Many Drivers are at Work, But None Can Yet Break Oil’s Range

It is difficult to quantify, let alone qualify how the flying equity markets' risk-on mood is spreading into oil, other than a possible notion of higher stock values forming a strand of demand, and that a flagging yield environment has brought an end to the rampant recovery of the US Dollar which has not made new highs for over a week now. Yet it cannot be dispelled, and as always in markets there is happenstance where small contributing factors, facing the same way, bring about a change in fortune or tone. It is doubtful that oil can break away from its current range because the current movers, while influential, are not game changers.

Despite the news of Libya's NOC lifting of force majeure and the reopening of the El Sharara oilfield, the reintroduction of its crude is likely to take as long in influence to supress prices as it did when they were ultimately lifted after the protests started. This ultimate bearish news is also somewhat negated by the cold snap that grips much of the US, particularly that of North Dakota which is the third largest producer of the country's crude and the attack by Ukrainian forces on the Russian company Novatek in the Baltic is a timely reminder that a bigger, more influential war is still waging on. It was too late last week to register, but the crimp in US production might allow for sizeable crude inventory drops in tonight's API and tomorrow's EIA reports. All this is sided with the Houthi missile strikes into the Red Sea, set to continue even after another overnight bout of attacks from the coalition tasked with nullifying the threat, and with every exchange of fire the creeping sentiment of conflict spread is kept alive.

The tone in equities remains as a positive driver this morning, nudged on by the decision of the Bank of Japan to hold fast to the loose monetary policy that has served the Nikkei so well that is again at 34-year highs and there was also an unexpected boon from China. Bloomberg report knowledge of a possible stock market rescue package of 2-trillion Yuan repatriated from offshore funds and the news had the initial desired effect. However, and as pointed out by a BNY Mellon analyst on the news service, the monies add up to 2% of GDP and is inadequate, which strikes accord with China's bourse doubters and values are in the process of giving the early gains away. Whether or not the rise in stock markets will extend further influence, seen or unseen, into commodity prices, is as always, dependent on flighty correlations.

There is nothing Artificial in China’s woes

There is a singular mindset from equity investors that had developed last year and spilled into this, on entries or increased allocation with all that maybe Artificial Intelligence. The recent projections of Taiwan Semiconductor Manufacturing Company (TSMC) included a revenue increase of around 20% and an allocation of capital in the region of $30 billion and with the likes of Nvidia and Apple as microchip clients, the circular effect of bullish forward expectation is easy to comprehend, and the AI rush resumed in earnest, rallying all bourses and sending the S&P to a record. Therefore, it can be forgiven to think economies that have large exposure to all that is technology would fare well as can be seen in Japan where the Nikkei 225 was sent to 34-year highs, albeit aided by a prolonged outlook for the easy monetary policy of the Bank of Japan.

Not so China, the immense investment in technology and chip making has failed to incur any of the tailwinds of the AI-induced buying around the world and the hitherto powerhouse of Asia cuts a forlorn figure as its neighbours scamper higher to the tune of modern industry. As mentioned, the national bourse of Japan soars away but in complete contrast to the fate of the Hang Seng, used because of its history and its relationship with technology, saw an all-time high of 33,000 in June 2018, stayed in the same vicinity of 30,000 at the start of the pandemic in February 2021 and has halved to the current level of 15,000 since. The index has been here before at the end of the zero-COVID policy period, enjoyed a substantial rally when that ill-gotten, ill-implemented policy was abandoned achieving nearly 23,000 exactly 1-year ago, but in the convening months as the zeitgeist of China’s economic largesse dissipated to miserliness in terms of demand, so has one of its most popular indices.

China and its representative markets seem to be falling foul of investor interest, which in times before might have seen renewed vigour bearing in mind the forthcoming and much speculated on pivot by the US Federal Reserve that largely sees more interest in emerging markets. Such is the ingrained scepticism that foreign direct investment (FDI) has dramatically reduced by as much as 8% in 2023, reported on Reuters, with reluctance being fuelled by government attitude as much as ailing industry. BNP recently highlighted that although FDI is only a small percentage of investment within China, it remains important because it transfers international best practice and discipline but that is completely undermined by authoritative diktats which obscure poor data, as seen in the scrapping of Youth Unemployment reporting and intolerance of independent compliance companies, all in the name of national security.

This heightened sense of isolation comes at a time when investors and markets are screaming out for signs of the ever promised, but loosely delivered stimulus that piques interest but is soon dismissed along with the accompanying banalities of government departmental talking heads. The latest instalment of disappointment came yesterday as the People’s Bank of China (PBoC) kept their 1-year and 5-year Loan Prime Rates unchanged, playing out to fiscal discipline and economic security while running a bureaucratic knife through the heart of any hopes for relief in beleaguered sectors such as housing. To say that property is distressed in an understatement, developers are in the throes of default and investment has all but gone save that which leans on sporadic state aid with sales up to 60% lower than that of 2019. The National Bureau of Statistics showed Manufacturing PMI at 49 in December 2023, a 3-straight month contraction and according to UBS, retail sales in 2024 will grow at a full 1% lower than that of 2023 as homeowners cut back due to falling house prices.

At Davos, China’s Premier Li announced that GDP last year was estimated at 5.2%, higher than the desired 5% which was the government's target but, and noted by Goldman Sachs quoted in the FT, the base of comparison with 2022 probably flattered GDP growth last year by 2 percentage points, with 2024’s predicted as slowing to 4.6% according to a Reuters poll of analysts. With CPI and PPI in continued retreat, deflation is upon China and without robust intervention and a turn in the fate of FDI, interest rates, PMIs and GDP, China will continue to fall down the list of places to be for monetary tourism which at present prefers representation in the ‘what ifs’ of AI rather than those of the mighty Asian dragon.

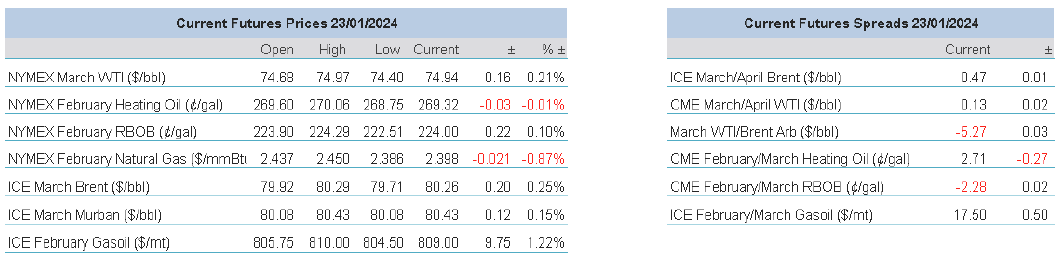

Overnight Pricing

© 2024 PVM Oil Associates Ltd

23 Jan 2024