No getting away from the Macro

After a tumultuous macro-economic week, WTI and Brent prices experience 4 lower lows and the 7-consecutive week rally has well and truly stalled. The idea that our market was starting to cocoon itself from the likes of lofty interest rates and Chinese property issues has been skewered by incessant bad data from China and a less than dovish FOMC minute report. Caught up in the wash created by investment tourists, oil finds itself not cocooned but marooned in the shipping lanes of financial news and not even continued inventory draw is enough to allow the continued navigation in positive waters.

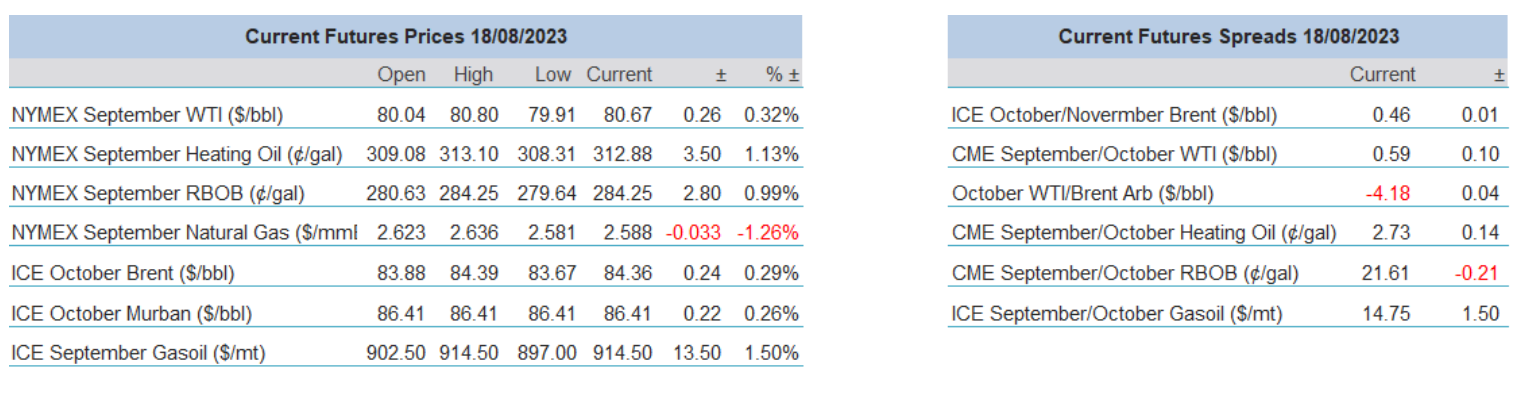

Bad news begets bad news, and unfortunately for the oil market, thinned in August volumes, any scrutiny finds prices more reactive and because of the impressive bull run of the last 2 months, the twitch factor is to the downside. Lately, Heating Oil and Gasoil amongst other distillates, have been the leaders in dragging our market higher as evidenced in the 6-week $17/barrel rally in the Oct23 Gasoil/Brent futures crack. With refiner turnarounds almost upon us, bulls have had ample opportunity to wheel out the positive nature of refiner margin and that run rates around the world are reduced. However, such is the stall in progression that even small adjustments to predictions are able to disrupt even much-fancied diesel. Rystad Energy slightly lowered its forecast for China’s diesel demand for the July-December period which aligns with IEA’s reduction of 150,00 barrels per day for second half 2023 (Reuters).

There we have it, back to China again. In another bout of Sino-gloom this morning it is reported, and in what is described as a procedural move, Evergrande, the huge China property developer has filed for Chapter 15 in a New York bankruptcy court as part of a $32 billion overhaul in financing. The Peoples Bank of China weighed in this morning with a 2-month-high liquidity injection into markets and banks fixed the Yuan at the most aggressive level on record but it appears that the moribund sentiment surrounding China’s economy is bedding in. Far-flung effects are seen in Australian mining company stock prices as its biggest customer endures the present economic woe. Whether or not this is a prelude to a contagion is somewhat doubtful, but the idea of it just shows how important China is in the scheme of oil which is discussed below by Tamas.

GMT +1 |

Country |

Today’s Data |

Forecast |

10.00 |

EU |

CPI YoY (July) Final |

5.5% |

10.00 |

EU |

Inflation Rate MoM (Jul) Final |

240k |

Little Trouble in Big China

The economic hardship China is facing has been weighing heavily on investors’ minds. It is plausibly the one last piece of the bullish jigsaw puzzle, that, if it is placed in the right place will immeasurably improve sentiment and will act as a catalyst of a rally in equities and oil. But will the world’s second biggest economy be able to turn the corner and set itself on a growth path? The current signs are ominous. Stuttering economic activity has forced Barclays to downgrade its Chinese growth forecast to 4.5% and rating agency Fitch has warned that it might reconsider the country’s A+ credit score.

The country’s economy has been facing headwinds ever since the health crisis broke out more than 3 years ago, in absolute terms as well as comparatively. Think of the following: the Shanghai Composite Index is up less than 20% since the March 2020 bottom. In this period the MSCI All-Country Index has rallied 55% and the Nasdaq Composite Index has more than doubled in value. The yield gap between the 10-year Chinese and US government bonds is the widest for 16 years.

China is fighting deflation whilst the US is seemingly successfully reining in inflation. China is trying to revive its economy, the US, and the western world to cool it. China is cutting interest rates, the US has been raising them, one loosens its monetary policies the other tightens it.

There is a simple explanation for this deviation, and it lies in the diverging (mis)management of the devastating impact of the Covid-19 outbreak. China shut its economy for nearly 3 years whilst the US and other countries threw money at it. China’s economy came to a near standstill because of the ill-fated and stubborn zero-Covid measures, whilst considerable pent-up demand was created in other parts of the worlds. The confidence of the Chinese consumer dived, pent up demand in the US and elsewhere spurred economic activity and was partly responsible for the elevated inflationary pressure – demand-pull inflation has been on full display.

The economic malaise in China is not caused by a liquidity crisis, it is not a lack access to capital, it is a crisis of confidence – from consumers and private companies alike. Consumer spending, especially on big ticket items, has been rather weak in China. It is reflected in struggling retail sales. The latter expanded by a mere 2.5% in July, down from 3.1% in June and well below analysts’ expectations of 4.5%. The average consumer is nervous about job security, savings are a priority and consequently the crucial property sector also suffers.

China is an export-oriented country and when demand for its exports is on the descent excess capacity usually tend to drive prices down. And this is precisely the case presently. Traditional importers have, especially during the height of uncertainties triggered by supply chain bottlenecks, restocked and consequently demand for Chinese goods are on the wane, something that is expected to normalize next year. No surprise then that investment from private Chinese companies in fixed assets have dropped to 0.2% in the first half of the current year versus 8.2% by state enterprises. Foreign Direct Investment only rose 0.2% in 1Q 2023.

The government is doing what it deems to be its best to spur economic growth. Measures include cuts in borrowing cost, tax rebates and attracting investment – from multinationals as wells as domestic private companies. Probably one of the key focuses of the communist party is the revival of household consumption, which, as a percentage of the GDP, is on the bottom end of the global scale and represents a critical structural imbalance in the economy. If one accepts that economic performance will palpably brighten once investors’ and consumers’ confidence improves it would not be stretching imagination to conclude that next year will look much more sanguine than the current one. Nonetheless, it is only reasonable to base one’s view on the Chinese economy on data, much like the Fed does. From the that respect it is intriguing to observe that the country’s oil demand estimates have not been revised down despite the economic turbulence. Maybe it is just the question of riding out the storm.

Tamas Varga

Overnight Pricing

18 Aug 2023