Markets Stumble Over US PMI

Whether or not it is due to some members of the globe's wide investment suite downing tools for the Northern Hemisphere summer, a touch of divergence from central banks or a shifting geopolitical landscape in the Middle East, is rather difficult to say, but markets are suffering a small crisis of confidence. The uniformity and collective will of bankers of nation's wealth has endured for over a year and a half, therefore when the Bank of Japan hikes, the US FED holds and the Bank of England cuts rates, pricing strategies and correlations in currencies are having to be rethought. Although the differences in economic application are small at present, the very idea that the network of perceived cooperation in dealing with the world's money has itself, like much of politics, taken a nationalistic turn would be alarming for swathes of the investor fraternity.

Tech stocks and associative satellites have an air of arrogance about expectation in results. Therefore, when earnings, profits and outlooks are published and do not continue to be bright and shiny spectacular, investors sell in a something of huff. Apple performed well overnight with third-quarter iPhone sales better than expected but most other results were cautious. Amazon saw second-quarter sales slip, but chipmakers had something of mini wake-up call. Not only did Intel's results come in lower than expectation but the company will pay no dividend and reduce the workforce by 15%. The company is poorly positioned in AI, and there is no following-on funk to others that are AI-dependent, but it is a shot across the bows of tech investors, nonetheless.

Oil remains vulnerable to macro whimsy and geopolitical shifts. With OPEC's JMMC offering nothing, and a reduction in some cuts a reality, the market is now readying itself for increased OPEC oil. The Middle East is something of head fake. The killing of Ismail Haniyeh in Tehran, which was the catalyst for a $3/barrel rally in crude prices has lost nearly all of its influence. Oil participants are indeed immune to such events unless direct consequence to oil flows can be proved and with Israel neither denying nor confirming involvement, some of the tension abates. What brings all this end-of-week stutter together was the poor showing of the US ISM Manufacturing PMI. The measure came in at 46.8 against a 48.8 call being very much in contraction. With four-straight months of shrinking activity the decline is accelerating as new order PMI fell from 49.3 to 47.4 and production dropped to the lowest PMI reading since May 2020. Along with other poor global PMIs (discussed in part below), the traditional manufacturing base of the most important economy in the world is signaling weaker demand, giving every reason to be careful across all instruments.

The Olympics are the best thing about Europe for the moment

Such is the importance our market attaches to the current grey scape of China’s economy, that which occurs in Europe can be overlooked. Not that it acts as any warmth to the wet blanket being thrown from Southeast Asia, for one might even argue that the influence of the Eurozone and Europe as a whole is one of diminishing returns. Yet its part in the macroeconomic make up of how the clockwork of global financing ticks continues to play a major role, because the EU, using 2023 data from Eurostat, accounts for around 14% of the world’s trade in goods. The United States was the largest destination for EU exports of goods in 2023, while China was the largest origin for EU imports of goods. Revealing an early hand as to where this note is going; that is about as good as it gets.

The continent remains in a puzzle of small gains in one country’s economy, often than not countered by sobering data from another. This is showcased in the recent GDP growth rates. In France, the GDP growth for the second quarter of 2024 increased by 0.1% at the first estimate according to National Institute of Statistics and Economic Studies (INSEE). Paltry as it sounds, it is better than that flat offering from the quarter before. Referring back to the importance of exports, INSEE observes that foreign trade made a positive contribution to GDP growth with overall output increasing. Here comes the counter ‘but’. The German economy shrank in the second quarter. On a quarter-versus-quarter basis, GDP growth fell by 0.1% which is truly disappointing after the much better showing in the first quarter of 0.2% growth. The Federal Statistical Office (DESTATIS) also reports that there was a decline, “in particular, in gross fixed capital formation in machinery and equipment and in construction.” With German inflation in July running at 2.6% and decreasing growth, the economy is once again coming under the inauspicious idea that it is suffering from stagflation. Joining Germany in the repechage of negative quarterly GDPs are only Latvia, Hungary and Sweden and even though the growth in the rest is enough to give an overall EU and Euro Area a +0.3% growth reading, Germany’s flounder will obviously have an outsized influence because of its GDP making up 25% of the Union’s total.

