Middle East is Thrown into Turmoil

As laid out below, serious doubts might have emerged last week about the sustainability of the uptrend in oil, the weekend developments, however, swept aside such concerns – whether temporarily, remains to be seen. In what has turned out to be the deadliest attack for the last 50 years, the Palestinian organization, Hamas, launched an unprecedented attack on Israel in the early hours of Saturday. The Israeli response was swift and equally devastating. The combined death toll has reached 1,100 by this morning and is rising, whilst Israel’s Prime Minister, Benjamin Netanyahu has warned of a long and painful conflict.

Any rise in tension in the Middle East usually leads to an increase in oil prices and it is no different this time around. Whilst the underlying supply-demand balance is unaffected for the time being focus is now firmly on Iran, the main supporter of the Palestinian militant group. Any retaliatory measures on the country’s infrastructure and the potential threat to close off the Strait of Hormuz, which 17 mbpd of oil passes through daily, will send prices spiraling out of control. Brent is $3/bbl higher at the time of writing, some $1.5/bbl under the early morning peak and albeit no supply disruption is currently foreseen the war between Hamas ad Israel has put a floor under oil prices.

Flexing of the Financial Muscle

It is curious to observe that the latest uptrend, which took the price of Brent from $71.39/bbl to $97.69/bbl started almost on the first day of the third quarter of the year and finished close to the last one. And the stampede toward the exit, therefore, got under way as the fourth quarter kicked off. As if commodity funds, CTAs and money managers, collectively referred to as financial investors, are now exclusively in charge for the flat price movement, as last week’s perfect bearish storm, which left almost immeasurable devastation in its track and severely obliterated confidence signaled. The 3Q strength was understandable and almost harmonious. Expectations of a tight 2H 2023 pushed futures prices to multi-month highs, the structure of the market, in general, was characterized by deep backwardation and refining margins were on the ascent. The physical and derivatives market were singing from the same hymn sheet. Last week’s carnage, on the other hand, was greeted with a less than convincing weakness in structure. WTI and Brent both show a healthy backwardation, although admittedly narrower than just two weeks ago, physical Brent is still priced at $2/bbl over the forward contract and the CFD market is also gobsmackingly strong. We find it challenging to recall past occasions when the impact of the financialization of derivatives markets had been so brutally on display.

The bleak weekly performance was the product of financial gloom ie. worsening demand expectations and improving supply back drop – despite Suadi Arabia and Russia both agreeing to keep the voluntary constraints in place until the end of the year. To begin with economic developments, movements in the bond markets insinuate that high interest rates could ultimately affect economic performance and pressure oil demand growth. The 10-year Treasury yield rallied to 4.9%, the highest since 2007, after unexpectedly high September nonfarm payroll figures suggested towering borrowing costs for 2024. Life will remain expensive, but the outlook can actually turn even grimmer as it is now. Just think of the SVB collapse earlier this year. Rising yields and falling bond prices could entice depositors to withdraw cash from lenders who, because of the recent turmoil in the bond market, are sitting on exorbitant paper losses. Potential inability to finance their margins could lead to a liquidity crisis with disturbing repercussions. The movement of bond yields will have a profound impact on other risk assets in the coming months. This increased anxiety also pushed equities south and triggered a flight into dollar until late Friday – the antithesis of a bull market.

Last week’s EIA stock data contributed to the demand woes caused by economic concerns. US gasoline demand is falling off the cliff. (In last Thursday’s note I misreported the weekly implied demand data, it is more dire than suggested, apologies for the oversight.) The latest Weekly Petroleum Status Report puts weekly proxy gasoline demand at 8 mbpd, down from 9.3 mbpd at the beginning of September. Of course, this dismal reading added, appropriately saying, more fuel to the demand fire. Whether it is just a brief hiatus as the driving season is now over or the result of refinery maintenance is ambivalent at this point. No doubt, implied gasoline demand will be closely watched in the next few weeks. It is noteworthy that in its latest monthly report, which will be updated tomorrow, the EIA envisages a 4Q 2023 gasoline consumption of 8.75 mbpd.

