Losing Confidence in Equities, Oil Finds Support from Ukraine.

The following bullet points summarise the latest developments in financial markets and oil, and draw tentative conclusions about their impacts on oil prices.

• The re-opening of the US government has been met with a sell-off on Wall Street, as a lack of clarity about job and inflation data has forced investors to lower their expectations for a December Fed rate cut. The IMF has warned of economic headwinds facing the US due to tariffs, slowing immigration, and political uncertainty. A prolonged downturn in stock markets would weigh on oil prices.

• China’s economy is unable to get on an upward trajectory, as echoed in the latest manufacturing and retail sales data. Both sectors recorded their slowest growth rate in a year. No oil demand support is forthcoming from the world’s second biggest economy.

• Oil forecasters expect a supply surplus next year. This is discussed in more detail below.

• US crude oil inventories rose more than expected, while gasoline and distillate stocks declined slightly. The former reached its lowest level since November 2014. Nonetheless, US commercial inventories remain comfortably above both last year’s level and the long-term seasonal norm. The picture is ambiguous, with price risks probably skewed to the downside.

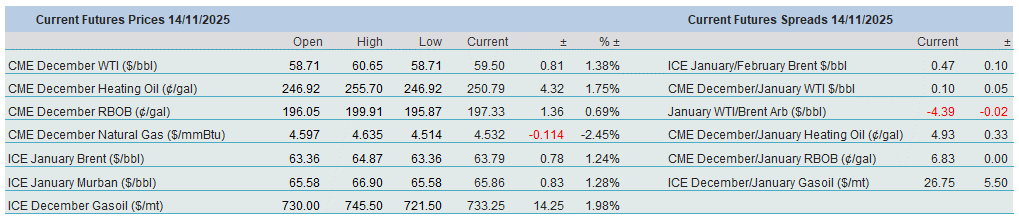

• The relative resilience of product prices and the resulting strength in crack spreads are rooted in the limited availability of Russian products as Western sanctions bite and Ukrainian military manoeuvres continue. Overnight, a drone attack damaged a ship and an oil depot in Russia’s Black Sea port of Novorossiysk, triggering a rally in oil prices, particularly in Gasoil and Heating Oil.

• Unsold Russian crude cargoes are adding to floating storage. Major Persian Gulf crude oil exporters have cut their December OSPs. It had led to the narrowing of the backwardation in the Brent structure and in CFDs, which came to a temporary halt overnight due to Ukraine’s drone assault.

Healthy inventory levels and the absence of renewed stock market enthusiasm are offset by concerns about Russian product exports. This remains the most salient factor standing between the current price level and a test of this year’s low of $58/bbl basis Brent.

Divergence Turns into Convergence

It has had numerous labels: differing views, lack of consensus, or an irreconcilable chasm. The wide and wild gaps in demand estimates stem from attempts to predict the impact that the transition from fossil fuels to renewable energy will have on oil consumption. The task of forecasting accurately became even more cumbersome after the 2020 health crisis, when the global economy, including oil supply and demand, was devastated, and after Russia invaded Ukraine, when energy security became the focal point for decision-makers. The varying interpretations were evident in both short- and medium-term estimates. This week, however, the views have become more aligned than ever before. We will take a detailed look at the changing expectations to 2030 and beyond next Tuesday. In today’s report, we outline the relevant changes for 2026.

The most significant twist regarding next year’s oil balance is the not-so-tacit admission from OPEC that the sharpest sword of Damocles hanging over the oil market is oversupply. But before delving into that, it is prudent to begin with the updated findings from the EIA. These are particularly telling considering last week’s comments from the Deputy Secretary of the U.S. Department of Energy, who did not foresee a supply surplus. Yet the figures from the statistical arm of the DoE are simply alarming, if you are an oil bull, that is. Although the EIA expects global oil demand to grow significantly faster next year than supply from producers outside the OPEC+ alliance (+1.06 mbpd versus +780,000 bpd), thereby raising the OPEC+ call by 280,000 bpd to 42.02 mbpd, OECD inventories are projected to swell in every quarter of 2026, ultimately reaching 3.18 billion barrels by year-end, up from 2.93 billion barrels this year.

The reason lies in an anticipated output level of 44.22 mbpd from OPEC+, an increase of 630,000 bpd year-on-year. This may appear somewhat overzealous, but if it proves accurate, both global and OECD inventories will indeed build, weighing heavily on prices. Under this scenario, the EIA projects a Brent price of $54/bbl in the first quarter of 2026 and an average of $55/bbl for the year, compared with a futures curve of around $63/bbl in both cases.

There has been a noticeable and understandable shift in OPEC’s view of next year’s oil balance. This adjustment comes despite only minor revisions: next year’s demand forecast has been raised by just 20,000 bpd, while non-DoC output has been revised higher by 100,000 bpd, resulting in a 70,000 bpd downgrade in the DoC call. Like the EIA, OPEC believes that global oil demand will rise faster than non-DoC supply, though to a more pronounced degree. Global consumption is expected to grow by 1.4 mbpd, while non-DoC supply increases by only 630,000 bpd, implying a DoC call of 43.03 mbpd.

The culprit is the group’s recent effort to reclaim some of its lost market share. The planned production increase will ensure that, while global oil demand continues to rise, inventories, both global and OECD, will also grow. The extent of this build depends entirely on how much oil the cartel ultimately produces next year. Assuming output of 44 mbpd (which may be on the high side), global stocks would rise by around 1 mbpd, with OECD inventories increasing in every quarter compared with the corresponding periods in 2025. The market’s immediate reaction to Wednesday’s monthly OPEC report spoke volumes.

And finally, the IEA. While it may eventually adjust its approach to the medium-term oil balance, it remains resolutely pessimistic about next year. Using the same OPEC+ supply assumptions as above, the 2026 glut appears even more severe than previously expected. This is partly because global oil demand is projected to increase at a snail’s pace compared with non-OPEC+ supply, and partly because OPEC+ is producing more. Last month, the Agency projected a supply surplus of 3.97 mbpd; the latest report trumped that figure by another 120,000 bpd. Yup, global oil inventories are expected to build at a rate of 4.1 mbpd. Credible? Time will tell. Nonetheless, the key takeaway from the latest data set is the unmistakable alignment of views on ballooning oil inventories.

Would it entail lower prices, which, by the way, have been holding up remarkably well, so far, this year? Consider the conjectures for end-2026 OECD stocks: OPEC 2.98 billion bbls, EIA 3.18 billion bbls, and IEA 3.59 billion bbls. Now, we need to answer the crucial question: which of these reflects most accurately the futures curve? For one, we haven’t a clue. We are, however, confident that in the plausible case of 2026 inventories surpassing this year’s level, the price of the barrel will cheapen year-on-year.

Overnight Pricing

Overnight Pricing

14 Nov 2025