Yesterday’s Hamburg Commercial Bank (HCOB)/S&P Global Manufacturing (July) Final PMIs were released for Germany, France and the EU. They make for reading through fingers of face covering hands. Germany published 43.2, France 44.0 and Eurozone 45.8. With such miserly data from industrial activity, it is little wonder then that GDP’s barely waddle above flat growth. Even though Germany saw stabler costs, manufacturing experienced a sharp downturn due to output being at a 5-month low as demand fell away and order books cleared. France has now endured seasonally adjusted Manufacturing PMIs of contraction for 18-months straight. Input prices inflate to the highest over the same period as production reduced and job losses increased. No surprise then that the two largest economies and what ails them are the reasons listed by HCOB for the poor showing in the Eurozone as a whole. Time then for another rate cut from the European Central Bank?

Disconcertment must be found within the ECB as ponders on how and when to cut interest rates. A surprising turn of events in which inflation saw an uptick will throw a spanner into the workings of quantitative easing of interest rates. Euro area annual inflation is expected to be 2.6% in July 2024, up from 2.5% in June according to a flash estimate from Eurostat, the statistical office of the European Union. Gritted teeth will also greet annual core inflation, which discounts energy, food, alcohol and tobacco, and how it remains stubbornly high at 2.9% whereas many an economic analyst called for a slight ease to 2.8%. The ability of the central bank to ease financial burden on an economy that refuses in the main to kick start, has just been made all the harder. Frustratingly it is the increase in the services industry that has seen the greatest upward influence in inflation (although slightly down this month), therefore the only part of the economy that might just be the spark to eventually lift very poor manufacturing is counterintuitively the barrier against the ECB bringing some relief. Pricing for a cut at the September 12 meeting is still relatively bullish at 65%, but with Bank of England following cutting rates yesterday, and the US Federal Reserve playing ‘wait and see’ until September, Europe’s bankers are not being aided in consensus. Any more negative data markers within the Eurozone, especially that of belligerent inflation, might just make an interest rate hold or cut an experience similar to a red or black gamble as one leaves the casino.

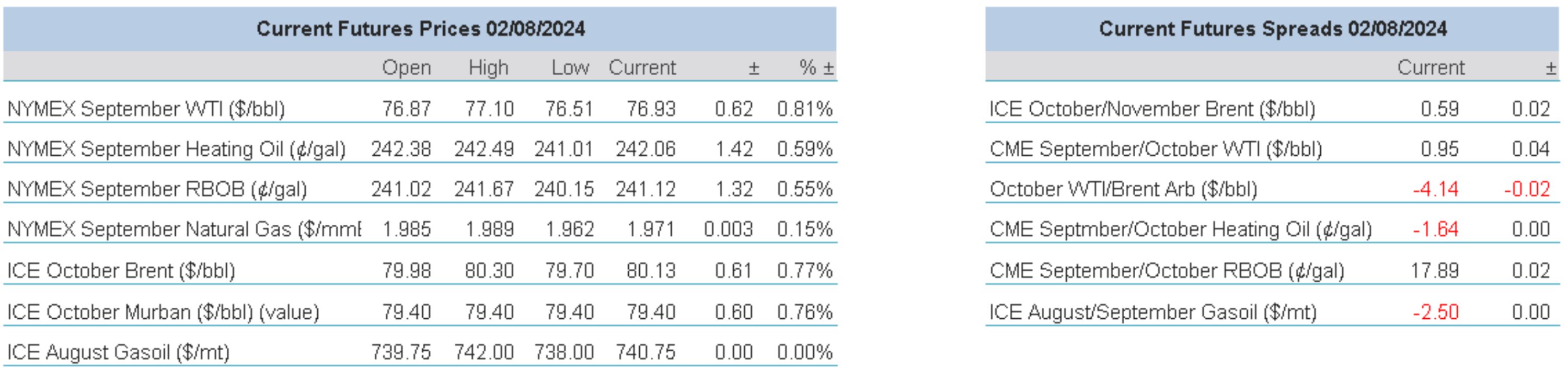

Overnight Pricing

© 2024 PVM Oil Associates Ltd

02 Aug 2024