Limited Downside – For Now

Investors are remarkably calm about the tension in the Middle East. Fears of supply disruptions that pushed the price of Brent up from $85/bbl prior to the Hamas attack on Israeli civilians to $94/bbl two weeks later have considerably dissipated. This relatively relaxed attitude prevails despite Israel having launched its ground offensive, something that was expected to exacerbate the tension and spread the conflict to the entire region with a plausible adverse impact on oil supply. The Iranian President Ebrahim Raisi said on Sunday that his country’s regional foe had crossed the red lines and warned that its offensive within the Gaza strip ‘may force everyone to take action’.

The possibility of reduction in Middle East oil supply, consequently, has not evaporated and should it materialize oil prices will rally towards their annual peaks and possibly even above depending on the extent of the setback. Until then, however, no significant price jump is anticipated. The market psychology is such that the initial reaction to a geopolitical event is usually exaggerated in a financialized environment as investors become pragmatic and cautious but without tangible impact on the regional and global oil balance a drawback in prices is usually inevitable. On the other hand, without a reassuring resolution to the conflict the geopolitical risk premium will persist but will be meaningfully less than the initial market reaction suggested. Given the recalcitrant attitude of the warring parties and the potentially protracted and explosive nature of the ongoing conflict the Middle East premium will likely put a floor under the prices in the foreseeable future even if there is no tangible effect on region’s oil output.

GMT +1 | Country | Today’s data | Expectation |

10.00 | Euro zone | Core Inflation Rate YoY Flash Oct. | 4.2% |

10.00 | Euro zone | GDP Growth Rate YoY Flash 3Q | 0.2% |

14.00 | US | CB Consumer Confidence Oct. | 100 |

The recent weakness and the retracement from the peaks seen on October 20 might suggest that geopolitical concerns are overlooked, and physical markets are oversupplied. The structures of the two major crude oil contracts are still faithfully backwardated but weakened considerably. The front-spread in the US benchmark has narrowed from $1.67/bbl at the beginning of the month to 63 cents/bbl by yesterday’s settlement, which might be the function of reduced refinery demand due to the October maintenance. On a sanguine note, IIF Energy sees US refinery offline capacity plummet from 2.433 mbpd for the week ending October 20 to 1.295 mbpd by the end of this week and to 743,000 bpd a week after. This might just breathe some life into frail WTI spreads. The expiring Brent spread, conversely, remains resolute because elevated freight rates prevent WTI from coming to Europe – hence the cheapening of the arb. Further down the curve the weakening of its structure, however, is palpable. Brent CFDs, which reflect the future value of the underlying physical oil, on the other hand, are supportive as Dated Brent is assessed $2/bbl above the forward contract for this week and significantly above $1/bbl for the following two weeks. The strength in Russian crude oil also implies healthy thirst in Europe. Russian export blend, Urals in the Mediterranean, is now priced only $6/bbl under Brent whilst in Northwest Europe the discount has narrowed to $8.30/bbl, according to S&P Global, a jump of $3/bbl from the end of August. (Back in May Urals changed hands at more than $20/bbl under the European crude oil marker.) India is now willing to pay a discount as high as $4.35/bbl for Russian crude, the price reporting agency estimates, an improvement of $1.30/bbl from two months ago and up from $11.70/bbl from the end of May.

The crucial crude benchmarks do not imply an immediate flood of oil and neither does the latest estimates oil balance. Partly because of the OPEC+ supply agreement seasoned with the voluntary reduction in output and exports from Saudi Arabia and Russia demand ought to exceed supply in the incumbent quarter. The gap in views between the group of oil exporters and the energy watchdog of the OECD nations, pivotal consumers, has been growing ever so wider in the past year as the perspectives on managing the transition from fossil fuel to renewables differ widely. Nonetheless, both anticipates depleting global inventories in 4Q – OPEC by 3 mbpd and the IEA by 1.4 mbpd. Based on the derived OECD inventory levels Brent should average $94/bbl in 4Q, OPEC data indicates or $90/bbl if the IEA is to be believed.

