Money is a Coward

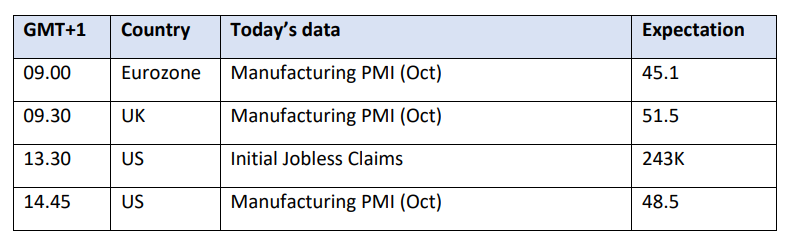

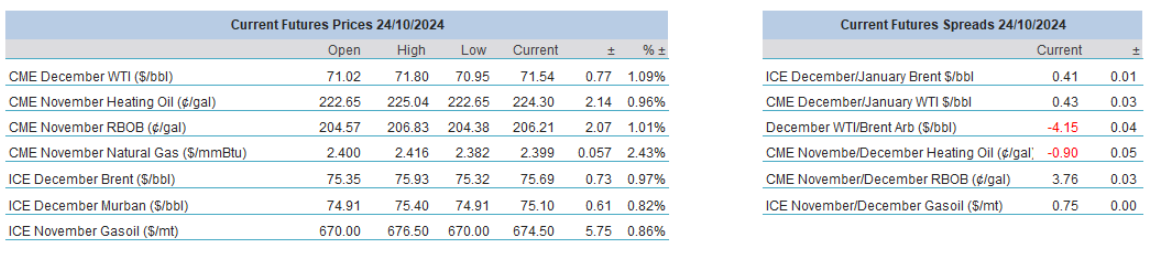

Oil moved lower yesterday in tandem with bond prices and equities as the dollar kept advancing and gold scaled yet another historic peak before retreating. The price action had the hallmark of growing macroeconomic concerns as risk was disposed of and sanctuary was sought. It might have been a reaction to the rising odds of Trump winning the US elections in less than two weeks and if it was, the move must be the harbinger of things to come should the former President collect most of the electoral college votes. Estimates of still-shrinking manufacturing sectors in the eurozone and the US possibly contributed to yesterday’s pessimism. Uncertainty remains the key word here and as the Wall Street mantra goes, money is a coward; it does not go to places where there is fear and unpredictability.

Fingers can also be pointed to the weekly EIA statistics. It recorded an unexpectedly large build in crude oil stocks due to elevated imports. Gasoline inventories went against projections and rose slightly as refiners ramped up runs whilst distillate stockpiles drew less than hoped. Commercial stocks edged higher, and the net impact of the report was less heartening than the API findings from the day before.

Geopolitical/geoeconomic risks were relegated to the back of inventors’ minds but it would be unwise to ignore Near East developments. The latest US attempt to halt atrocities between Israel, Hamas and Hezbollah has proven futile, for now. Israeli strikes on Lebanon continue ceaselessly and with the systematic obliteration of the military leaders of the Jewish state’s adversaries, Iran’s more direct involvement, or an Israeli retaliatory operation on the Persian Gulf OPEC member, with all its consequences on oil supply and transport, simply cannot be ruled out. No wonder then that oil prices are recovering this morning. Equally troubling are reports of the presence of North Korean troops in Russia for possible deployment in Ukraine. If accurate, it would add a new and unpredictably perilous dimension to the conflict in the eastern part of Europe. The opposing forces of economic anxiety, loose oil balance and potential war-related supply disruptions will ensure that no clear oil price direction emerges in the immediate future whilst the risk remains skewed to the downside in the medium-term.

Damocles Economic Sword

There is no denying that the worldwide inflationary pressure precipitated by supply chain bottlenecks after the 2020 health crisis and exacerbated by Russia’s invasion of Ukraine has been greatly mitigated. Soft landing, particularly in the main economic hubs in the world, is likely to be achieved as central banks started to lower the cost of borrowing in line with the diminishing growth in consumer prices. The performances of stock markets are a testament to the recession being avoided. The MSCI Global Equity Index has more than doubled in value since the pandemic-induced sell-off and is 60% higher than the 2022 low.

The economic recovery, in addition to central banks' monetary policies, was also aided by government spending. In the immediate aftermath of the Covid-19 pandemic the UK government, according to estimates, spent more than £400 billion or in excess of £6,000 per head. In the US, the federal government authorized $5 trillion in pandemic response spending. It included the unprecedented $2.3 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act. The International Labour Organization calculates that the combined EU economic response to Covid-19 amounted to €3.7 trillion. Other nations, including developing countries, were also forced to open the spending spigots.

Government debts, however, continued to climb after the coronavirus was defeated. Global public debt reached $97 trillion in 2023, up from $73 trillion in 2019. Most of it was accumulated in developed countries ($68 trillion). Asia and Oceania were responsible for $22 trillion, Latin America for $5 trillion and Africa for $2 trillion. According to the IMF, the $100 trillion threshold will be breached by the end of 2024.

Public debt is the backbone of development and should lay down the foundation of economic prosperity. An exorbitant rise in government spending, however, can achieve the exact opposite effect and can be a heavy burden on societal and economic well-being. The IMF, in its updated Fiscal Monitor this month, issued an ominous admonishment to stabilize government borrowing worldwide.

The headline is not sugar-coated and reads as follows: Global Public Debt is probably Worse Than it Looks. The $100 trillion milestone equates to 93% of the value of global goods and services, which should approach the 100% mark by the end of the decade, 10% higher than in 2019. Countries where debt was forecast to keep increasing include Brazil, France, Italy, South Africa and the UK. In total, countries with possible and continuous increases in public debt account for more than half of global debt and they represent more than 60% of the world’s economy.

As the IMF’s managing director, Kristalina Georgieva, noted rising public debt entails a growing share of government revenues being spent on interest payments and not on public investments. She pointed to the substantial budget deficits economic juggernauts are running. In its Fiscal Monitor issued in April, the IMF said that the US fiscal deficit would reach 7.1% of the GDP by next year, and in case of a Republican win in next month’s election, announced economic measures might increase the gap. China and India’s fiscal deficits are expected to exceed that of the US and grow to 7.6% of the GDP by next year.

The reluctance of governments to cut spending and raise taxes in order to reduce public debt will lead to ‘unforgiving’ economic climate with sluggish growth prospects. In an inauspicious economic environment, lenders will demand more return for the increased risk. Higher rates will have an adverse impact on private investment and hinder growth.

The IMF warns that countries must start dealing with widening fiscal deficits now. With central banks cutting rates in the US, Europe and the UK, it is the right time to build up a financial buffer by raising taxes and remove tax incentives. Failure to do so will lead to severe repercussions felt across the globe and in every constituent of the global economy, including oil. Central banks have done a brilliant job to overcome inflationary pressure and set the world’s economy on a rising trajectory. Elevated levels of public debt could counter this conducive achievement and those warning of worldwide recession might ultimately prove correct.

Overnight Pricing

24 Oct 2024