Not the Time to Call Oil's Rally Over

Oil prices have been bound in the medium-term to the trouble in getting Kazak and general Caspian Pipeline Consortium oil production to water, and in the short-term, the icy blast in North America which rather caught the market on the hop, resulting in the upward scramble in prices associated with heating. With reports of a resolution to the problems in CPC and the Tengiz field and an increasing belief that the current weather afflictions touching upon the production in Texas will not be as bad as the prolonged freeze witnessed in February 2021, oil and gas prices are being tempted lower.

However, and unlike a bad press announcement from the White House which can be walked back a few hours later, restarting oil wells and pipelines or unfreezing refinery power plants and other services is not as immediate. Reports have the energy ministry saying Kazakhstan is ‘poised’ to resume Tengiz field production, which is not the same as the spigots being thrown open. Additionally, pushing oil through a mooring pier on the Black Sea that has been out of service for quite some time may not be so straightforward. The current Texas freeze might only be affecting 2mbpd of crude production, but with another cold front due in at the weekend, elongation in repair to oil infrastructure is not out of the question. With the arrival of the USS Abraham Lincoln carrier group in the Middle East, the US now has the pieces on the board if it chooses to strike Iran. Howsoever one quantifies ‘risk premium’ it is not about to be abandoned just yet.

We take a look at currencies below, but the sudden fallout in the US Dollar is also a welcome boon for oil bulls and looks set to continue. The current cause for the swoon in the greenback is having far-reaching consequences. It is fascinating to watch the speculation on whether intervention is real or perceived in the Japanese Yen, but with further reports of the US also propping the ailing currency in the Land of the Rising Sun, it is by default devaluing the Dollar and by doing so gives the Federal Reserve another peg to hang its woes upon. Attention will turn to the Fed meeting this week and its decision on interest rates. Handing the FOMC another reason to keep rates steady, which any conservative committee would do given such flux in its currency is likely to stir up an already agitated Donald Trump. If the US President resumes his brouhaha over the path his central bank is plotting, then all the fears of executive interference will once again undermine the US system already stressed under the threat of a partial government shutdown due to the unmentionable acts committed by ICE agents.

In Gold we trust, in the Dollar we do not

Has there ever been a time when currency mistrust is higher? The bastions of standard, from the US Dollar, the Japanese Yen, the Euro and even British Pound are subject to the head-spinning whimsy and policy reversal of contemporary politics, and it has always been assumed that the head of pyramidical, so-called democratic governments ought be a guardian of a nation’s money. But as is the case with all current leaders, there is a paucity of statesmanship and the only thing that can be relied upon is that any president to prime minister in the current cluster of ‘not my fault’ mewls, do not much care for anything other than their survival of the next crisis, which will surely come hotfoot five minutes after the current one is tackled. The patriotic pride and knowledge of a nation’s money is being as quickly abandoned by its populace in much the same way as that of feckless leaders. The currencies listed above are fiat monies; currencies that are backed by a guarantee of the performance of the current government rather than any tangible holdings. The value is much more derived from supply and demand of the currency and most importantly the trust in government and indeed, its stability.

At the end of 2025 and as seen on Visual Capitalist, with data from the International Monetary Fund, using COFER (Currency Composition of Official Foreign Exchange Reserves) the share of total global currency reserves sees the US Dollar at 57.8 percent, the Euro at 19.8 percent, the Japanese Yen at 5.8 percent and the British Pound 4.7 percent. There is not much change from the previous year, the US Dollar’s share of global foreign exchange reserves has fallen from around 70 percent from the start of the century, but interestingly and very telling is how none of its would-be competitors have taken much advantage. While de-dollarization is a thing, there is not a counter movement of re-Euroization or the like, because investors fear that abandoning one spoiled nest would be to experience a cuckoo in another.

The US Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England regard themselves as independent. By definition and make-up, they are, but they must set out lines of action based around their current governments’ spending habits and there is not an incumbent in the White House, the Kotei or Downing Street able to avoid a charge of being profligate including many that make up the complicated and squabbling horde of the European Union. The single currency has never lived up to being the US Dollar replacement. While there is a sheen of unity at present, inspired by a mutual need to stare down a bullying US President, the European Community cannot ever get over its parochialism, its penchant for red tape and an inevitable jawboning into a state of stasis. The ECB has to pull all such considerations and tread a line for the common good, which is more often than not what Germany wants followed up by France and then screams of derision from the balance.