The World Bank is closer to the latter projection. They believe that in 4Q the consensus price should be $91/bbl. It means that Brent should average around $92/bbl for the last two months of the year. The World Bank warns that in case the Middle East conflict results in a ‘small disruption’ scenario, ie. the loss of say 500,000 - 2 million bpd then the price could rise to anywhere between $93 and $102/bbl. The bottom line, nonetheless, is that even without Middle East supply disruption significant weakening in prices is not foreseen for the remainder of the year, something that is reflected in the current state of the physical market.

In the light of yesterday’s dump, the above call might seem bold and even irresponsible. Outright prices plunged nearly $3/bbl and spreads have also weakened meaningfully. Again, we believe that for the time being not much should be read into it. The market is volatile and even violent as it reacts to headlines and ignores medium to long-term developments. Take the performance of the January/February Brent spread as a gauge of the current market sentiment. During the last six sessions the closing values were as follows: 94 cents, 79 cents, 85 cents, 72 cents, 87 cents and 72 cents. There is no palpable trend, neither in outright prices nor in spreads. Our slightly optimistic view is based on supply side developments: the aforementioned cuts from OPEC+ and the potential disruption due to the Israeli-Palestine conflict. At the same time, we believe that economic headwinds will loosen the oil balance next year assuming no supply disruption. The Chinese economy will struggle as demonstrated overnight. The country’s manufacturing sector shrank this month, a sign of policy failure to shore up the economy. Entrenched inflationary pressure in the developed part of the world will keep borrowing costs high. For the remainder of this year, however, the supply deficit ought to be sufficient, with or without Middle East supply disruption, to hinder prices falling below $85/bbl basis Brent.

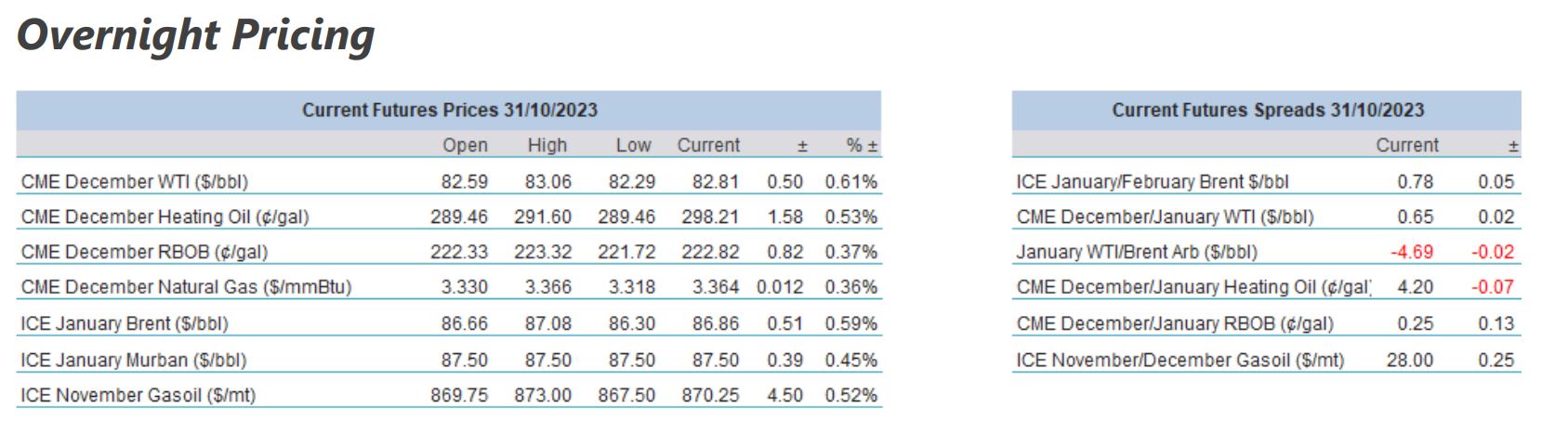

Overnight Pricing

31 Oct 2023