Middle East Price Reaction Remains Studied

Five or ten years ago, oil prices would have shown a very different and violent reaction to missile strikes and bombings in five countries. Needless to say, anything around Israel pulls on historical impassioned attitudes, but in oil terms, the involvement of the more influential Iran ought to bring favour for bulls. Take for example the September 2019 Houthi drone attack on the processing facilities of Aramco's Abqaiq and Khurais that over a weekend rallied the Brent M1 futures price by nigh on $10/barrel. Since then the world has wandered into the massively price altering Russian/Ukraine war and the sentiment altering Gaza conflict. Comparativeness, desensitising and cynicism has set in, but it is not only an emotional change that stops 'close your eyes and buy' reactions, it is how the world can now rely on alternative sources of crude supply. In 2019 the US production was at its highest reading 12.3mbpd, in yesterday's EIA Inventory Report it stood at 13.3mbpd, but there are other sources including Canada, Brazil and Guyana that are willing contributors to the world oil supply puzzle and one of the biggest cushions to shocks is the enormous spare capacity of OPEC which is well over 5mbpd. There are so many considerations to this web of war intrigue, including OPEC member cheating, which we will no doubt cover at a later date. But staying in the prism of Israel and Iran, will the US really allow Israel to blow up oil facilities in its antagonist's border during an election year? Will Iran really close the Strait of Hormuz which will not only cut off neighbours' exports, but its own, only noteworthy source of international income? The market is answering these questions with price. Preclusion of anything in the Middle East is a mistake, which is why the market remains at present defensively bid, however, even though the skew has pushed positive the buying of $80+ call options is no cascade, let alone $90 and beyond. Expansion of war and its damage will need to be proven before oil market participants will shake off the over-riding presence of scepticism.

The middle of the barrel nags on and on

One of the debilitating influences on oil prices that bulls will need much persuasion to overcome is that of distillate. The once marker of industrial prowess and power, its many forms including Heating Oil, Diesel and Jet Fuel are being served notice that they are not the foundation for the oil industry they once were. To ignore the warnings is price prediction suicide for the middle part of the barrel accounts for at least 30% of world refining processing with that figure very much higher depending on one’s geography.

As we pointed out in yesterday’s summation of oil progress in the third quarter of this year, Heating Oil and Gasoil lost 16% of value in a dire period for industrial markers. In fact, this is something of a continued pattern. When measured on a year-on-year basis 3Q23 v 3Q24, both the Heating Oil/WTI and Gasoil/Brent cracks have lost over 50% of their values with the high of the move to the low very much more. The lack of demand for distillate fuels bears a direct correlation to how manufacturing PMIs have registered across the globe in the last year. In the United States, and apart from March 2024 at 50.3, every monthly posting has been under 50 showing contraction. Europe has not even registered once over 50, with its usual industrial heartbeat of Germany descending to an extremely ugly and worrying 40.3 as recorded Tuesday by HBOC. In China, the National Bureau of Statistics (NBS) showed two readings in March and April this year just above 50, but all the other 10 months of the yearly comparison show contraction.

There have also been plenty of warnings concerning aviation. Consumer Confidence is a fickle hook to hang oil demand concerns on, but it gives an insight into how the world might spend money on travel. The US CB Consumer Confidence data remains subdued and missed its September target. In China it is at an all-time low and in Europe confidence registers in negative numbers. Jet Fuel demand has seen downgraded forecasts from banks and the IEA, and technology is playing a suppressing role. Analysts believe that efficiency gains alone have reduced jet fuel demand by around 10% versus the same level of activity before 2020. BloombergNEF’s Jet Fuel demand forecast for this year averages 6.58mbd, 7% higher year-on-year. However, the momentum is cooling, with growth rates well down from the 24% observed in 2023 and 39% in the same quarter of 2022. It sees Europe as the worst of global consumers for aviation fuel. Western and Eastern Europe are poised to cut 33kbd of jet fuel consumption each between October and December.

Diesel consumption is not spared scrutiny either. Last month the IEA said that Gasoil demand in OECD Europe is set to fall some 250kbpd this year with 70% of the decline attributable to road Diesel. Such is the problem that Bloomberg recently reported major oil refiners in Spain and Italy were cutting runs due to decreased ‘margin’. What will also prove a headache for European processors is the gearing up of Nigeria’s massive Dangote refinery, which after sating domestic product needs will likely point additional oils towards the old continent. Global refinery runs have reduced, but this has not tightened diesel demand. Energy Intelligence coins a fine phrase observing “an increasing number of analysts now see Diesel as a proxy for structural demand changes”. It follows up by estimating global Diesel demand will fall to 28.6mbpd in 2024, down from 28.8mbpd in 2023. Many media sources return to China as one of the leading problems for Diesel demand, not just in the poor performance of its economy, but because of over-capacity from refiners and the switch to alternative fuels for road transport.

Modern refineries are not the ‘one trick ponies’ they once were. Adaptable and adept, many will be able to adjust to the current issues befalling Distillate and its many constituents. But there is no doubt that this is a sobering period for oil processors. If the Northern Hemisphere enjoys a non-winter repetition of 2023/2024 and the industrial and manufacturing climate stays unchanged, the outlook for middle barrel products looks very tricky indeed. Market share is being eaten away by not only EVs and their like, but LNG also which is seeing massive growth in both use and investment. Until there is a marked change in global industry, or such sparsity of runs leads to distillate shortages, the warnings from Diesel, Heating Oil, Jet Fuel et al are currently hard to ignore.

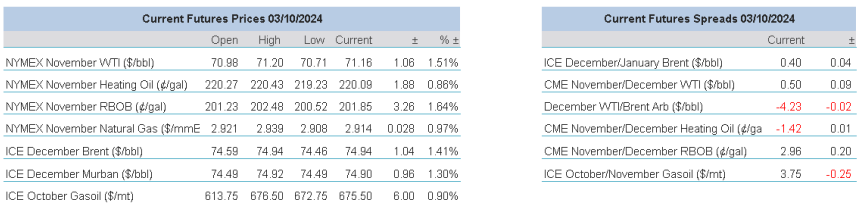

Overnight Pricing

03 Oct 2024