Mixed Messages and Drivers Will Give Over to Rumination

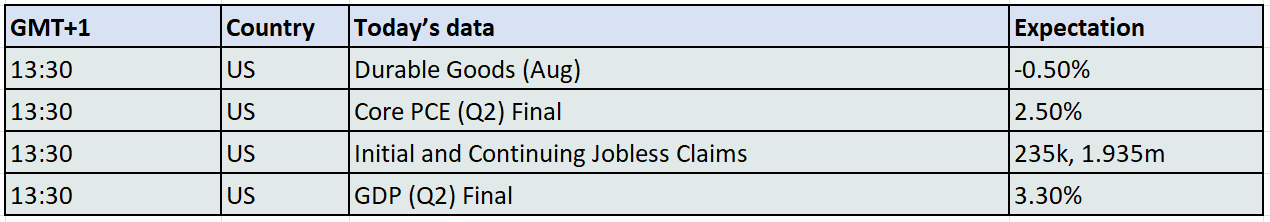

The macro world will once again turn US-centric for the next couple of days as a very important docket drags eyes back to how the Federal Reserve might react in its interest rate decisions. With Jerome Powell’s robotic stressing of the importance of inflation and employment earlier this week, today’s quarterly PCE readings, Jobless Claims and tomorrow’s PCE monthly data will keep the greater markets in thrall. Personal Consumption Expenditure has for some time been the favoured price rise measure for the FED and Jobless Claims give a ‘live’ feel to employment rather than having to wait for when ADP, JOLTs and Non-Farm Payrolls compete for attention at the beginning of every month. As it stands, some of the buzz around future interest rates is reducing to a hum as consecutive cuts are pricing more conservatively with 100-basis points seen rather than 125-basis points. Some of the pep in bourses might just start to disappear as the end of month/end of quarter approaches with plenty of warnings on ‘rebalancing’ where risk is moved between financial tools and indeed, even countries.

If rebalancing does occur, one wonders whether the small renaissance in oil prices might just be a little more attractive for investment tourists, or even the big guns of institutional funds. Despite the warnings of glut from almost every quarter, and news of more supply coming from the likes of an Iraq deal with its Independent Kurdistan Region to once again allow KRG oil to flow into Turkey, oil prices appear to be offering something of a bottoming action. It is not justifiable in calling crude to $75/barrel at present, but with EIA inventory report showing another dip in crude stocks, continued buying in Asia amounting to 27.18mbpd in August, according to LSEG Oil Research, and a possible change of heart from the US in the Ukraine war (debated below), there is upside risk. Oscillation with grind is the most probable outcome, but the path to lower prices is not as easily discernible as the avid ‘glut’ bears would have all believe.

The President is for turning, well, maybe

One wonders whether the new outlook on the Ukraine war expressed by Donald Trump after a sidebar meeting with Volodymr Zelensky is indeed a seminal moment in the conflict. After all, scrolling back only a couple of months, history will find the mercurial President floating the notion on how Ukraine might just have to cede a chunk of its Eastern land to gain peace. However, Monday, he threw another political hand grenade into a very much globally stirred pot by posting on Truth Social, "with time, patience, and the financial support of Europe and, in particular, NATO, the original Borders from where this War started, is very much an option." It is difficult to ascertain what has prompted such a change of rhetoric. It also must be taken in the context of Trump’s address to the United Nations on its eightieth birthday, where he rolled out a telling off to almost every country in attendance as would a headmaster of a school of old. Never bashful in courting controversy, the Donald seemed visibly pleased to be sparring with the English language as he vented judgement on all and sundry. He lambasted the UN on being ineffectual, Europe on losing its identity to immigration, the countries that have recently recognised Palestine as terrorism rewarders and all that pursue alternative energies as throwing away their wealth to ideology.

If one sees truth in any of his verbosity, context remains key, because this follows up on his previous day’s warning that paracetamol/acetaminophen, the most widely used global pain killer, causes autism in babies of mothers who have sought its relief. Given the rounding on him by global medical institutions as talking abject nonsense and being the man who thought injecting disinfectant would cure Coronavirus, his latest invective is all about pleasing his homebase support rather than being of sound statesmanship.

Yet, Trump critics cannot have it both ways. Will his newfound verbal support of Kyiv soon see a US aircraft carrier parked in the Baltic Sea and a ‘no-fly zone’ declared over Ukraine? Absolutely not. It would be an abhorrence to President Trump given his supposed anti-war agenda for US and Russian jets to eye each other down the barrel of gunsights, and any sane-minded member of this planet would shy away from such a prospect too. But outside of war-triggering confrontation, if the US Administration is about to roll out all the measures it has bandied around to isolate Russia and cut off its main source of income, it should be roundly welcomed. The Kremlin’s game of chicken being played out over the skies of NATO countries, including Poland and Estonia, are hailed as a discovery of weak points and resolve. Yet the aggressiveness might just be a wounded gambit. We now read daily of Ukrainian drone success on the refineries of Russia and even crude loading sites such as those in Primorsk last week.

There is a fuel crisis going on in the vast lands of Mother Russia, so much so that according to an assortment of news agencies the current gasoline export ban might be extended along with possible curbs along the same lines for diesel. Russia will now have to rely on income from crude exports and with an ‘all eggs in one basket’ scenario, it makes its petro-income even more vulnerable. Its reliance on Chinese and Indian custom is now much more easily targeted with secondary sanctions, and whatever barrels are getting through, the income from them is made low by the current state of crude prices and the discount Russia needs grant for loyalty. It is almost a revelation on how openly home voices are talking on the state of the economy. High inflation, high interest rates, recession have all made their way to international press from Russian quarters, and there are just too many fires for the Kremlin to fight let alone squash what would normally be considered seditious writings.

Are the stars aligned for decisive US action on Russia, something which NATO and Europe can fall in behind? Possibly. China, while never averse to cocking a snoot toward Washington, finds itself in sensitive times in trade negotiations. It is also swimming in cheap crude oil which it has been slopping into its SPR. India, diplomatically wounded by the US meting out of extra sanctions, might be easily appeased with a promise of easy access to American crude. We are also at the seasonal juncture where taking Russian barrels away from the market will have a reduced effect than if closer to either winter or summer demand. So, should we expect yesterday’s Ukraine appeasing warbling of Trump to manifest into activity? The differential between words and action are akin to vast contango. The President sets time limits that are never realised and maybe this public change of heart is just indeed for the MAGA folk. However, it cannot be ignored, as is the case always when the most powerful man in the world exercises his jaw and emits statements of possible intent. Whether or not, the intent becomes fact is the reason oil prices have just been given the best support they have enjoyed for many, many months.

Overnight Pricing

25 Sep 2025