Middle East Premium is Just not Enough

The API data overnight included draws for all of the major components of the oil complex and comprised of Crude -2.7 million barrels, Gasoline -4.2 million barrels and Distillate -2.3 million barrels. Those that have been fearful of so-called ‘tank bottoming’ at the main storage hub at Oklahoma, will be relieved to see Cushing show a build of 0.5 million barrels which is line with the TankWatch call of +0.4 million. Clearly the APIs will need confirmation from the EIA/DOE data later, but the very muted reaction from oil prices indicates the state of sentiment within oil players as the market was served a quadruple whammy of overall poor PMI data, a concerted diplomatic effort that seems to be calming the Middle East, a technical breakdown as a whole for the complex and a rallying US Dollar.

Without going into intricate detail, the main futures contracts of WTI, Brent, Heating Oil, RBOB and Gasoil have all refunded at least 50% of their gains from the start of the Israel/Gaza horror with WTI, aided by the recent expiry, giving up nearly all of the conflict premium. As the concept of a spreading war frayed, it did not take long for macro-economic news to come along and pull at the cotton ends of this rally and unravel it. The resurgent US Dollar comes from a mixed reaction to the US PMI data which outperforms the rest of the world, but brings worries that continued strong economic signals might just compel the FED to reconsider any action it could possibly take as we dwell in the sensitive time in front of next week’s FOMC gathering.

There are little other fresh drivers this morning that are oil sensitive. China’s hierarchy are intent in grabbing a positive narrative and while President Xi pays an unprecedented visit to the PBoC, China announces a new sovereign bond worth 1-trillion CNY in a display of stimulus and just over the border Hong Kong announces a halving of stamp duty for home purchases. There has been criticism that China has failed to catch the mood of investors while seeming to procrastinate in a sea of commentary, therefore this ought to have markets a little more interested. For oil, maybe reticence comes from contemplation of China’s National Development and Reform Commission (NDRC) putting meat on the bone of proposals limiting China’s refiners to a 1-billion ton cap on crude refining capacity by 2025 (Reuters) with the obvious outcome being a subsequent limit on imports. However, pouring the most warnings of demand destruction came from PMIs as studied below.

GMT+1 | Country | Today’s data | Expectation |

09.00 | DE | Ifo Business Climate, Current Conditions, Expectations | 85.9, 88.5, 83.3 |

15.00 | CA | BoC Interest Rate Decision | 5% |

PMIs can no longer be ignored

Yesterday served up a timely reminder that all is not well in the land of manufacturing and even in some service sectors. The various October Purchasing Managers Index (PMI) data produced from most of the largest economies runs somewhat counter to the idea that oil will be free from bumps to the seasonal demand forecasted for this winter in the Northern Hemisphere.

Japan: Jibun Bank Manufacturing PMI flash remained at 48.5, the same as September and still represents contraction. The Services PMI flash registered at 51.1, distinctly lower than the September reading of 53.8, which dragged the Composite PMI flash into contraction at 49.9 from September’s expansion of 52.1. New orders, industrial production and overseas business declined. However, it is to the services PMI that most concern should be concentrated. Japan has enjoyed an increasing Consumer Confidence reading for much of 2023 but has retreated from a high in July of 37.1 to 35.2 in September, with reported optimism for the future reducing in corporations large and small.

France: HCOB Manufacturing PMI flash registered 42.6, not only lower than September’s reading of 44.2 but also of the forecasted 44.4. Services PMI at 46.1 outperformed September’s 44.4 and the forecasted 44.6 but remains firmly in contraction. The Services number dragged the Composite higher to beat September’s (44.1) and the forecasted 44.4. Fuel and wage pressures have driven costs up sharply, HCOB reports, its economist Norman Liebke went on to say that ‘[t]hings are going south in the manufacturing sector […] output fell by the greatest margin since May 2020’.

Germany: HCOB Manufacturing PMI flash registered 40.7 against September’s 39.6 and forecasted 40. However, Services PMI fell away with a 48.0 reading against a September one of 50.3 and forecasted 50. This dragged the Composite down to 45.8, lower than previous 46.4 and forecasted 46.7. The German economic malaise continues and judging by these data is unlikely to see much change into the year end. The labour market saw job losses in the service sector as well as manufacturing and overall demand decreased. Dr. Cyrus de la Rubia, of HCOB commented ‘PMI results mean the downturn is broad based’, after earlier stating, ‘we are calculating a 0.4% slip in GDP this quarter, after an estimated -0.8% slide in the previous.’

