

Given these developments, there is a better-than-coin-toss chance of renewed downside pressure as the final quarter of the year approaches. This view, however, will need to be reassessed if distillate inventories, particularly in the US and Europe, begin to plummet again, or if Russia, due to drone attacks or tighter sanctions, is forced to reduce its product exports sharply. On the other hand, while expecting oil price weakness appears reasonable, a breach of the annual low seems unlikely unless concrete signs of recession and demand destruction emerge. In short, a test of the lower end of the annual range is possible, but little more.

Overnight Pricing

22 Sep 2025