Markets and Investors are Backfooted

There is a pause of breath and light reprieve for oil prices this morning caused in the main by a greater draw of stock in the US API data than anticipated. Crude drew 7.4mb barrels against a -1mb expectation, Gasoline -0.3mb and Distillate -0.4mb with both products forecasted to have mild builds. If matched by the EIA Inventory Report later, the Crude draw will be the largest for 2-months, but as the two publications have not exactly chimed in agreement of late, the market will have to wait for such confirmation. That is of course if it is given the opportunity to wait. There is an ill wind blowing through the confidence in oil prices and the OPEC alliance group must be hoping that it is an acute one and not chronic. News leaks were not slow in coming yesterday that OPEC+ were considering shelving the 180kbpd of increased production due in October. Yet the headline was transitory and with such a mood the amount was almost laughed off as M1 Brent proceeded to settle $1.05/barrel lower than the previous day and $6.10/barrel from the close of Friday, although allowance must be made for the backwardated expiry. OPEC and partners have a tough decision, having lost the Libya prop and the Middle East being figuratively numbed with too many 'cries of wolf', many and varied voices will again ask the cartel how it hopes to manage demand with supply cuts?

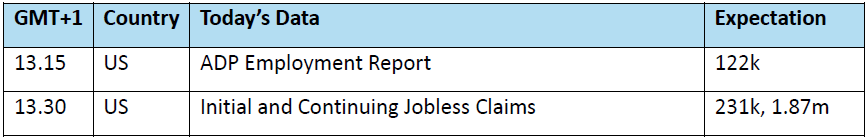

Little aid is forthcoming from the wider suite. Bad news is deemed bad news again. The ISM Manufacturing PMI is still ringing in the ears of those that listen for US demand. However, employment data takes centre stage in the United States at the back end of this week and the start of a spate of numbers does not bode well. JOLTs Job Openings fell for a second consecutive month and to the lowest since January 2021, with the ADP Employment and Jobless Claims data due later today, any more bad readings will see speculation of a double decker cut from the FED in September. Ordinarily, that would be met with glee from the hunting packs of bulls that have prowled the US bourses this year, but the cut is defensive, and the market is practiced enough to understand the nuance. This is particularly true in a month where historically, stock markets have often felt the appearance of profit taking. NVIDIA have denied receiving any subpoena from the US Department of Justice, which itself would not comment when pressed by agencies. But with no redress to the major slump in the 'darling' shares, the coyness of all markets is plain to see.

Norway, generally getting it right

Every time the oil price takes a negative turn it must be presumed that the case for renewables or anything in the green belt becomes a harder sell because they lose some of their claims to being cheaper. With the advent of positive outcomes of AI being able to increase the yield in current drilling, it is not just alternative energies that benefit from modern technology. Summed up by Reuters, Goldman Sachs said on Tuesday that Artificial Intelligence could hurt oil prices over the next decade in boosting supply by potentially reducing costs via improved logistics and increasing profitability in recoverable resources. In a time of price normalisation after the dizzy heights of the Ukraine war era, the world is adopting a more common-sense approach to energy and even the most adamant of green seekers are having to accept that fossil fuels, in whatever medium, will have to be part of any nation’s energy security.

Therefore, countries that are blessed with mineral riches will find it hard to ignore such cheap assets on their doorsteps while the transition, whatever and however that may be, grinds its way to fruition. Such consideration might be being exhibited by Norway, a country that has probably the greenest of public perception. In January of this year, a court ordered temporary injunctions on Yggdrasil, Tyrving and Breidablikk, three gas and oil fields that are trying to be expanded by their owners. Frankly, the Norwegian government has taken a much more realistic attitude in building its green minded path. This is highlighted in its plan to cut emissions, not economic growth. Instead of shackling itself to grand statements of being carbon zero by this date or that and embarrassingly missing them, Norway has communicated a nationally determined contribution (NDC) under the Paris Agreement to reduce greenhouse gas emissions by at least 50% and towards 55% by 2030 compared to 1990. This is a crucial step on the path towards Norway’s target of being a low-emission society by 2050 as is laid out in its Climate Action Plan for 2021-2030. Therefore, it should come as no surprise that it challenged the ruling on the three fields, obtaining a hold in March until a hearing, which started yesterday, will see a permanent lifting or reinstatement of the initial ruling.

Yet the Nordic idyll finds itself on the wrong end of criticism from powerful green campaigners. “Norway claims to be a climate leader, but in reality, it is a climate hypocrite,” so says the head of Norwegian Greenpeace. Boasting a world-envious grid delivering fully renewable power due in the main to hydro-electric power and some wind generation enable Norwegians to drive almost all cars that are EVs. Having only a population of 5.5 million, the ever-present electricity is sustainable and sees citizens easily able to access modern technology as it rolls out. The duplicity is found, according to the Guardian, in Norwegians digging up more petroleum per person than Russians, Iranians, North Americans and Saudi Arabians. By such arguments, the two-faced charge is hard to counter but in national strategic thinking, understandable. Norway’s paradox is by giving up exploitation of natural wealth it will give up economic security, surely as important or more than energy security. Income from oil and gas has not been squandered on ridiculous wars or meting out dividends to shareholders, it has taxed its assets hard and ploughed much of the monies raised into the largest sovereign wealth fund.

Norwegians do indeed enjoy an enviable renewable power system, but it has all been made via the profits of the pilloried black stuff. The oil and gas industry employs 200,000 people, in a population of 5.5 million it is a huge proportion, and such a culling would be tantamount to employment suicide. Taking its 2-2.5mbpd production from the world’ pool might bring a hurrying along, if possible, of green energies elsewhere in the world, but it will most assuredly bring about ferocious global oil price rises and the accompanying, crippling inflation. Evidence of how Norway is making the most of all assets as oil production and electrical power are married up at Johan Sverdrup, the huge Norwegian field. According to Equinor, the field emits only 5% of carbon dioxide compared with the world average for oil production. This is due to hydroelectric power from shore avoiding the equivalent to yearly emissions from more the 310,000 cars. Duplicity and paradox are both trumped by pragmatism and Norway will continue to practice it.

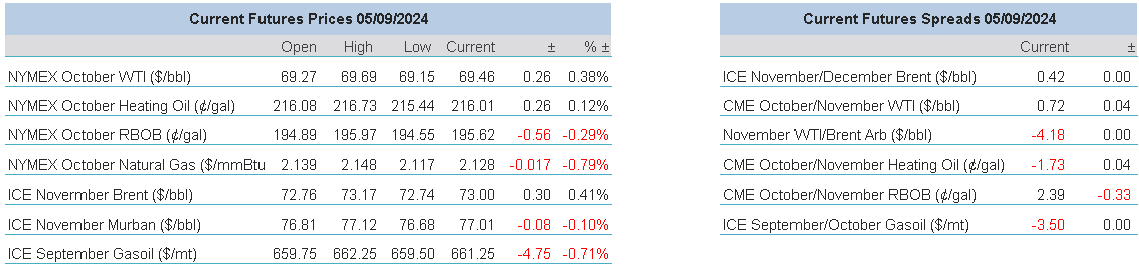

Overnight Pricing

05 Sep 2024