Currency manipulation is global sport and as much as it is decried, particularly from the White House, messing around with interest rates and or buying assets and eventually running them down is fair game. As for the howls coming from 1600 Pennsylvania Avenue, they might be given a little more respect if the denigration of the Federal Reserve and the illegal sacking of its members to achieve Donald Trump’s wish of lower interest rates did not daily undermine both the reputation and standing of the Fed and the currency it serves to protect. Over in Japan, it is unclear whether or not there is an ongoing intervention to prop up the Yen, but such intercession is not in the remit of the BoJ, it lies with the Minister of Finance, to which any action the BoJ is then expected to manage.

Such examples are easily expanded on, but viewing currencies through a prism of manipulation does not tell all of why confidence in currencies is fragile. It would be easy to rant on how all is the fault of the Donald, but it is not. He is the founder of the current geopolitical unease, but just an accelerative in the problems in trade relations. While one cannot dismiss tariffs and possible land grabs as being some of the axes chopping into established currency expectations, the decreasing exposure to currencies has been long coming. Even if the loudmouth in Washington was indeed entirely responsible, current affairs define current investments and the US Dollar among all other currency peer are no longer the first call when seeking portfolio haven. If the first quarter of this century has seen a 12 percent runoff in global USD holdings, what will that look like come 2050? The end of the US Dollar is nowhere near nigh, but its influence remains on the wane. For all the sophistication modern markets come with, there are not that many more new vehicles to get teeth into. If Crypto is a currency, what it shares mostly with other of such money ilk is an ability to be misunderstood and untrusted. Taking the premise of a limited range of investments, and the size of the yearly growth in fund-like inflows, it is little wonder on how the A.I. bet is super populated and why, my oh my, Gold is trading at $5000 per ounce.

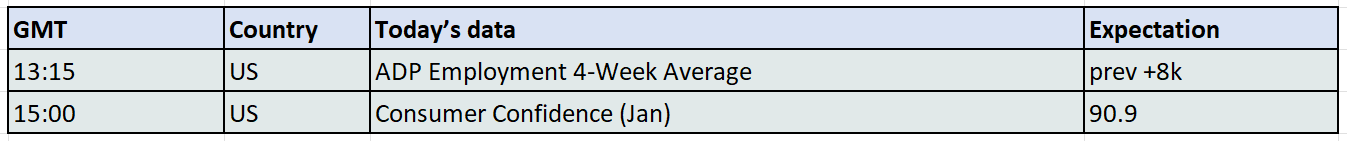

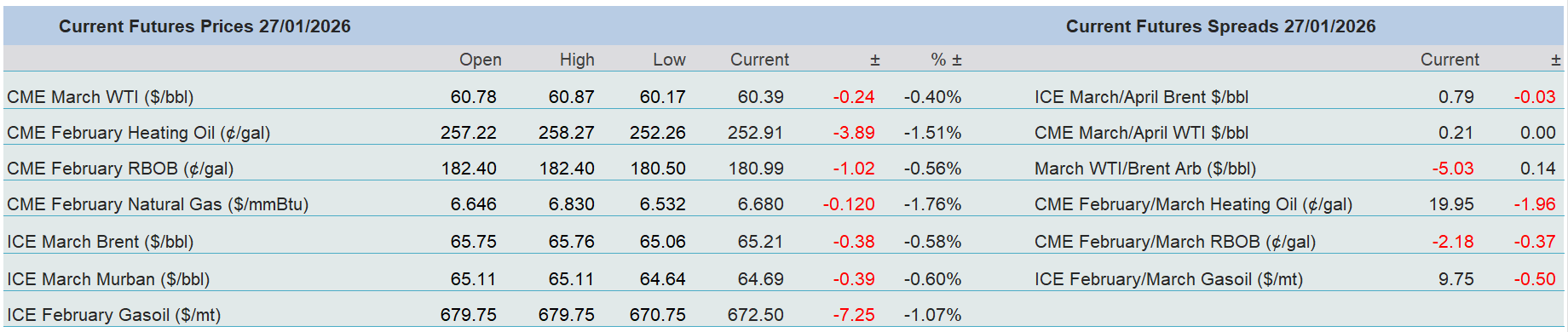

Overnight Pricing

27 Jan 2026