Kudos to OPEC

Predictable unpredictability is the motto of 2025, and yet, notwithstanding the unforeseen and the capricious, one thing seems certain, at least for now. That is, that OPEC production does not feature high on investors’ list of concerns. Or, you might say, the producer group has been reading the market sentiment admirably well. They started to increase output at the accelerated pace of 411,00 bpd the month after Brent fell below $60/bbl because of the US tariff charade on April 2. After three months of stern commitment to claim back market share, 8 member countries with voluntary reduction upped the ante over the weekend when they announced a 548,000 bpd increase for August, with strong hints that by September the unwinding of the 2.2 mbpd constraints will be completed with a rise of 550,000 bpd. Yet, Brent finished the day $1.28/bbl stronger and more than $10/bbl above the April trough.

The rather muted reaction is possibly a transitory approach as market players are preoccupied with the tight middle distillate market as discussed below. Renewed Houthi attacks on cargo ships in the Red Sea temporarily raised the regional risk premium. At the same time, investors are trying to find a method to the US tariff madness. The US Commerce Secretary now sees higher tariffs to come into effect on August 1, three weeks later than the well-publicised July 9 deadline. President Trump is firm, but not 100% on the new cutoff point, but at least he announced 25% punitive measures on Japanese and South Korean imports. Allegedly, letters are going out to 12 other countries. The ensuing sell-off in equities demonstrates that the market is getting fed up with this incoherent reality show, and it is a dead cert that more twists and turns are to follow.

Strong Sour Crude, Robust Middle Distillates

Ask any forecaster, and they will tell you that the upside potential in oil prices is very limited. The end-of-June Reuters survey put the 2025 Brent price at $67.86/bbl. Although this is somewhat higher than the previous month’s estimate, it remains well below the year’s peak of $82.63/bbl, reached in January just before President Trump moved back into the White House.

In fact, this prediction broadly reflects the current outlook: the average Brent price of $71.88/bbl during the January–June period, combined with the forward curve for the second half of the year at around $67.00/bbl, yields an annual average of approximately $69/bbl, close to the latest survey result. Goldman Sachs expects the European benchmark to fall to $59/bbl in the last quarter of the year and to $56/bbl in 2026. The EIA, which will release its updated oil balance this afternoon, forecasts Brent to average $61/bbl towards the end of this year and $59/bbl in 2026.

While these prognoses may not be significantly below current levels or the forward curve, it is nonetheless intriguing to observe that the prevailing lack of optimism is not corroborated by the structures of the two major crude oil futures contracts, nor by assorted crack spreads, particularly the price differential between middle distillates and crude oil.

Front-month WTI is currently commanding a premium of $1.4/bbl over the second month. The front backwardation on Brent is well above $1/bbl. When the annual high was reached in the first half of January, the front-end structures on the two most pivotal crude oil markers were more or less the same as now, notwithstanding the significant drop in outright prices. Dated Brent for next week is assessed $3/bbl over the forward contract. It compares to around $2.70/bbl mid-January, still a decent premium, but outright prices are currently significantly lower than seven months ago. Looking further ahead, it is notable that the backwardation narrows dramatically in the months ahead and the curves flatten out in 2026.

The current strength is likely driven by the strong performance of sour crude, which is in turn supported by counter-seasonal strength in middle distillates. Sour grades, including Dubai, are relatively expensive compared to lighter and sweeter grades, even though OPEC+ has been consistently adding sour barrels back into the market. The reason for the ostensibly robust demand for heavier crude lies in strong distillate consumption. Implied US demand was above 4 mbpd in the US last week.

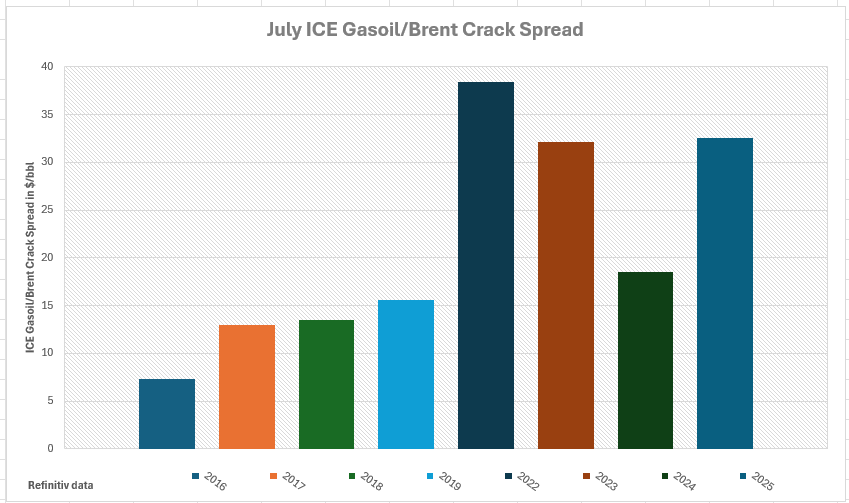

The chart above illustrates the ICE Gasoil/Brent crack spread values in July for the last 9 years. Setting aside the abrupt rally of 2022 and 2023 caused by Russia’s invasion of Ukraine, the spread is remarkably strong, and the same is true for the CME Heating Oil/WTI crack spread. Looking at inventories in major oil hubs in the world, one realises that this tightness is a global phenomenon. Distillate stockpiles in the US are close to their 20-year lows and show a significant deficit to the historical seasonal norm (-11%). In the Singapore hub, they match the 5-year average, but in Northwest Europe, Gasoil stocks are well under both the 5-year average and the year-ago level. When combining these three centres, the middle distillate tally shows a deficit of 10% to the 5-year average and is 15% below the corresponding week of 2024.

Rising tension in the Middle East, which mercifully did not result in disruptions in oil flow, also added to the bullish sentiment as around 1 mbpd of gasoil and diesel travel through the Strait of Hormuz. Erratic Russian exports, refinery problems in Europe, power generation in the Middle East and the harvest season in the northern hemisphere also contribute to the tightness. It is imperative to keep a very close eye on distillate stock movements as any increase in inventories will be accompanied by weakening crack spreads, narrowing sweet/sour differentials and most plausibly, a decline in outright prices, provided that other parts of the equation, namely trade wars, remain unchanged.

Overnight Pricing

08 Jul 2025