Markets Await the Last Banking Events of the Year

Oil prices ought to see more of a reaction to the Crude inventory draw seen in the API data overnight. The feedstock saw a decline of 4.7mb against an expectation of -1.6mb. In addition, the implementation yesterday of the new sanctions by the EU on Russian shipping and the UK targeting a particular company should again give more buoyancy. However, such is the diverting power of Central Bank rate decisions that investors in all of the trading mediums are taking a very light touch to proceedings.

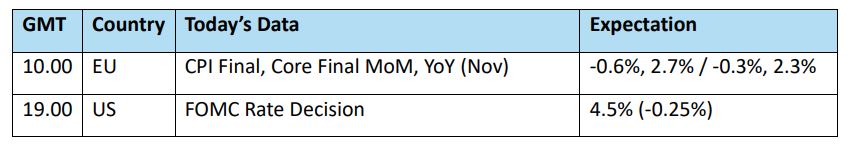

There is little doubt that agendas and forward thinking in the FED, the BoJ and PBoC must involve consideration to a new Donald Trump regime. The FED is unlikely to deviate from the expected 25-basis point cut that is about as 'priced-in' as any decision could be, the BoJ will be hamstrung tomorrow, and China's bankers are expected to cut LPR on Friday due to tariff concern. In anticipation, Chinese markets are a little better off this morning but most bourse and commodity moves need to concern themselves with the US Dollar, which is prowling around the 107.00 area for the Dollar Index due to possible hawkish language that may be deployed at the post-FOMC press conference.

How to not win friends but influence people

With apologies to Dale Carnegie. We often touch on the exceptionalism of the United States with regard to its economic performance in investor returns. However, what is quite the phenomenon is how an incoming President, albeit the post of the most powerful person in the world, wields extraordinary international influence before placing a hand on the Bible, taking the cavalcade to 1600 Pennsylvania Avenue and signing any law. Countries from China to Switzerland and trading blocs such as the European Union are adopting duck and cover tactics as they massage interest rates and economic outlooks in defence of a perceived trade war. President-elect Donald Trump cuts a swagger matched only by the fawning and fainting of other world leaders and their governments at the very prospect of his re-entry into the penthouse of politics.

Europe is not the only continent to experience political flux, nor is Donald Trump’s poll-busting electoral victory the only political intrigue in North America. North of the border the premiership of Justin Trudeau is under as much scrutiny as at any time since he took over as Prime Minister of Canada in 2015. Feted as a liberal darling, Mr Trudeau took ideas of environment consciousness, multiculturalism and the politics of consensus into the mainstream and had initial national support as he crafted better international relations and even championed a rewrite of the North American Free Trade Agreement (NAFTA), the trade pact between the United States, Mexico and Canada. Fast forward to the present day the Prime Minister’s popularity is all but drained with recent polls suggesting that up to 60% of Canadians believe he should leave office. His governments’ problems are manifest. Immigration is blamed for a population that has expanded at the fastest rate for decades leaving a housing crisis fuelling house price surges and subsequent increase in mortgage debt. Construction is muted, infrastructure is based around green policies, imports outweigh exports, GDP is 1.3% compared with its southerly neighbour’s 2.8% and national debt increases as each quarter of 2024 has seen accelerated government expenditure.

Frankly, it is something of political miracle that the Prime Minister has lasted so long. However, that might be about to change and the final push that will see him out of the door comes from the erstwhile TV celebrity that will soon again grace the West Wing. So far, and according to The Canadian Association of Petroleum Producers (CAPP) the year-to-date average of Canada’s oil production is 5.7mbpd. Where this becomes interesting and ties in with the political machinations of Canada is that, and according to the US EIA, the US imports 4.3mbpd of Canadian output. The US then is Canada’s largest customer and hydrocarbons accounts for well over 20% of all exports, and in general 80% of all trade. Therefore, the threat of 25% tariffs from the incoming Trump administration hangs like a Damoclean sword and if enacted will be nothing less than a catastrophe for the producers at Alberta Sands and elsewhere. The Donald has not specifically singled out Canada’s oil sector, he does not need to, the vulnerability is obvious. Frankly, the US needs its neighbour’s heavier crudes and any curb to imports from the north can only lead to higher domestic prices at the forecourt pump.

If the feint by the incoming President was deployed to get attention from Ottawa it has surely been successful. On Monday, Chrystia Freeland, the Finance Minister, delivered her own “Et tu, Brute” moment as she twisted the knife on Justin Trudeau in a resignation letter of maximum damage. Paraphrasing the words used, the letter warned against frivolous increased deficit spending when monies should be held back to counter any possible implementation of US tariffs. Turmoil has erupted in the country’s corridors of power, and none are betting against a no-confidence vote, such as those seen in France and Germany. Mr Trump has not even reinstalled the bust of Winston Churchill into the oval office, but it looks as if he has toppled the government of a neighbour just through the threat of tariffs and the power of oil.

Overnight Pricing

18 Dec 2024