No Appetite to Rall

In today’s inter-connected trading world, where financial data is closely watched and scrutinized it is tempting to stay on the sidelines because there is an important release in a few days’ time, which might or might not shed further light on how the global economy might or might not perform. This time around it is the ECB interest rate decision, and perhaps more importantly the post-meeting press conference that might or might not clarify the timing of the forthcoming rate cuts. It is, however, the lazy approach to explain yesterday’s lukewarm performance after Monday’s semi-decent rally.

The fact of the matter is that there are prosaic reasons why outright prices keep failing to make meaningful advances despite a plausibly supportive fundamental backdrop that is embodied in perpetually rising risk in the Middle East and weather-related output problems in the US. These include unhindered supply from the Persian Gulf (albeit longer voyage time and rising insurance makes oil somewhat more expensive), the return of 300,000 bpd of output from Libya’s Sharara oil field and expectations that the cold spell will end shortly. No support is forthcoming from the API. The huge drop recorded in crude oil inventories was countered by an even bigger build in gasoline stocks with distillates broadly unchanged. No doubt, uncertainty surrounding the Red Sea and the Middle East is a factor to consider but it prevents oil from violating last month’s bottoms rather than providing ammunition to trigger-shy bulls. Unless regional supply is materially affected in the region, the market will remain content with the $72-$82 range basis Brent.

No Impending Supply War but…

OPEC and its de facto leader, Saudi Arabia, cannot be accused of complacency. By constraining output levels and setting production ceilings for member countries they intend to tighten the oil balance and support oil prices. It is worth remembering that the Saudi budget price, for example, is around $85/bbl. The OPEC basket price averaged exactly 79/bbl last month and is around the same level in January. The Kingdom cut its February official selling prices to every major region of the world and at current outright price levels the price it charges for its different grades are unequivocally below the perceived price where it can balance its budget. It needs higher prices.

The tapering of oil supply started in the second half of 2022 and including voluntary cuts the organization, together with its non-OPEC peers, have collectively curbed output by more than 5 mbpd – on paper. The latest IEA report published last week finds that OPEC+ crude oil supply fell from 43.5 mbpd in 4Q 2022 to 41.9 mbpd a year later. When NGLs & Condensate and Non-conventionals are included total OPEC+ supply thinned by 1.4 mbpd, it dropped from 51.6 mbpd to 50.2 mbpd. OPEC itself produced around 1.1 mbpd less in 4Q 2023 than during the comparable quarter of 2022. During this period global supply climbed from 101.3 mbpd to 102.5 mbpd and prices refused to rally.

These developments had an inevitably adverse impact on the group’s financial performance. Although the average OPEC basket price only cheapened by $2/bbl or 2.5% between the last quarters of 2022 and 2023 with reduced output the loss of income is close to painful. OPEC’s daily revenue averaged nearly 10% lower in 4Q 2023 than the prior year.

The lack of enthusiasm to punch significantly higher is the result of non-OPEC+ producer happily filling the void left by OPEC and its allies. Or better say, danger is actually lurking from three directions: from non-OPEC+ producers, from OPEC’s peers, chiefly from Russia and from within group, particularly from member countries with no quota obligations.

To begin with, the non-OPEC+ group (countries outside of the cartel and signed up allies) supplied 49.94 mbpd in 4Q 2022 and 52.35 mbpd in 4Q 2024. (For the sake of consistency Angola’s oil production is now included in the non-OPEC+ group.) Since global production increased by 1.27 mbpd from 101.25 mbpd to 102.52 mbpd the group’s share of the total market grew from 49% to 51%. It is also curious to note that within the non-OPEC+ category US production increased from 12.30 mbpd to 13.22 mbpd despite prioritizing capital discipline and shareholders’ return. All the while, Saudi output dropped from 10.60 mbpd to 8.97 mbpd. In layman’s term, there was a transfer of wealth between these two producing nations.

Within the OPEC+ group tension is also simmering under the surface, especially between the two bellwethers, Saudi Arabia, and Russia. Although both producers voluntarily pledged to implement cuts in production/exports on top of the collective deal there is a clear competition between the two for market share and it appears that currently Russia has the upper hand in its desperate attempt to circumvent international sanctions and increase oil revenues to finance its war against Ukraine. Russia has become the biggest crude oil supplier of China in 2023 by sending nearly 300,000 bpd of oil there last year compared to 236,000 bpd by Saudi Arabia, Reuters calculation shows. Russia was also the top supplier of India last year and any promise to support the market must be taken with a healthy dose of skepticism.

It is also noteworthy that the Saudi share of oil production within OPEC has suffered a significant blow lately, almost exclusively because the Kingdom bears the brunt of supply cuts. Its size of the total OPEC pie shrank from 39% at the end of last year to 33% a year later. At the same time Iran increased its portion of the whole from 9% to 12%, Libya from 2.5% to 4.5% and Nigeria from 3.7% to 5.3%. Angola’s decision by the end of last year to leave OPEC served another setback to Saudi Arabia and to the entire organization as the group’s unity has been questioned and internal discontent laid bare.

It would be unfair to conclude that the OPEC+ and the Saudi intention to balance the market utterly backfired; without it prices would probably be lower. On the other hand, it also must be acknowledged that the OPEC+/OPEC/Saudi cuts provided an unmissable opportunity for non-OPEC+ and member countries to maximize oil revenues. It is dubious if the Saudi patience will persist in the long run. Whilst a full-on supply war would cause severe collective damage to OPEC+ and non-OPEC+ producers, further unilateral tightening is implausible and lax quota compliance might well be the theme later this year. This, together with a reassuringly comfortable supply cushion, is another reason not to expect a sustained oil price rally to or above $100/bbl in 2024 barring any unexpected supply disruption in the Middle East.

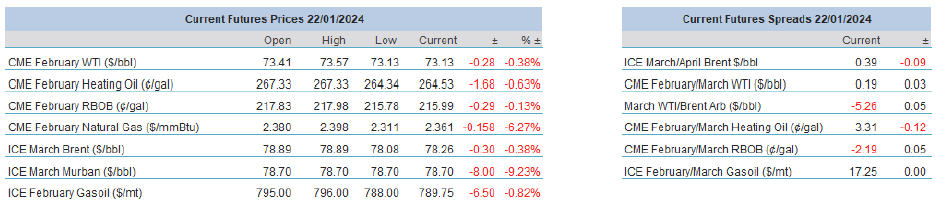

Overnight Pricing

© 2024 PVM Oil Associates Ltd

24 Jan 2024