No Signs of Peace

The two major driving forces behind investor sentiment have been, and are likely to remain, Russia’s war on Ukraine and the economic reverberations of the tariff war. Of course, the hostilities in Gaza equal, at the very least, the humanitarian tragedy unfolding in Eastern Europe. Yet, for now, there is no immediate threat to oil production, exports, or transport, the pragmatist concludes.

There have been seemingly meaningful attempts to ease tensions between Ukraine and Russia. The Presidents of the US and the aggressor met in Alaska over a week ago, followed shortly by talks between President Trump, President Zelensky, and European leaders in the White House. On a rhetorical level, progress was apparent; on the ground, developments suggest otherwise.

President Trump’s pre-Alaska ironclad commitment to sanction Russia absent a ceasefire, the prerequisite for a possible de-escalation, morphed into a push for a broader peace agreement. Meanwhile, Vladimir Putin’s demands, eliminating the “root causes” of the conflict, removing the current regime, blocking Ukraine from joining the EU and NATO, and annexing parts of the sovereign state, remained unchanged, if not hardened.

The Alaska summit, largely ceremonial and devoid of concrete outcomes, was swiftly succeeded by a gathering of the leaders of the US and Ukraine, with the latter being accompanied by European potentates. The talks were more cordial than the disastrous February encounter, but tangible results were still lacking. The most notable outcome was a vague promise of some kind of US security guarantee, floated by Donald Trump and conditionally welcomed by Russia, provided Moscow itself is part of it.

The status quo is discouraging, offering no imminent halt to Russia’s aggression or Ukraine’s countermeasures. The narrative from Washington remains muddled: Vice President JD Vance points to significant Russian concessions towards a negotiated settlement, while President Trump, with his mood swinging widely between irritation with and admiration for Putin, threatens sanctions on Russia (and India) if no progress is made in settling the atrocities within two weeks.

Markets, while reactive to headlines, promises, and pledges, ultimately and inevitably respond to events on the battlefield. The futility of diplomacy is aptly mirrored in intensifying assaults between Ukraine and Russia, including energy installations. Ukrainian drone strikes on fuel terminals and refineries forced Russia to suspend product exports to secure domestic supply. Around 10 Russian refiners were under attack recently, and 17% of the country’s refining capacity, equalling 1.1 mbpd of refined fuel production, Reuters calculates, has been disrupted.

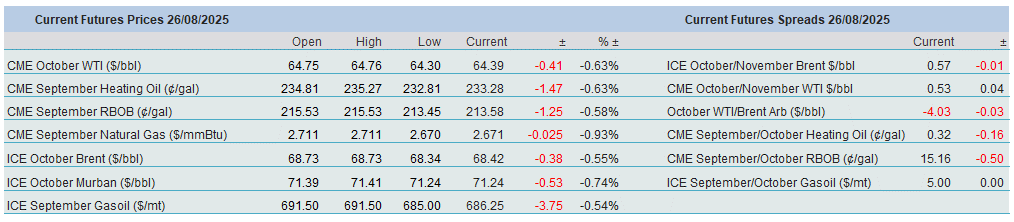

Retail and international fuel prices climbed accordingly. The two major crude benchmarks returned less than 2% last week, but refined products advanced about 4%, led by the CME RBOB contract. Prospective peace would ease supply anxiety, something that remains nowhere in sight. Crack spreads strengthened. Money managers increased their net short positions in WTI but added to their net length in Heating Oil and RBOB during the latest reporting period.

No Signs of Bathmophobia

Military interventions in Ukraine and the Middle East understandably unsettle investors. By contrast, the impact of the tariff wars launched in February appears less troubling. Equity markets remain buoyant despite last week’s wobble, caused by doubts over the sustainability of the tech-led rally. The US trade balance has improved dramatically in the past three months, and the Congressional Budget Office, a nonpartisan agency, estimates that import tariffs will reduce the US primary deficit by $3.3 trillion through 2035, with interest payments falling by another $700 billion. Combined with constructive global PMI readings, the picture sharply contrasts with earlier predictions of financial Armageddon originating from isolationist US trade policies in general and import tariffs in particular.

Against this backdrop, central bankers convened at their annual Jackson Hole symposium last week. The highlight was the Fed Chair’s address on lowering borrowing costs. With recent data showing neither inflationary nor recessionary pressure, providing further economic support by cutting rates would not necessarily be a reckless undertaking, so the argument went.

That much was tacitly acknowledged by Jay Powell on Friday, who said that: “…with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Equity markets experienced a sharp reversal; the S&P 500 rose 1.5% on Friday, transforming what had looked like a weekly loss into a modest gain, although the optimism frayed yesterday.

Considering the Fed’s dual mandate of full employment and price stability, such a cut, come September, is not set in stone yet. The CME FedWatch tool assigns an 85% probability of a 0.25% cut on September 17, but two critical data releases stand in the way: the September 5 employment report and the inflation data a week later will be thoroughly assessed and scrutinised. Either could throw yet another spanner in the works of lowering interest rates.

Whatever the outcome, the political backdrop is clear. The President continues to pressure disobedient Fed officials, demanding that they be hanged, drawn and quartered (or just brazenly fire them, as we learnt overnight) unless they become the unconditional advocates of the ultimate interest rate goal of 1%. Central banks chart monetary policy; governments, fiscal policy. Heavy-handed intervention in the Fed’s independence is an implicit admission of the fiscal bind: every available tool is needed to manage a ballooning debt pile. It is an ominous sign insinuating that today’s optimism may prove fleeting.

Bathmophobia is the fear of slopes. Prematurely lowering rates is, indeed, a slippery slope, with potentially catastrophic consequences. The current administration, however, clearly suffers from no such fear, the price of which could be paid later.

Overnight Pricing

26 Aug 2025