Market braces for news shocks and higher prices

Oil steps into the morning firm but with an air of uncertainty as it faces a few days and news cycles that will have a great influence on its current destiny. Today will see the monthly oil reports from both the Energy Information Administration (EIA) and OPEC, tomorrow a release of the US CPI data and US inventory report and Thursday, the European Central Bank’s interest rate decision. There is little doubt that the oil industry feels a collective rally risk with a perception of, and actual tightening in parts of oil flow. Even the seemingly and seasonally unfancied RBOB Gasoline futures price has improved so much that it has, from a technical point of view, filled a higher gap left from last month’s expiry. WTI and Brent both made new 2023 yearly highs yesterday and the distillate contracts, Heating Oil and Gasoil remain the main drivers with refinery turnarounds foremost in market thinking. Maintenance at refineries in Russia has reduced fuel exports and even though this is not relevant to followers of sanction rules, refined fuel reduction from any source to any destination will make for a world bargaining over less product availability.

Aiding and abetting commodities in general yesterday was a hiatus in the climb of the US dollar. Of late, China news and a blasé assumption that Japan will forever carry on in plying its domestic market with loose money, have respectively depressed the Yuan and the Yen allowing for greater reasoning in ‘safe-haven’ buying of the world’s marker currency. However, the continued liquidity injections of the People’s Bank of China and marking down of the Dollar was surprisingly accompanied by an unforeseen interjection by the Bank of Japan Governor, Kazuo Ueda. His comments have been somewhat qualified latterly, hence the recovery in the US Dollar, but he speculated that there might be enough economic triggers to allow a rise in short-term rates by the end of this year. Agreeable to the market, and keeping China from the bad news tray, is that the embattled property giant County Garden has secured 6-month extension on payment pertaining to 6 of its onshore bonds.

The news tone remains bullish for oil and the market appears to be preparing itself in positioning by guarding against another run on prices. If the tragic life-taking flooding in Libya interrupts crude flows, then the market is wise to be wary of more supply side shocks.

Where is Nigeria’s oil?

A major factor in the success of the Saudi Arabia and Russia ‘keeping crude tight’ alliance is the failure by some countries to live up to their oil production potential. Any exemption that OPEC might or might not grant for the Nigeria’s oil industry is almost made irrelevant by time-and-again misses of what production limits might be. Production issues at Forcados recently and a leak within the Niger Delta have not only exampled the fragility of Nigeria’s oil infrastructure but again poured a light upon the extensive pilfering it experiences. The trouble with oil theft is that it has become endemic within the nation. Recently, and according to All African Global Media, security agencies have charged collusion over some Ministry, Department and Agencies, oil companies and communities of carrying out large scale appropriation.

Tajudeen Abbas, the speaker of the House of Representatives, spoke last week on spiralling theft and its menace to oil production. He said between 5% and 30% of daily output was being lost and in the 2009-2020 period had amounted to the equivalent value of $46 billion. Sharing with the Nigerian Guardian and quoting from Nigeria Extractive Industries Transparency Initiative (NEITI), the Speaker said oil production declined from 2.51 million barrels per day in 2005 to 1.77 million barrels per day in 2020. Currently there is no sign of an improvement in the situation as production totalled 1.184 million barrels per day in May 2023 and 1.249 million barrels per day in June.

Larceny is not the only motivation. Political inclination among oil company workers is being expressed through sabotage. Militancy is not just in the remit of armed extremists such as Boko Haram and the Islamic State in West Africa (ISWA), employees who carry out such acts are in some ways harder to trace. Nigeria’s armed forces now police two-thirds of the states in the country, but with so many contributors with intent to disrupt oil production it would appear not only to be a thankless but also unwinnable task. The whole of Nigeria consequently suffers as the inflow of petro-dollars decline on an almost daily basis. With a budget assumption of 1.69 million barrels per day in production, the fiscal differentiation is plain to see and even if Nigeria were to bemoan OPEC’s recent cut of quota from 1.742 to 1.38 million barrels per day, it does not have the production wherewithal to back up such a challenge.

It did not seem so very long ago that Nigerian crude cargoes plied their wares on the busy TD5 (West Africa to US Atlantic Coast) shipping route, with its influence not only moving Mediterranean values and the North Sea basket of crudes but was also an important alternative for Eastern buyers. Contemporary times see Nigeria losing influence in the oil fraternity which is besotted with security supply after the fallout of the Ukraine invasion. Cries of ‘force majeure’ will no longer be tolerated and sadly Nigeria’s voice is losing resonance within OPEC as do the other sub-Saharan members Angola, Gabon Equatorial Guinea and the Republic of Congo. The new power-play by the Saudi/Russia axis has no time for benevolence when negotiating with struggling members of OPEC+. However, if Nigeria ever gets to grip with the grand scale larceny and political militancy within its bounds and returns to historical production of 2.5 million barrels per day, it will not be so easily dismissed, and memories will run long in the largest African oil producer.

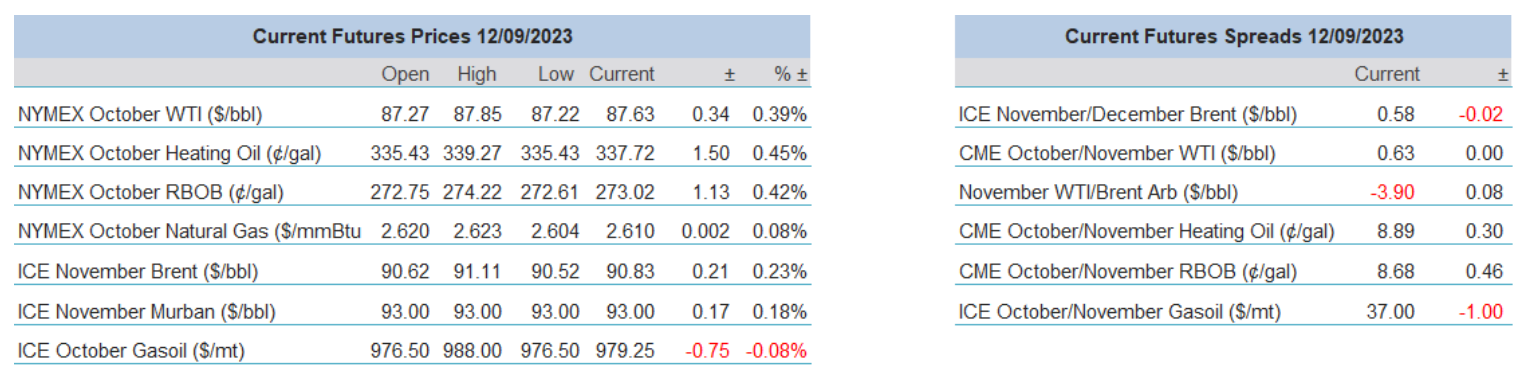

Overnight Pricing

12 Sep 2023