No Looking Back in Equities, No Looking Forward in Oil

The optimist would argue that the scaremongers of trade tariffs were badly mistaken. Investors cannot be fooled, and the relentless march north in equities is a clear sign that reducing trade deficits does not harm the economy. A more nuanced approach would be to assert that what matters is not what the U.S. President says but what he does. Threats, blackmail, and coercion are all part of the grand plan to gain leverage, as reflected in the consistent lowering of excise duties, at least compared with the Liberation Day madness.

The realist believes that, while the above arguments appear solid, tariffs are the highest for 90 years; therefore, stock valuations are unrealistic and the bubble is merely becoming more inflated and will, in time, burst. The pessimist, the one who keeps losing money by stubbornly insisting on the unsustainability of the rally, would not concede and maintains that the bubble should have already popped.

The longer she remains unyielding, the more likely she will be proven correct, although markets can remain irrational longer than she can stay solvent. Yesterday, however, was certainly not the pessimist’s day in the sun. At the first stop of his Asian tour, the U.S. President signed trade deals with four countries, inked a rare earth deal with Japan, and sounded upbeat about his upcoming meeting with his Chinese counterpart later this week. It is the scent of truce between the two economic juggernauts that appealed to investors.

Adding to the buoyant mood, slightly better-than-expected U.S. inflation data from Friday make this week’s Fed rate cut a dead cert. And while stocks are probably overpriced, unless concrete evidence of economic malaise, in the form of deteriorating data, emerges, the current sanguinity will likely persist.

Lower U.S. rates, coupled with anticipated stable borrowing costs in Europe and Japan, should be bearish for the dollar and therefore supportive for oil, much like galloping equities. It is, however, the supply side that remains in focus, as doubts about efficiently enforcing Russian oil sanctions resurface and, as reported by Reuters, eight OPEC+ members are contemplating yet another slight output increase during their monthly meeting at the end of the week. On the other hand, the persistent strength in Heating Oil and Gasoil suggests that anxiety about reduced Russian distillate exports ahead of the winter remains elevated and revisiting the year’s lows is not imminent just yet.

Ambitions Scaled Back

Scorching temperatures, floods, and increasingly frequent wildfires are all signs that the planet is warming. Greenhouse gas emissions such as carbon dioxide and methane are the main contributors to this phenomenon. These gases result from burning fossil fuels for electricity generation, transportation, and heating; deforestation; agriculture, particularly livestock and rice cultivation, manufacturing processes; and waste management. While there are undeniable efforts to reduce greenhouse gas emissions, the pace of progress remains the subject of fierce debate. Every stakeholder agrees that emissions must be reduced, but the voices arguing that economic, and not only environmental, impacts must also be considered are growing louder, with discernible consequences.

The transition from fossil fuels to renewable energy is irreversible. The latter is becoming progressively more cost-effective than most fossil fuels, particularly coal. A report by the International Renewable Energy Agency (IRENA) found that after 582 gigawatts of renewable energy capacity were added globally in 2024, more than 90% of utility-scale projects were cheaper than their fossil fuel alternatives. Nonetheless, net-zero targets are being reassessed at both the company and national levels to mitigate the potentially adverse economic repercussions of phasing out fossil fuels prematurely. The latest failed attempt by the International Maritime Organization (IMO) to implement stricter emission standards for global shipping confirms this trend.

The IMO had planned to establish a legally binding framework to cut greenhouse gas emissions from the global shipping industry by 17% by 2028 and to achieve net-zero emissions in roughly 25 years. The IMO Net-Zero Framework was intended to be the first international agreement combining emission limits with greenhouse gas pricing across an entire industry sector. Its ultimate goal was to accelerate the introduction of near-zero greenhouse gas fuels, technologies, and energy sources while supporting a fair transition.

The key elements of the framework were a global fuel standard and global economic measures. First, ships would be required to gradually reduce their annual greenhouse gas fuel intensity or their emissions per unit of energy consumed. Second, those emitting above the greenhouse gas fuel intensity limit would be required to buy “remedial units” to offset the deficit, similar to acquiring carbon credits. Compliance also played a crucial role in the IMO Net-Zero Framework. The two levels of compliance were the Base Target and the Direct Compliance Target, at which ships could earn surplus units.

As for the timeline, this month was supposed to see the adoption of amendments. In spring 2026, detailed implementation guidelines were to be approved, and in 2027, the agreement would have come into effect. Two weeks ago, representatives from more than 100 countries gathered in London to adopt internationally mandated targets to reduce emissions from the shipping industry.

At the last minute, however, the United States intervened. True to its customary modus operandi, it threatened countries with tariffs if they voted in favour of the deal. In the view of the U.S. President, the agreement was nothing more than a “green scam,” while his Secretary of State hailed the outcome as a great victory, claiming the U.S. had prevented “a massive UN tax hike on American consumers that would have funded progressive climate pet projects.” Following the U.S. intervention, Saudi Arabia tabled a motion to adjourn the talks for a year, which passed by just a handful of votes. The EU and the UK pressed to continue the discussions, but Russia, the U.S., and Saudi Arabia favoured postponement, while Greece abstained. Island states, most vulnerable to climate change, also made U-turns or abstained, as their economies are heavily dependent on U.S. trade.

With the talks now delayed, the planned timeline for the regulations to take effect by 2027–2028 has become untenable. Although shipping accounts for “only” about 3% of global greenhouse gas emissions, or roughly 1 billion metric tons of carbon dioxide per year, according to Climate Watch Data, the setback in reducing global shipping emissions will, on the one hand, further slow the transition. On the other hand, it will bring economic relief to the sector and, since between 80% and 90% of global trade by volume is transported by sea, to consumers as well.

Overnight Pricing

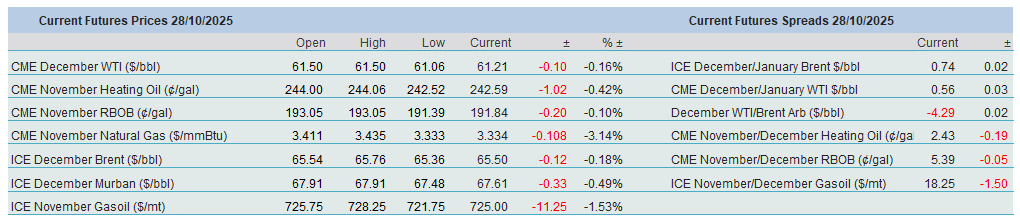

28 Oct 2025