On the supply side the Saudi/Russian decision to stick with the unilateral production/export cuts does not come as a surprise and last week’s price fall will probably do nothing to hasten these producers to change course. There have, however, been improvements elsewhere. Firstly, September OPEC output, a Reuters survey showed, grew for the second successive month. The major gainers were Iran and Nigeria. Secondly, if the latest report proves accurate, the Iraq-Turkey pipeline that has been shut for six months due to an arbitration ruling by the International Chamber of Commerce is about to resume operation, the Turkish Energy Minister said on Thursday. When re-opened it could add 450,000 bpd of oil to the international market. Lastly, Russia lifted its export ban on pipeline diesel exports via ports just two weeks after introducing the moratorium in its effort to prioritize domestic supply. Whether it is an indication of impulsive and chaotic decision making, a deliberate attempt to keep sowing the seeds of confusion in the oil market or the result of the weakening of the rouble is not and will never be clear. It, however, played a significant role in pushing the price of the CME Heating Oil contract down 12% on the week whilst ICE Gasoil lost 13% of its value, much more than the weekly plunge of 8% in Brent.

Corrections are the inevitable part of any trending market, last week’s fall, nonetheless, was brutal. If it lasts or reverses depends on a few factors. A sluggish bond market and a continuously resilient dollar will not help. Russian product export figures will also be in focus but remember, Europe is structurally short of distillates ahead of the winter. It will be intriguing to see whether global oil demand forecasts (and US gasoline consumptions estimates) will be amended when the next set of monthly data is released this week. There is an axiomatically good chance that the predicted 4Q supply deficit will narrow and the call on OPEC will retreat. Stock draws, nevertheless, should still be anticipated. It might mean that financial managers will have found last week’s bloodletting an irresistible dip to buy into – especially with the re-surfacing conflict in the Middle East. If true, would the $100/bbl mark be in danger of being broken above? We brazenly recall our view from a few months ago of Brent topping out around $95/bbl. At the same time, we ashamedly admit that we got the timing disturbingly wrong - the peak was expected to be reached in 1Q 2024. Yet, last week’s price action was the firmest of warning signals that economic headwinds are likely to dent the sentiment of financial players, whenever oil approaches the $100/bbl milestone – unless geopolitics overwrites this view.

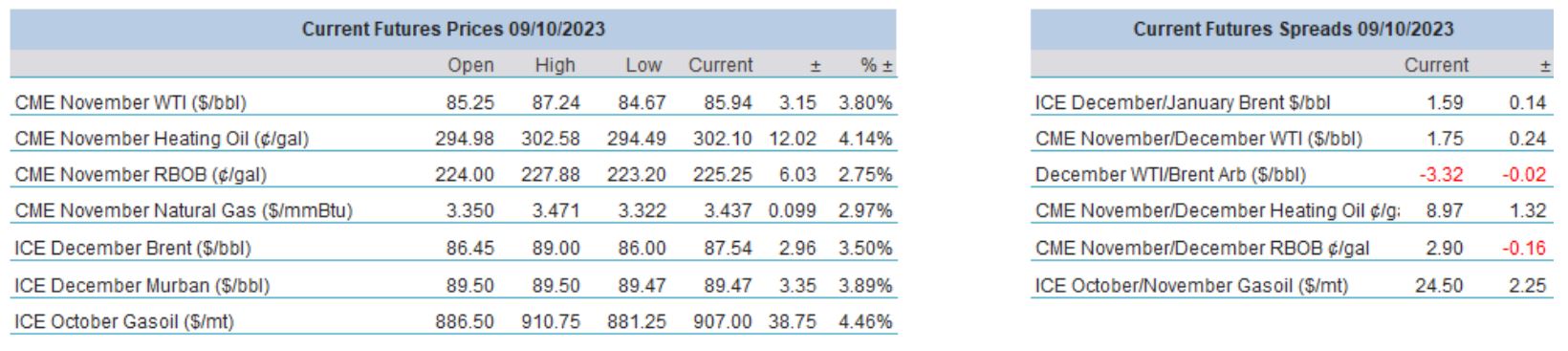

Overnight Pricing

09 Oct 2023