Markets are Taking a Summer Breather

Investors seem somewhat disconsolate as the suspected over-expectation of the tech stock mega-caps sees a very crowded ownership lightening up, and because of the nature and powerful influence projected by the likes of Tesla and Alphabet/Google and yet to report peers, markets feel an uncomfortable dose of reality. A check back in the world's bourses is not just from an over-cooked fraternity alone. There is meat to the worry in the very poor Manufacturing PMIs reported in Europe and matched in contraction by the US S&P Global reading of 49.5 against a 51.7 forecast. This mini crisis of confidence in which the Nasdaq lost 4%, brought about a positive reaction in the CME FedWatch tool in which pricing for a cut in September increased from 95% to fully loaded. When this is attached to a rallying JPY caught up in conviction that the BoJ will raise rates, the US Dollar feels more pressure with the Dollar Index (DXY) touching back to nearly 104.10 before regaining a little composure to stand at 104.20 this morning. If the fate of the mega-caps and its investors are the hot topic, it is run close by an ever-increasing scrutiny of the failings of the Chinese economy.

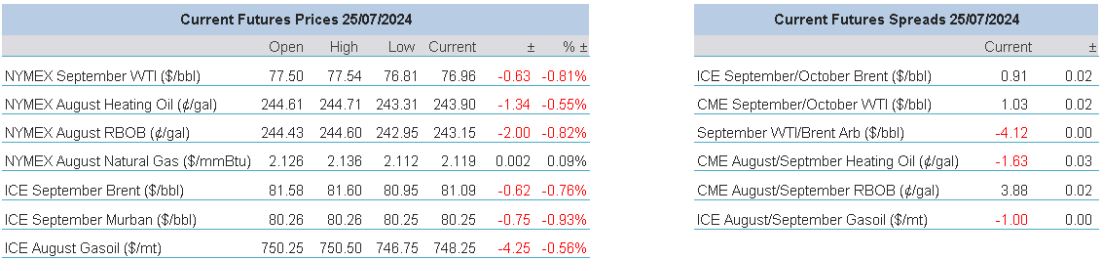

There is at last some recognition by the government of a need for more than words and after a cut earlier in the week to interest rates, China put in another surprise by cutting the one-year medium-term lending facility (MLF) this morning by 20-basis points. However, a cool reaction from both markets and commentators is witnessed, for while 'easing' in policy should be welcomed, it is very different from actual stimulus needed for beleaguered sectors such as property. The idea of worrying Chinese demand is exacerbated by a report sourced to China Petrochem by Bloomberg in which fuel demand will fall 3.8% in the second half of 2024, accelerating the drop from the first half of 1.4%. With continued, and according to some sources, conciliatory developments in Gaza peace talks, oil prices are finding it increasingly hard to hang on to intermittent rallies. Not even a submissive Dollar and across-the-board draws in the US EIA Inventory Report is enough to break the current shallow trend lower. US Crude stocks fell by 3.7mb, Gasoline by 5.6mb and Distillate by 2.8mb. The tightness in US stocks plays out well for current spot premiums, but, and as touched upon below, the current state of the world's macro drivers precludes oil prices from a sustained rally.

Do not look for conviction

The current state of play within the oil market is an increasing one of encroaching influences that do not have enough oomph to allow a convincing break either way. It is always an intriguing concept when one hears of ‘balances’ in the market and more often than not demand/production and refinery ones are convenient explanations when price movements are occluded or lack explanation. But balance in stories is present in the form of drivers in the many and varied, serving to counter each other and in all likeliness lead us into a severe bout of summer doldrums. It is not as if the market is running out of reasons to be bullishly hopeful, it is just that there are enough questions from a troubled path that any rally cannot presently answer.

Take for example the continued draws in crude inventory of the United States. Four consecutive weeks of decline have seen levels lose over 20 million barrels and fall to below the 5-year average. On the same continent the wildfires in Canada are now threatening 10% of production, over 400kbpd if the worst ensues. Even the look-to influencer, Gasoline, experiences a draw not to be ignored which on the face of it should keep the idea of a summer season and third quarter demand intact. Rightly, those of a bullish disposition and longs will point to the very healthy state of both WTI and Brent backwardation. The logical conclusion is that nearby demand is outstripping that of the future offering evidence of spot interest. Indeed, the ‘roll up’ trade, where follow-on spreads seek to at least match its precedent has seen success in the last two-months for WTI and judging by how Brent is approaching its own expiry next week, it might be similarly repeated. Further afield and flirting with geopolitical influence, the success of Houthi and probably combined other Iran-backed organisations in the Middle East in launching missile and now drone boat attacks is a massive headache for the purported Operation Prosperity Guardian tasked with creating a defensive shield for maritime conveyance. Because of the longer journey times as ships navigate Africa, there has also been a very decent prop offered by demand for marine fuel oil. Staying with missiles for the moment, what also should bring some pep is that on top of suggesting Gasoline exports might be impaired, Gasoil now may also see some curtailment from Russia. Whether or not it is as a direct consequence of Ukrainian drone activity, as seen in the attack on Tuapse refinery in the Black Sea on Monday, or another attempt by Russia to adhere to its OPEC+ quota depends on how cynical one feels. There is also a whispered possibility among wires that because of the current funk in flat price levels, OPEC might be thinking on abandoning the idea of reducing production cuts.

Yet for all this litany of friendliness, and apart from the crudes’ backwardations, it does feel that for every ladder available to take flat prices higher there awaits a snake to bring them back to down earth with a bump. None is more dampening than where China appears to be in terms of its oil need. Total crude imports fell 11% against the previous year and our conscious remain barraged with unravelling domestic markets that are compensated due to the trade surplus. However, the surplus is on the mouths of all the world’s leaders and China appears to be travelling headlong into what will be an increased tariff war which is awful news for any sort of demand. Even a tweaking of interest rates to the downside had the equivalent of a nano-second of benefit and investors are just not buying into the stimulus promises. With China’s issues in the foreground, the background suggests that Asian demand in general is flat at best, if some reports are to be believed. The grades of Dubai and Murban continue to struggle versus Brent and so much so that there are even reports of discounted Forties being sold into South Korea, competitive selling is sharp. For all the backwardation in the main futures markers, the Crude draws in the US and sporadic moments of Gasoline interest, they are not enough to equip a rally with anything like enough legs. There is no need in going on, the point of balanced influence does not need any more labouring.

Such counterweights to meaningful moves either way is being shown in volatility. The CBOE Crude Oil Volatility Index (OVIX) is printing at or around 26.00. In January of this year, it was 40.00, in April 36.00 and the current value being lower than that of the pandemic years. Ask a technician to show you a chart and witness graphs populated with narrow bands of weekly moving averages which again offers evidence of a market hunkering down. Accepting that spot markets do not need validation from flat price, and that backwardation/contango can be viewed in isolation, the inability of the flat prices across the complex to garner any sort of foothold is likely to be made even more cumbersome by the lunacy of politics that our world endures. We just do not see Brent above $90/barrel but hedge our bets of a floor at $75. Not very ambitious, but neither is the market at present.

Overnight Pricing

© 2024 PVM Oil Associates Ltd

25 Jul 2024