Masses of Endeavour, Little Return

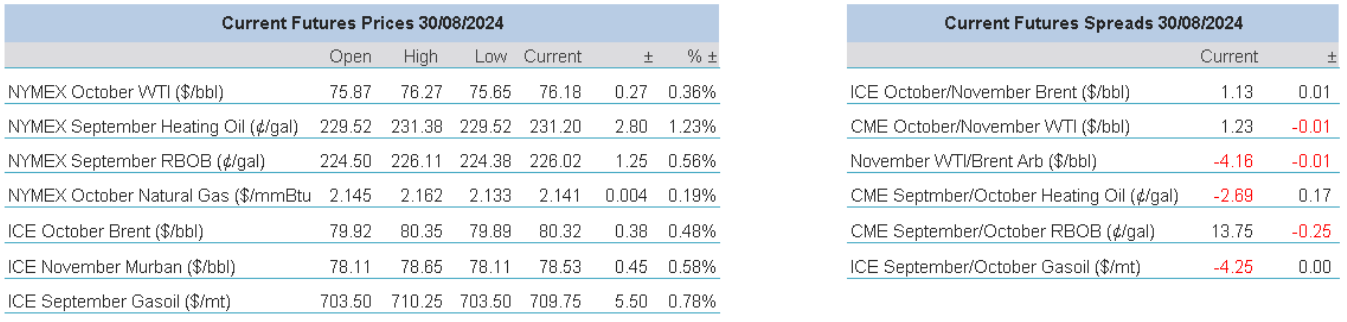

Oil prices have endured a topsy turvy week where M1 Brent futures on Monday rallied $2.56/barrel to $81.58, spent the next two days giving nearly all back by dropping to a low of $77.95 on Wednesday, and sits almost mid-range at $80.00 at time of press. It is a short-term technician's nightmare and trade bias sees bulls being bears, bears being bulls in something of positional fluidity. Do not look now, but right-wing observers will accuse Brent of being woke. Levity aside, the lack of commitment in price and the feeling that whoever is left on the field of trading battle is either all in or all out thus creating herd-like moves. We dwell on the problems faced by OPEC below, but the shopping list of influence makes for timid positioning in oil which is completely understandable.

There are three very bullish drivers in our market at the moment. The continued ugliness in the Middle East sourced by the Gaza conflict, US domestic inventory draw down and the loss of now reported 700kbpd from Libya due to political wranglings closing more oil fields. Yet the market smells short-termism in these problems. Despite the direst of warnings doled out by doomsayers concerning the Middle East, the market has seen barrels diverted, not taken off the market. The US is about to end the so-called 'driving season' and as turnarounds loom, Heating Oil cannot in anyway be seen to be taking up the baton of demand as it wallows towards pandemic prices. Finally, to trust Libyan influence, bullish or bearish, has never played out well in recent history. The market will find a workaround and is used to the on/off switch being thrown by the factions within the North African state. Frankly, it is also cash-strapped, and the lack of petrodollars hurts everyone, not just one of the protagonists, therefore, this game of chicken may not last very long.

Demand and price downgrades by agencies and Wall Street bankers haunt the wider investor populace and investment tourism is served better by being involved elsewhere. There is no point in wandering over the problems of demand from China, Europe and probably at some stage the United States. They have been more than covered. As the micro-drivers of oil counteract each other, our market becomes even more embroiled in what the macro suite is up to, but in most cases without the benefit. Take the shrinking US Dollar, it evokes no influence whatsoever. It also makes for an interesting appraisal of yesterday's rally. Was it all about Libya and Iraq’s pledge to counter cheating by cutting production in September, or was it just to do with the recovery of stock market bourses and near new highs in the DOW?

We have not suddenly turned super-bearish, just sceptical. We are not even brave enough to call the market much outside our current thinking of $75-$90 basis Brent until the fourth quarter. The downside will be protected by SPR filling from the US and it does not matter that China is in an economic flux, when it sees cheap oil, it will not be shy in utilising its magnificent storage capacity. One should never dismiss the geopolitics of our time. Just because nothing has caused wider conflict in the Middle East, does not mean the future can preclude another ramping up of hostilities. The Ukraine/Russian situation has numbed reaction, but some of the actions involved in the war of late seem desperate and might just lead to a serious targeting of energy infrastructure on either side. Daily sweeping ranges can be expected to carry on, pivoting in and out will become ordinary and all the while we are unlikely to make very much headway from our current $80 mooring point in Brent.

