Killing Them Softly with His Words

The next Fed rate decision is less than a week away, and the latest salient data, the ADP jobs report, was published yesterday. It showed that the US private sector cut 32,000 jobs, led by companies with fewer than 50 employees, which shed 120,000 positions. As one of the Fed’s mandates is full employment, the report may have been the final piece of the puzzle falling into place, and the emerging picture now suggests a clear lowering of borrowing costs next Wednesday. The CME FedWatch tool concurs, assigning an 89% probability to a 0.25% rate cut, even though inflation remains a concern. Unsurprisingly, equities stayed upbeat, and the major US stock indices ended the day in the black.

Lower borrowing costs make the dollar less attractive, which, in turn, supports oil prices, especially when combined with the stalemate in peace negotiations between the US and Russia. We have long argued that a substantive peace deal is not imminent; Russia is simply buying time and has no intention of halting its military campaign against Ukraine, leaving its neighbour with no choice but to continue its own strikes against Russian oil installations. The latest round of talks was full of words but delivered no results. According to the Russian strongman, the Ukrainian leadership is a “thieving junta,” and its allies in Europe are supposedly sabotaging genuine Russian peace efforts.

Alas, without decisive US intervention, the deadlock persists, which in the medium-term plays into Russia’s hands while bleeding Ukraine. The morning strength precipitated by the lack of progress, nonetheless, came to an abrupt halt after the release of the EIA statistics, which showed stock builds across the board. War and politics, balanced against comfortable stocks, expected supply surplus, and OPEC’s market-share strategy, keep Brent in the $60–$70 range for now.

Preparing for Transparency and Healthy Oil Demand

As far as the output level from the pivotal producer group, aka OPEC+, is concerned, last weekend’s meeting did not rock the boat. The group, after a series of easing measures to its voluntary output constraints, decided to leave production levels unchanged for the first quarter of next year. Reclaiming its lost share of the supply market remains a priority, but the move was, in all likelihood, intended to prevent prices from sliding further. Leaving the alliance’s output policy untouched also means that, after releasing 2.9 mbpd of supply back to the market between April and November, OPEC+ still has around 3.24 mbpd of cuts that can be utilised as and when the group sees fit. The remaining volume consists of a reduction of 2 mbpd, expected to stay in place until the end of next year, and 1.24 mbpd, which is part of the 1.65 mbpd of constraints eight members of the group voluntarily implemented and began to release back to the market two months ago.

A considerably more consequential decision was the establishment of a procedure to create a mechanism for assessing member states’ maximum production capacities, which, in turn, would serve as the basis for calculating output quotas. It would not be easy to overstate the significance of this move. The Saudi energy minister went as far as to declare that the meeting was one of the most successful of his career, as he expects the agreement on how to evaluate the production capacity of individual member states to help stabilise markets and reward those who have the willingness and funds to invest in production. It will also go a long way toward providing transparency, always a welcome development, and it is, additionally, an unmistakable sign of the producer group’s confidence in the enduring reliance on oil to satisfy global energy needs.

The definition of production capacity used to be a considerable point of contention and, at times, even forced members to leave the organisation, the latest example being Angola in 2024. The new mechanism is widely expected to provide a fair and equitable approach. Labelled the maximum sustainable production capacity (MSC), it is defined as the average of the maximum number of barrels produced within 90 days and sustained continuously for one year, including planned maintenance. The assessments will be carried out by an independent auditor. The group is said to have appointed the US consultancy DeGolyer and MacNaughton. The company will be tasked with reliably estimating the capacity of 19 of the 22 member states. The remaining three nations, Iran, Russia, and Venezuela, are currently under some form of US sanctions; therefore, they will be subjected to different arrangements. Russia and Venezuela will use a non-US auditor, possibly from India, and OPEC’s secondary sources will be responsible for assessing Iran’s MSC based on the average production of a three-month period to be specified later.

The initial evaluation will take place between January and September 2026, and the results will form the backbone of decisions on individual quotas for 2027, possibly at the November 2026 OPEC meeting. Member countries will undergo annual assessments to obtain a realistic investment and production outlook.

The MSC will hopefully eliminate internal disputes among member countries, which have originated either from over- or underproduction or from demands for higher quotas as production capacity increases. The most notable example of the latter is the UAE, which recently saw an increase in its production ceiling because of past investment in its capacity.

The MSC will inevitably incentivise investment in exploration and production; however, Middle Eastern member states will probably pick the lowest-hanging fruit of the new mechanism. As thoroughly outlined in a recent Reuters column, the UAE is planning to increase its MSC to 5 mbpd, with some suggesting that even 6 mbpd cannot be ruled out. Saudi Arabia’s crown jewel, Aramco, will bring two fields online by year-end, adding 550,000 bpd of capacity as its capex surges to $52–55 billion. Kuwait plans to ramp up its production capacity from the current 2.9 mbpd to 4 mbpd by 2035, and Iraq to 6 mbpd by 2028, a rise of 1 mbpd. For other countries, where extraction costs are higher, it will take longer and be more expensive to increase their MSC. Nonetheless, the message is loud and clear: OPEC+ remains bullish on oil demand and, in its efforts to satisfy it and gain market share, is doing its best to eliminate internal quarrels and keep group cohesion as intact as possible.

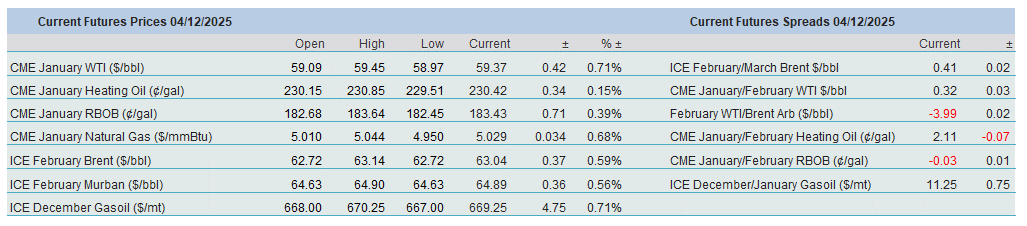

Overnight Pricing

04 Dec 2025