United Kingdom: S&P/CIPS Manufacturing PMI flash printed 45.2 versus previous 44.3 and forecasted 44.7. Services PMI was basically a push as was the resulting Composite. Although, there is a slight reversal in the fortunes of the Manufacturing PMI it is not enough to give any glimmer of expansion. Indeed, contraction is now into an 8-month streak with manufacturers reporting of completed contracts not being renewed, higher workforce costs and lower factory gate prices. Higher interest rates, lower property prices and poor exports have some commentators, while not calling for an outright one, believing the UK will at least flirt with recession.

Eurozone: HCOB Manufacturing PMI flash prints 43 versus previous 43.4 and forecasted 43.7. Services PMI 47.8 versus 48.7 previous and forecasted 48.7, with both dragging the Composite down to 46.5 versus previous 47.2 against the 47.4 forecast. The only good news is that inflation has eased slightly according to HCOB, despite the upward pressure from energy but the rest of the picture is a canvas of grey which is hardly surprising judging by the plight of the biggest economies, France and Germany. Contraction reigns and is seen in factories that are experiencing a downturn not seen since 2009, excluding the COVID period. HCOB reported a depletion in backlog orders and reduction in new ones, which has led to lower employment. Businesses and the populace are stretched by the ever-tightening ECB meaning Europe may actually already be in recession.

USA: As has been the case for many, many months Uncle Sam bucks the trend and comes to the rescue of economic indicators. S&P Manufacturing PMI flash 50 versus previous 49.8 and forecasted 49.5. Services PMI 50.9 versus previous 50.1 and forecasted 49.8 which means they combined to give a Composite 3-month high reading of 51 against a 50.2 call. Some inflationary pressures eased on businesses which in turn saw costs and prices being reduced, according to S&P. New orders at manufacturers increased for the first time in 6-months but backlog orders reduced. Within the Services PMI there was an increase in the job space, but new business fell again. While the small expansion in US PMIs is to be welcomed, it will prove somewhat of a headache for the FED when assessing if the economy has cooled enough.

Outside of conflict premium, the oil price is funded by supply control from the Saudi/Russia axis, seasonal distillate demand and reduced refiner capacity. The United States runs as an outlier (only just), but much of oil’s demand has relied on personal behaviour as represented by Services and Composite PMIs and not Manufacturing. The peoples of Asia and particularly Europe are suffering under low growth and high interest rates, one wonders (barring Middle East influence) how long triple-digit calls for crude oil will be justified if data such as these continue.

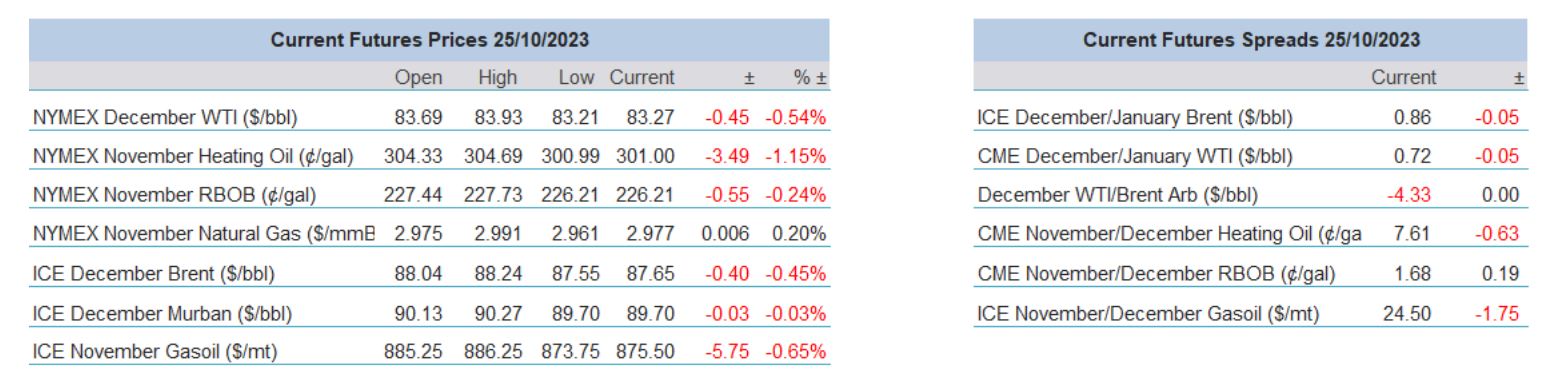

Overnight Pricing

25 Oct 2023