Damned if they do, damned if they don’t

OPEC+ face something of conundrum as the group approaches the time in which it must decide on whether it starts to sheath some of the voluntary cuts that have proved successful in tightening crude supplies around the world. It is obviously undeniable the strength of prices that saw Brent futures tick to 92.18 in April of this year was completely inspired by the Gaza situation, but the base of that strength came from an elevated starting point due to the cartel’s output reductions. As with any magnified market moves, when the ‘buy the rumour, sell the fact’ plays out, the ensuing selling challenges the reasons for bullish thinking. This was obviously the case after April and the choreographed missile exchange between Iran and Israel. Having now aped this scenario many times since, the concertina effect on prices has led to something of downward bias for each time war is feared, brinkmanship is invariably followed be a massive breakout of common sense and relief in price pressure. With each failure to capitalise on war premium, reasons to be negative garner more interest and so the cycle goes.

Commodity markets have been in some ways more susceptible to the prevarication of central banks as they wrestle on the whys and whens of interest rate relief. Cost of borrowing seems to be more of a prevalent worry to investment into tangible infrastructure such as storage. A double whammy comes from the diversion of commodity cargoes around the horn of Africa, because of the Houthi threat to a Suez transit, pushing up freight rates which are again more expensive to finance for traders due to current rates. Indeed, and from an oil perspective, one could be forgiven for thinking that the elongation of higher-than-expected rates in the US this year is a direct challenge to the consequence of OPEC’s desire to keep oil prices on simmer.

By most of the stretches of analysts’ imaginations, China will probably miss the bannered GDP growth level of 5% in 2024. The misery of the property sector might capture most of the headlines, but the manufacturing, industrial production and foreign investment levels are plain to see as evidence of an economy in decline. The reduction in crude imports and the shuttering of some refineries highlight the poor state of Chinese oil demand and growth which even found agreement in the recent OPEC and IEA monthly reports. The world’s biggest oil importer is an easy target for a negative take for oil demand, but it is not alone. The recent PMIs in Europe were nothing less than woeful and are not much better in the US. None can be unaware of the current anxiety in employment data in the US, it is after all the defining reason on why the FED will cut rates in September. The US is the home of oil demand at present, but with reduced employment in mind, the gasoline season coming to a close, and refinery turnarounds not in the too distant future being greeted by a Heating Oil market setting prices not seen since the pandemic, future demand is not exactly guaranteed.

The US does still suffer from tighter oil inventories. Wednesday’s US Inventory Report shows Crude 16 million barrels, Gasoline 4.5 million barrels and Distillate 11 million barrels below the 5-year average, giving a total commercial stock figure deficiency of nearly 10 million barrels below the same mean. Reuters have also recently opined that global inventories are 120 million barrels, or 4%, below the 10-year average. Hope then for OPEC. However, the trait of running lower stocks because of financing costs and the downward revision of both global demand from the IEA for 2025 and crude prices forecasts from the likes of Goldman Sachs and Morgan Stanely, offer argument against such hope.

The considerations that OPEC+ now face is similar to the daily strife endured by traders and price predictors alike. Yet, OPEC and partners must endure the political niceties of holding unity. The departure of Angola from the cartel is still fresh and African nation members remain in the belief that the continent suffers from quota abuse. The continuing cheating by Iraq and the obscure production data from Russia continue to frustrate members that are not only seeing a falling price but market share being gladly gobbled up the US, Brazil, Canada and Guyana. The market arguably lacks an institutional bid. One that might have in the past seen a follow through on geopolitical rallies. Open Interest remains healthy, but the style of positioning does not indicate involvement from funds other than short-term ones such as the ever-pivoting CTAs. The long-term long only money is much better served by equities. As observed elsewhere, one of OPEC’s biggest problems is NVIDIA and its cohorts, go figure. Will the cartel gamble and bring back barrels to the market hoping for absorption rather than a dramatic price drop? Or does it adhere to circumspection, delay the change in policy until better global demand data appears? The answer will be fascinating and for a time game changing. However, in the meantime, it will be another reason for participants outside of the oil circle to consider leaving well alone.

Overnight Pricing

30 Aug 2024