Momentary Equilibrium

Everything is discounted in prices. This mantra suggests our market is balanced. After all, trading ranges were narrow yesterday and settlements were broadly unchanged. There was no game-changing development in China, its outlook remains grim. The Shanghai Composite Index is unchanged despite the latest boost of funds for housing projects. Relative calmness was palpable in and around Israel, but this must not mislead anyone. The word ‘relative’ has gained an entirely new meaning over the past year. The country’s forthcoming retaliatory measures against Iran are still not clear. In the meantime, the offensive against Lebanon continues although on a slightly brighter note, aid lorries started to enter Gaza. According to Qatar, there have been no attempts for peace talks from either of the warring parties in the last 4 weeks.

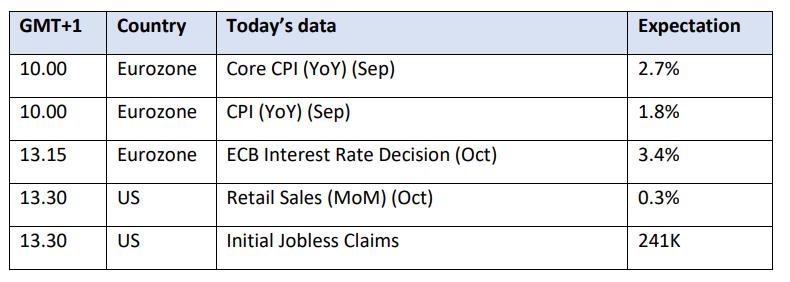

One can be certain, however, that this tranquillity will prove a temporary phenomenon. After yesterday’s settlement, prices got a nudge from the API, which showed drawdowns across the board. The Near East will certainly provide enough reason to move oil prices again soon enough and investors today will also be preoccupied with an abundance of financial data. The ECB is widely expected to cut borrowing costs as inflation keeps moderating. Headline and core inflation are forecast to have risen by 1.8% and 2.7% respectively last month in the common currency area. US initial jobless claims are predicted to have increased by 241,000 last week. Many moving parts shape investor’s thinking and yesterday’s inertia will undoubtedly prove the exception, not the norm.

The Dollar Never Really Goes Away

There is such a furore going on in our midst concerning all that is Israel and Iran that the plight of the US Dollar of late does not get much of mention. In times of great strife, the immediacy of a market’s gaze will be parochial and so it has been for oil and equities that are further diverging. But the fortunes of King Dollar should never be ‘put in the corner’, to appropriate the ‘Dirty Dancing’ line. As the notions of further 50-basis point cuts from the Federal Reserve disappear into the ether, the greenback has gone about a stealthy programme of rallying against all its peers and any further altitude will find it bombing on the hopes of risk assets and commodities alike. In anticipation and aftermath of the September US FED decision to cut interest rates by 0.5%, the US Dollar Index (DXY) took a tumble below the 100 mark which represents a 14-month low. Since then, and after much rethinking by markets on further double-decker rate cuts, the index has hauled itself back into weighty relevance at 103.42.

Other hurdles to a revamped Dollar have been removed, well, at least temporarily. There has been an apparent policy shift by the new Prime Minister of Japan, Shigeru Ishiba, who was expected to be something of a hawk on his swearing-in but has articulated on more than one occasion that it is not an environment in which higher interest rates should be implemented by the Bank of Japan. There can be little doubt that some of this unforeseen dovishness is in tribute to the snap election called for October 27, nevertheless, a BoJ rate hike is not an immediate threat to the USD from a resulting push by the Yen. With the European economy in dire straits and the ECB likely to cut rates by 25-basis points in both October and December, keeping pace with probable FED cuts, the Euro will not trouble the path of world’s money marker.

It is not just the rejigging of interest rate expectations that have brought about a sea change in the currency’s fortunes, it is also how Donald Trump is experiencing something of a rekindling in his campaign to capture the White House. The Kamala Harris bump is over and while appeasement and ‘I am better than the alternative’ can get you so far, her interviews and public performances have left many voters distinctly underwhelmed. Believing polling, particularly in America, is a sure-fired way of getting egg on one’s face. However, numbers in some quarters have Trump improving from evens to 55% probability of victory. His nationalist popular shouting of policies such as higher tariffs, lower taxes and lower immigration are also proving popular with Dollar bulls, for the price to be paid for such promises will be higher inflation and a more hawkish-leaning Federal Reserve. The ex-President is quiet this time around on manipulated weaker foreign currencies, any proposed devaluing of the Dollar would add even more upward pressure on inflation, something his administration could ill afford given the criticism he has doled out on the Biden one for a protracted battle to bring price rises under control.

As far as tariffs are concerned, the Donald doubled down at an appearance before the Economic Club of Chicago. Transcripts across various media have him in full preen. “To me," Trump said, “the most beautiful word in the dictionary is tariff. It's my favourite word. It needs a public relations firm.” Such unrepentant language will send a shiver through advocates of free trade but waves of warm convenience for Dollar bulls. It is only three weeks from the US election, markets and pricing are starting to line up for eventualities. As much as we see defensive length occurring in our market when the knives sharpen between Israel and Iran, pre-emptive Trump-hedge Dollar length just seems sensible in risk profiles. The current value of the Dollar and its resurgent representative index are not currently at levels that interfere with commodity risk, yet. But a victorious Donald Trump will not only deploy demand busting tariffs and other such egoism, but it will also add a once again flying US Dollar to the list of oil length concerns.

Overnight Pricing

17 Oct 2024