No Rest for the Wicked

OPEC+ not putting 180,000 bpd of crude oil back on the market for two additional months achieved nought, as discussed below. A seemingly constructive weekly statistics from the EIA – ditto. How would you interpret an unchanged settlement in WTI following a 6.9 million bbls decline in crude oil and an 8 million bbls withdrawal in commercial oil inventories? Surely, red flags were raised. Maybe, the focus was on dismal demand figures as refiners supplied 1 mbpd less oil than the week before with proxy gasoline demand falling under 9 mbpd – hence the disenchanting RBOB performance.

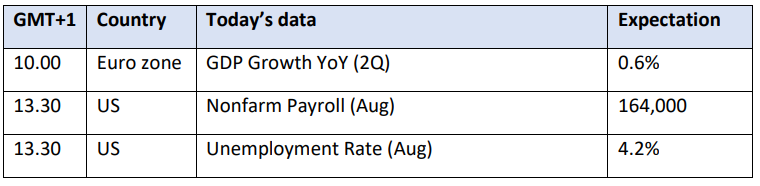

Contrasting US job reports did not lift the spirit either. Job growth in the US private sector reached a 3 ½ year nadir but weekly initial jobless claims are telling the story of a healthy labour market. By any stretch of the imagination, a September rate cut from the Federal Reserve is still in order, but only its extent is dubious. Confirmation will come from today’s nonfarm payrolls. As for oil, judging by the complete disregard of seemingly bullish developments, inevitable upside corrections will most probably be viewed as irresistible selling opportunities.

Missing Barrels and What Else?

With the beautiful wisdom of hindsight, oil was never going to challenge the April high of $92 on Brent this summer, simply because forecasts on oil balance, however diverging, would not have justified it. Perhaps peaking at $88 at the beginning of July was somewhat early and was below what most expected (including the writer of this report), nonetheless, the change in sentiment did not come as a complete shock. What has been unforeseen is the speed and extent of the ensuing weakness. The annual lows, reached in January in WTI, Brent and RBOB, and at the beginning of June in Heating Oil and Gasoil, have been recently violated with confident ease and stubborn conviction.

The job of any analyst is to put a price on data. If her prediction turns out inaccurate then it is imperative to find a solid argument as why the market thinking differs from hers. After all, the market is always right, even when it is wrong. Coming from this angle, it is crucial to make two lists of inventories: one of recent developments both on the supply and the demand side of the oil equation and the other one of which of these was swept under the carpet or played a dominant role in the formation of prices. Once this step is completed, we are left with the simple task of assessing whether the commanding factors are sturdy enough to support the prevailing trend or whether the move has mostly been driven by sentiment and it could turn on a dime.

Undeniably, the updated monthly supply-demand reports contributed to the souring of the mood. They brought with them downward revisions in 2H 2024 and the whole of 2025 global oil demand projections. Curiously, however, supply from producers outside of the OPEC+ alliance has also been revised down. The call on DoC oil has remained steady or even increased, but the recent price action insinuates numerous missing barrels. These can probably be found in underestimating future supply from the cartel.

Bleaker demand prospects are largely the function of the struggling Chinese economy – the manufacturing and real estate sectors are still in dire straits with consumers playing it safe and saving in lieu of spending. Oil demand from the world’s second biggest economy, therefore, is suffering entailing rising exports. Chinese headwinds, however, have been part of the formula for several months. The new and unwelcome piece of the economic jigsaw puzzle is the growing anxiety about the US, which, up until last month, was seen as the beacon of prosperity, the pillar of oil demand growth.

Probably not much should be read into the recent 4-5% plunge in the tech-heavy Nasdaq Composite Index. After the relentless rise since January 2023, some kind of retracement has been in the cards. The bubble has not burst but has somewhat deflated. More ominously though, slowdown fears are gaining ground. The manufacturing sector is underwhelming at best and not expanding, and justifiably or not, data on the labour market has ruffled investor’s feathers. It is no severe calamity but maybe alarm bells started to ring. The Fed will most plausibly cut borrowing costs in September, which should ease economic concerns – at least on paper. It will be interesting to see whether the impact of Chinese and lately US economic worries will be acknowledged in next week’s monthly updates on the oil balance.

The OPEC+ pledge to unwind the 2.2 mbpd of voluntary production cuts from October has been a major contributing factor on the other side of the coin. It has been deemed so salient that the Libyan production outage was dismissed out of hand. Because of the sharp drop in prices, the group decided yesterday to postpone the implementation of the plan by two months. The reception of the announcement was less than tepid, and one wonders when the patience of intentionally giving up market share with no return in sight could run out, when the gloves come off leading to a new supply war internally as well as between OPEC+ and the rest. Under this scenario, a violent drop in outright prices will be coupled with the structure of the two major crude oil contracts flipping into contango. The compensation plan of disobedient members might ease this pain but, history suggests, it is hard to see to be adhered to and enforced. Finally, lest we forget the substantial supply cushion at some OPEC members’ disposal, which can be utilized in a relatively short period of time and certainly plays an outsized role in the downturn.

Times and circumstances change, one needs to adapt and roll with the punches. Chinese and US economic concerns, the diminishing ability of the producer group to influence the oil market, and its ample spare capacity re-write the narrative, imply that further weakness is very much possible, and upside potential is more limited than a month ago. Next week’s monthly reports will provide a helping hand in determining what the new price range would look like. Cuts, both interest rates and production, will only provide temporary relief.

Overnight Pricing

06 Sep 2024